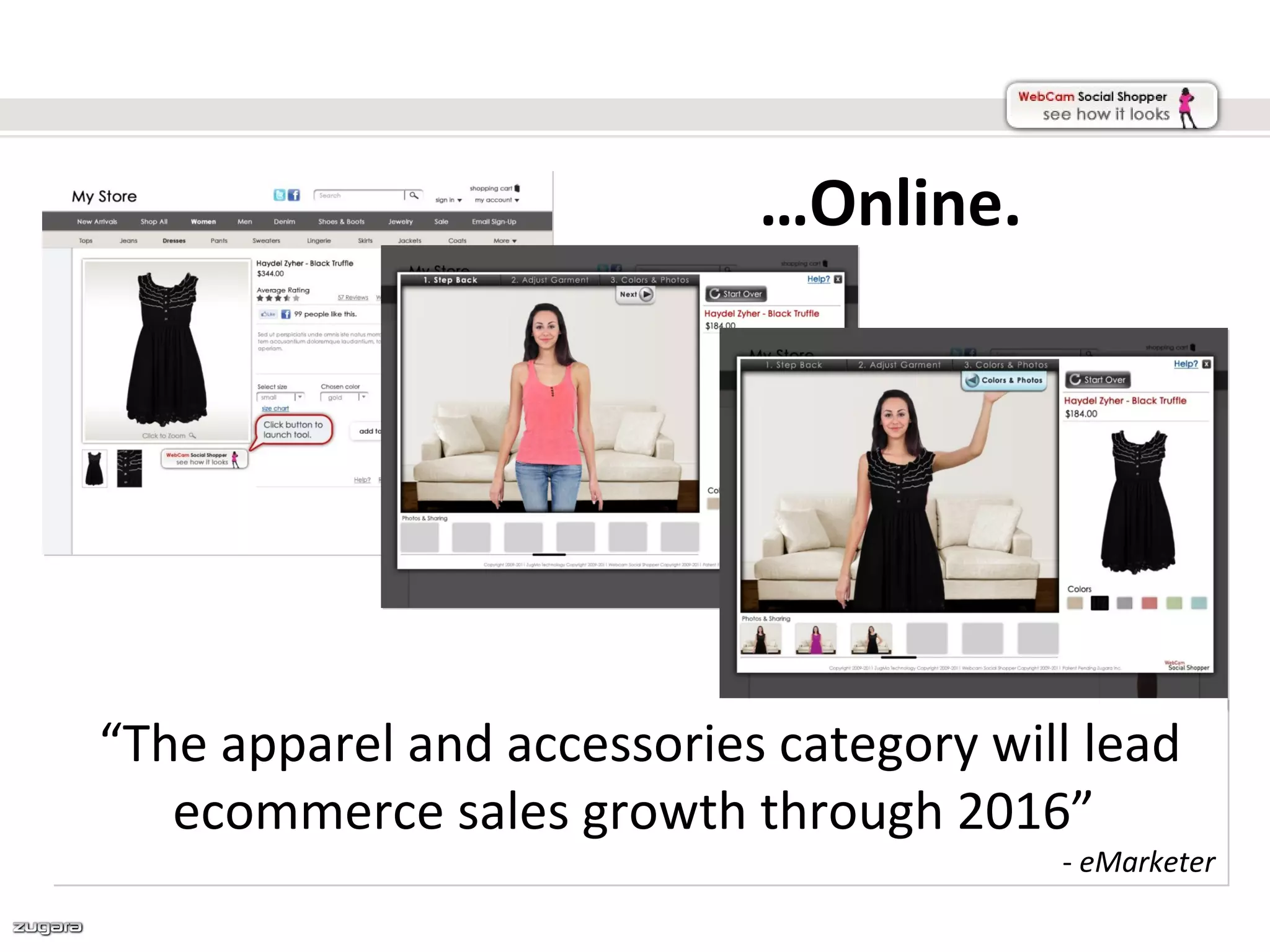

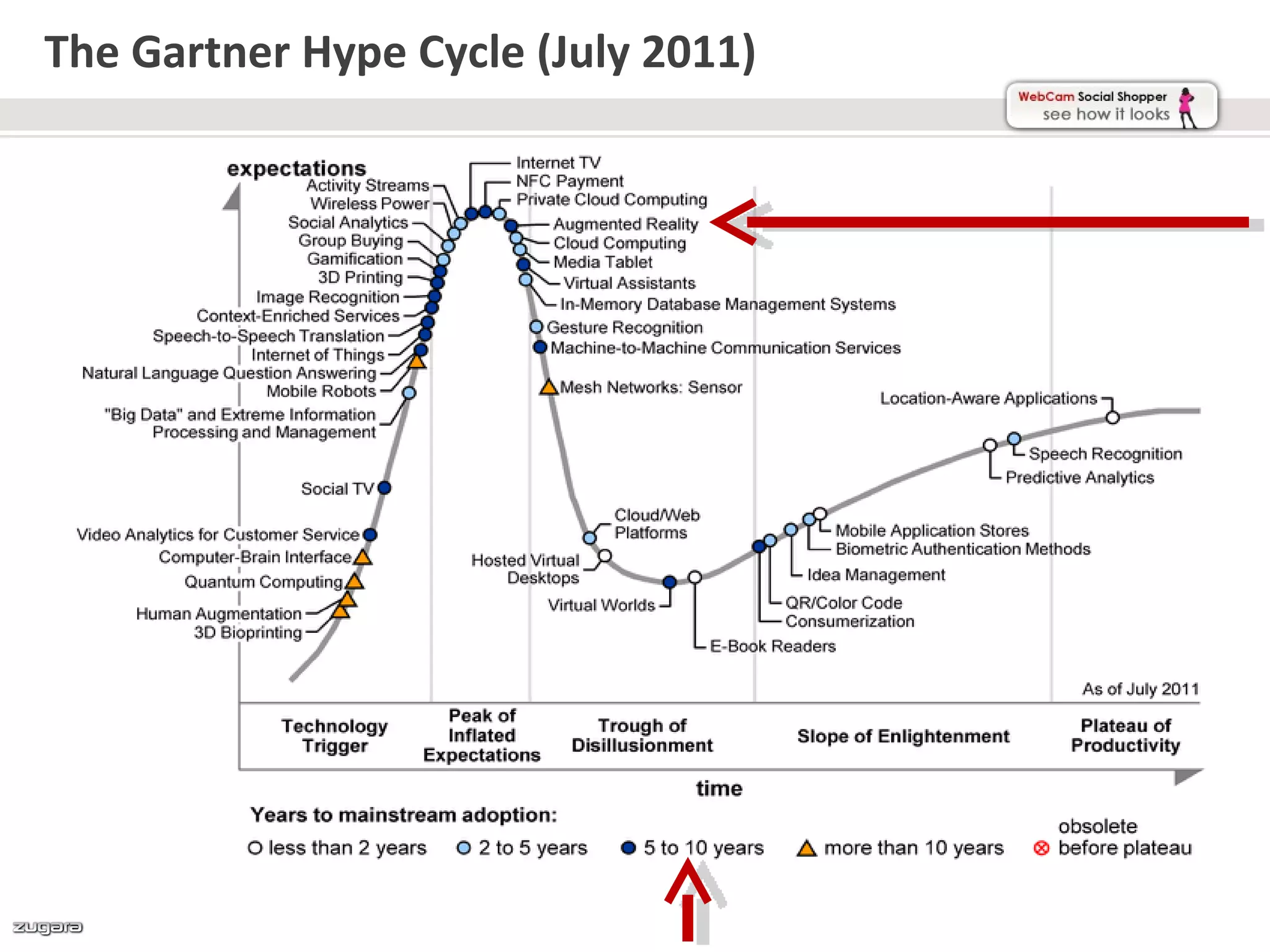

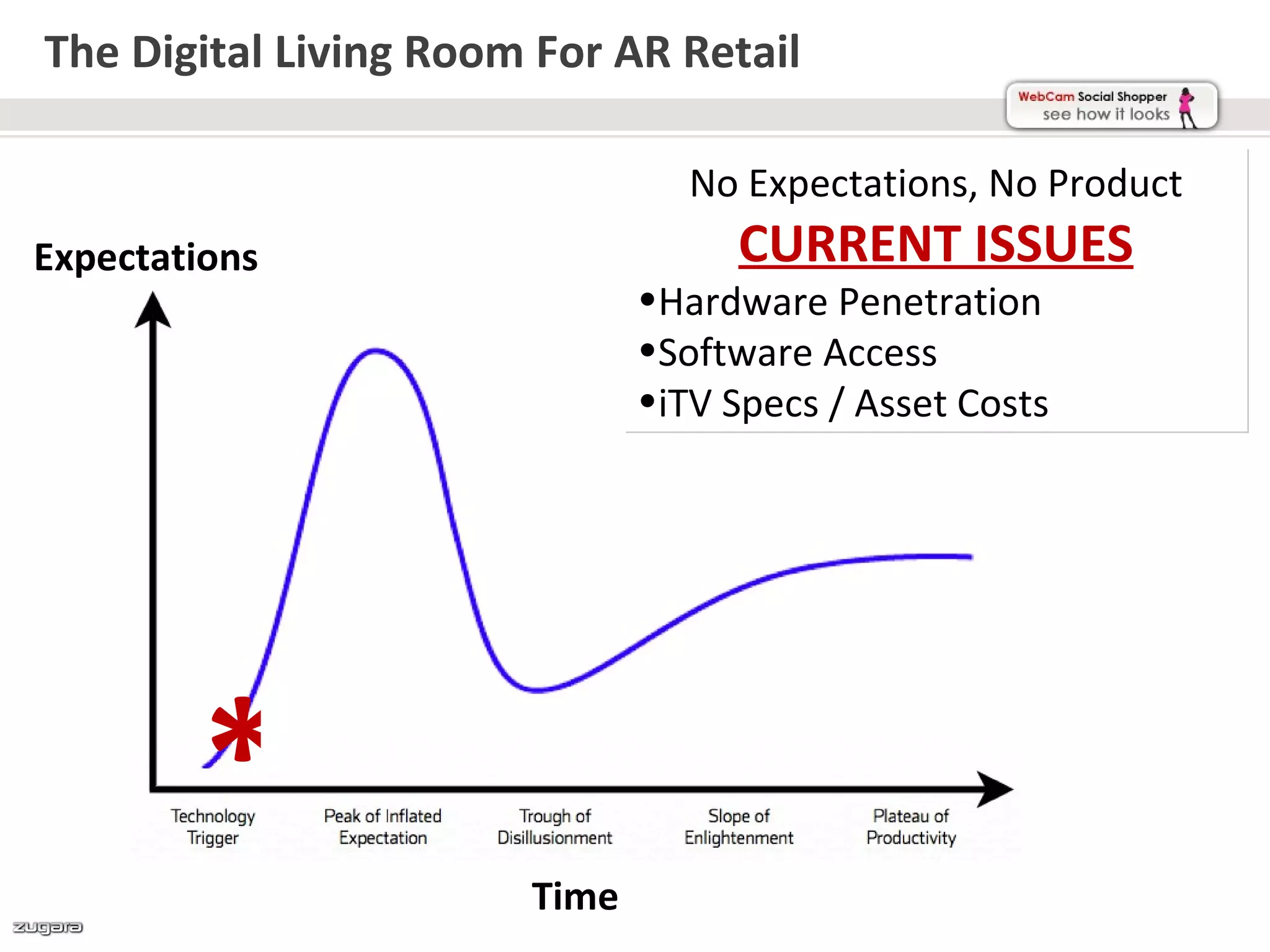

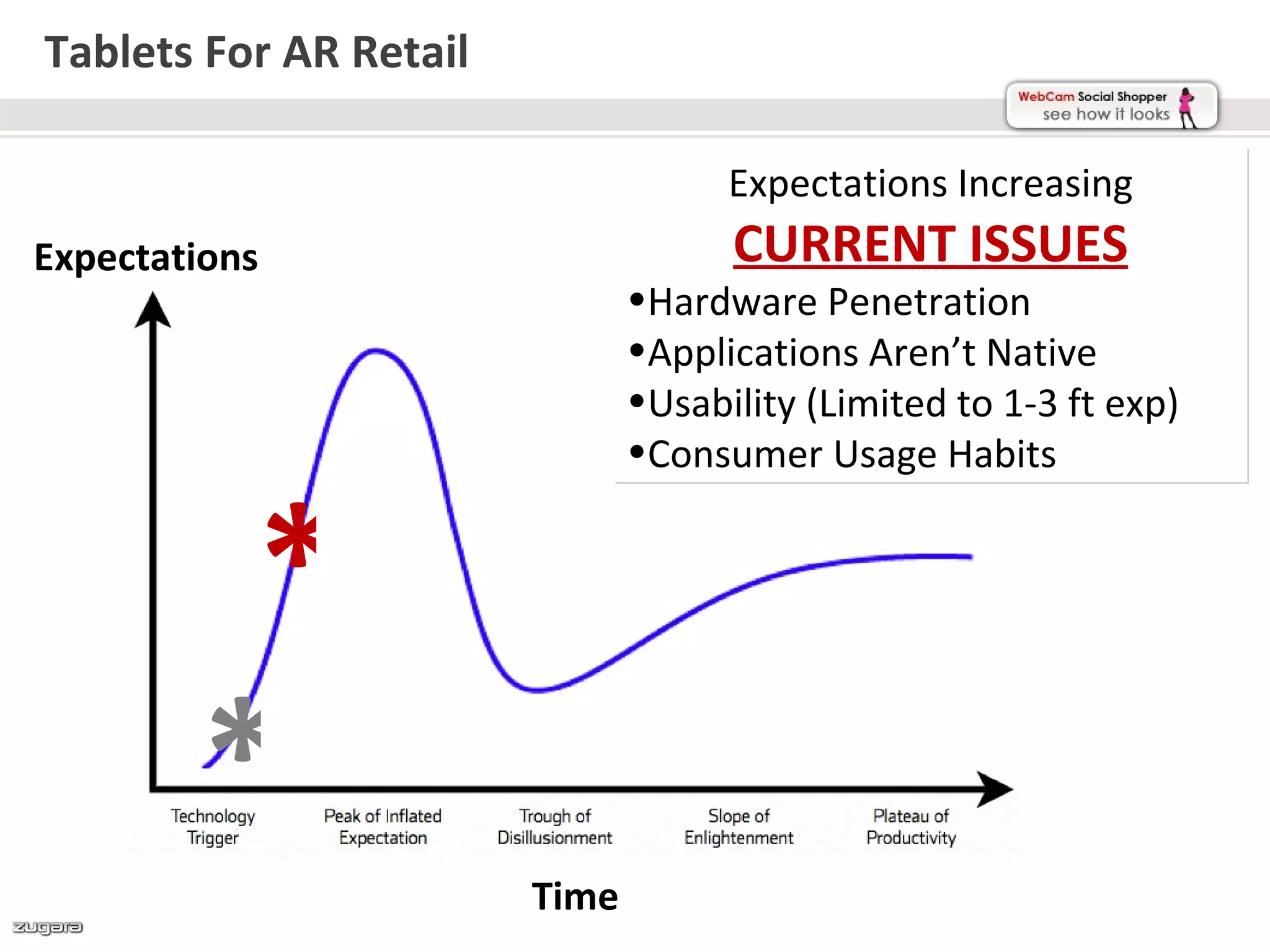

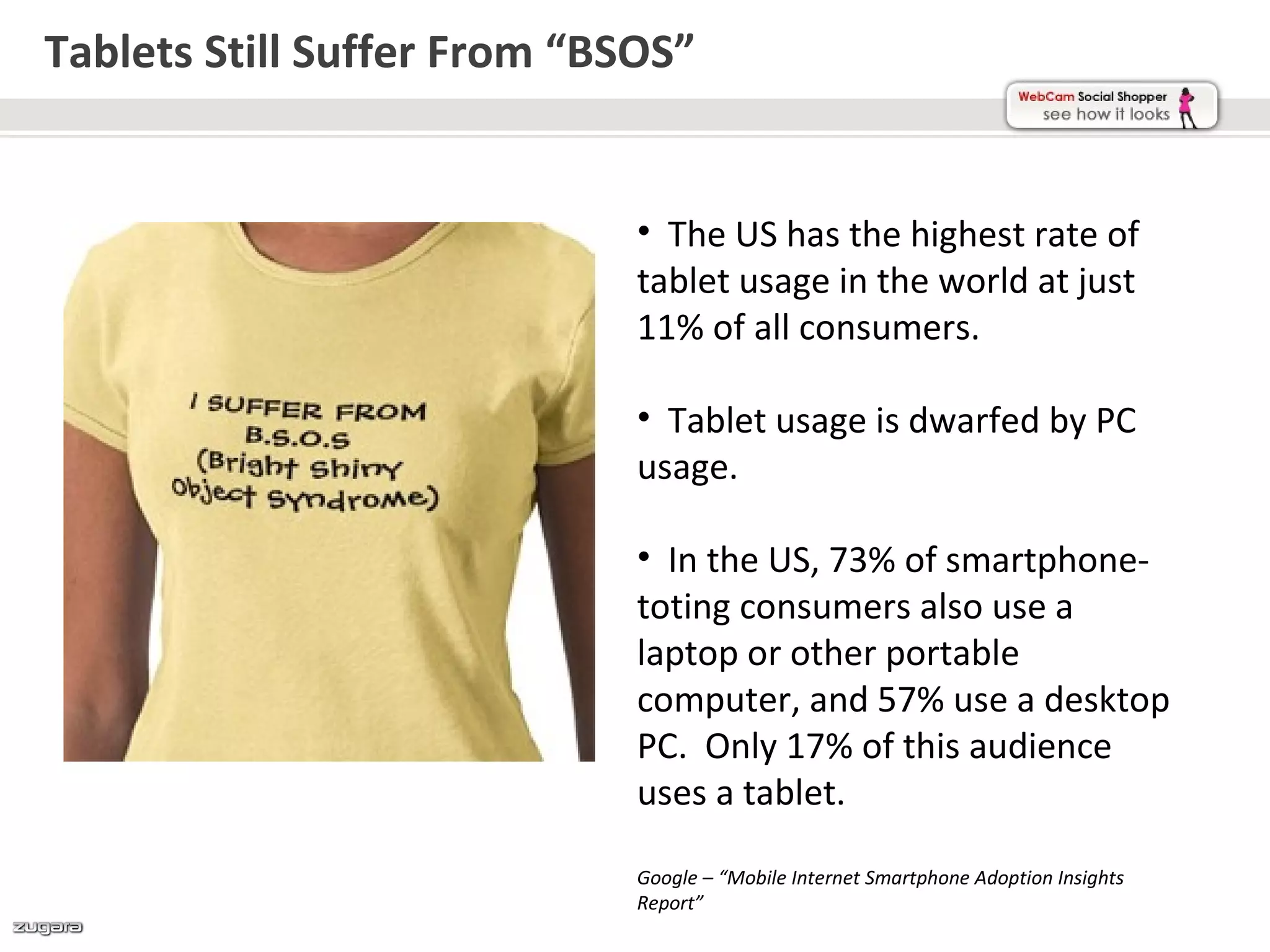

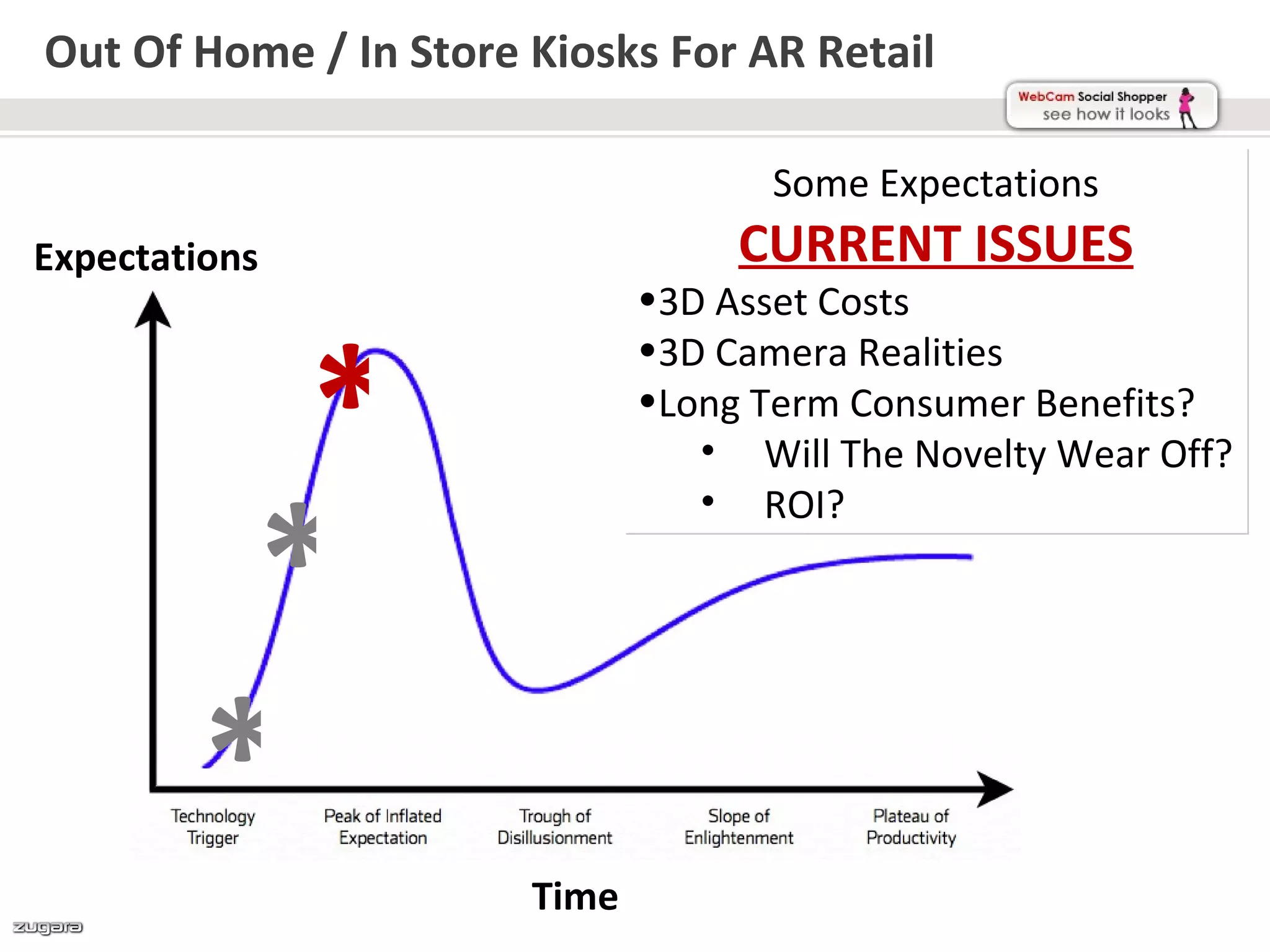

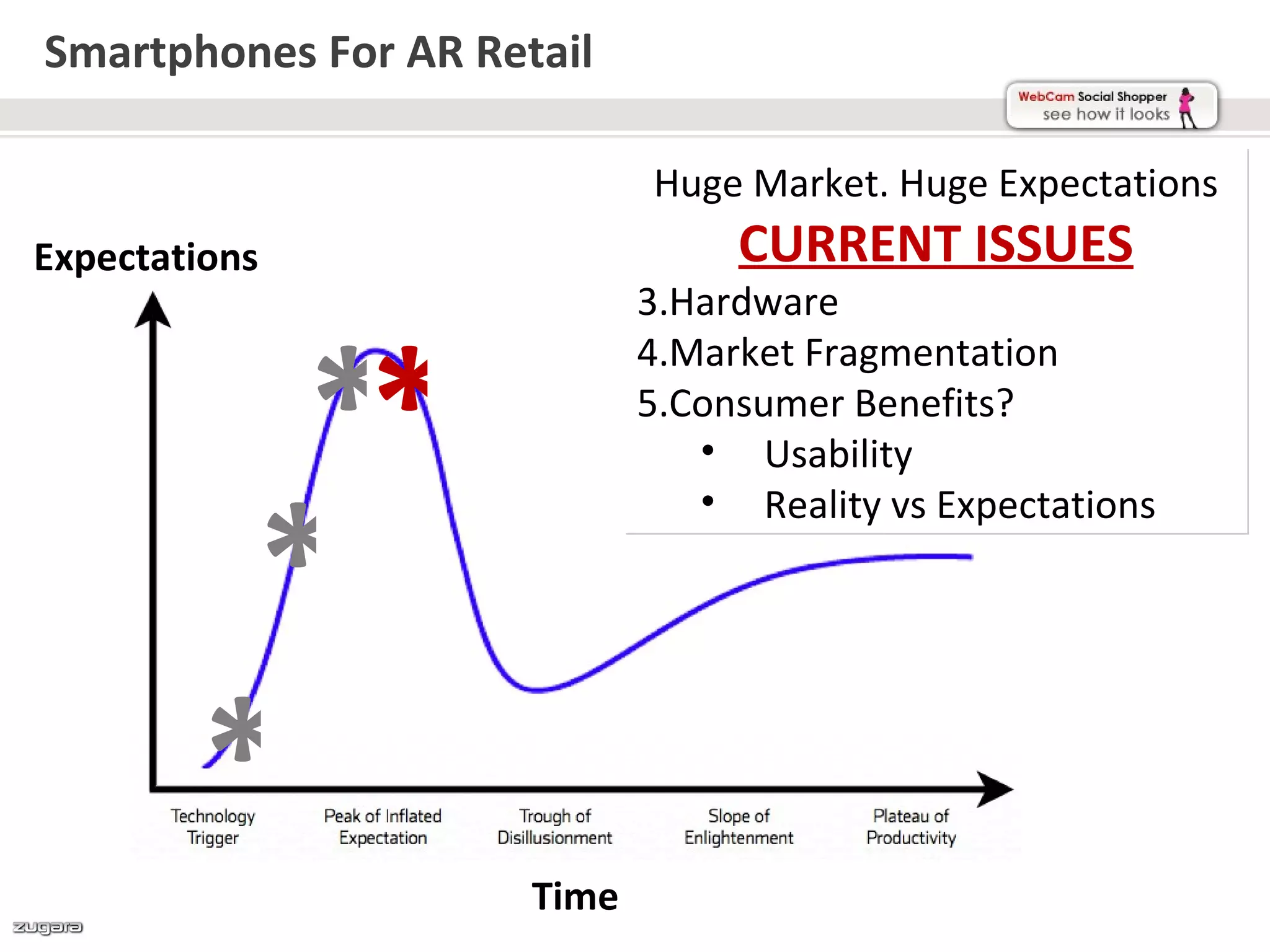

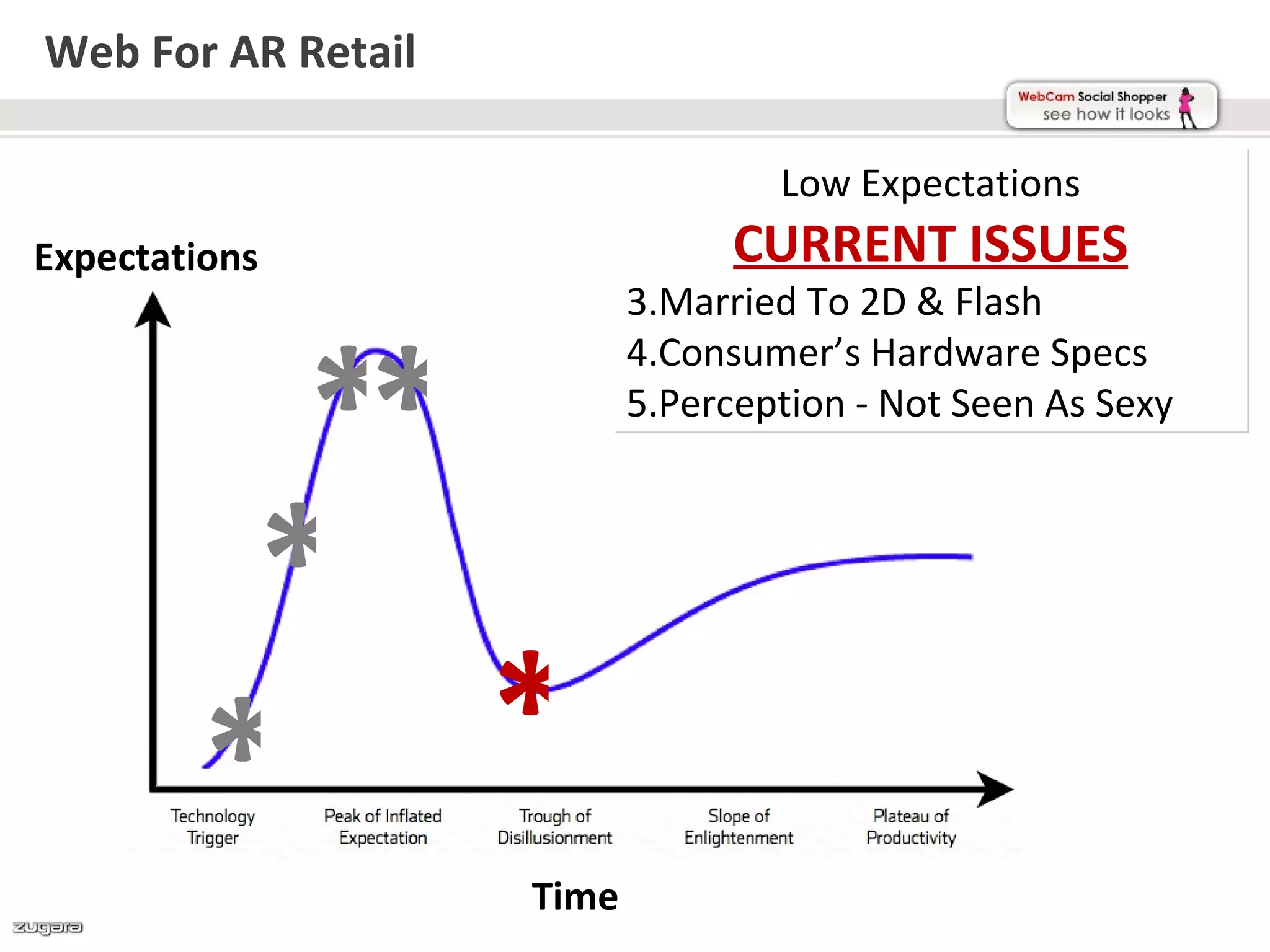

The document discusses the current state and future potential of augmented reality (AR) technology in retail, highlighting the hype cycle and various platforms like smartphones and tablets. It notes the challenges faced, such as hardware penetration and limited consumer adoption, while emphasizing the need for realistic expectations and the focus on immediate usability. Ultimately, it advocates for companies to focus on solving practical problems and selling current benefits rather than future promises.