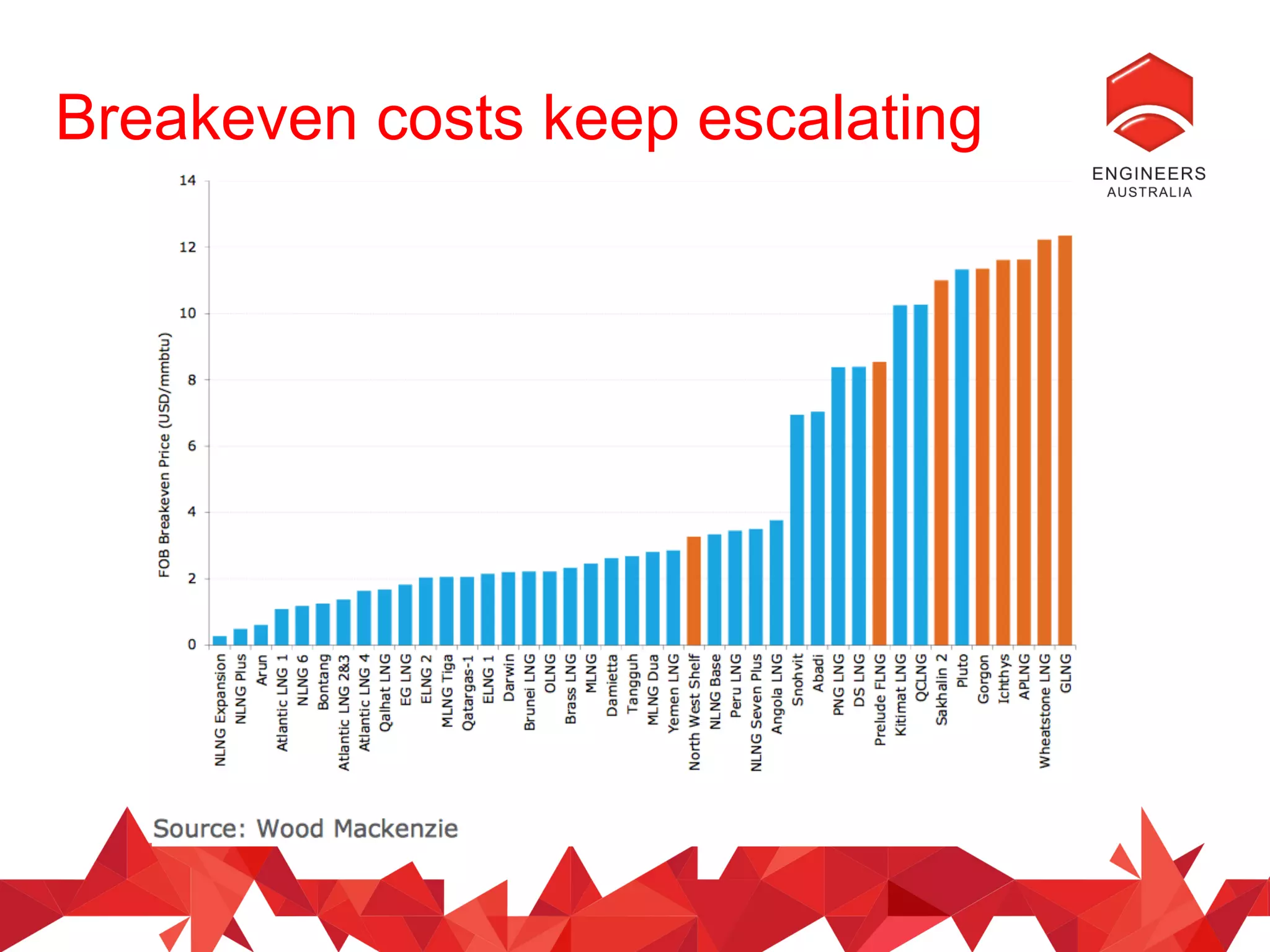

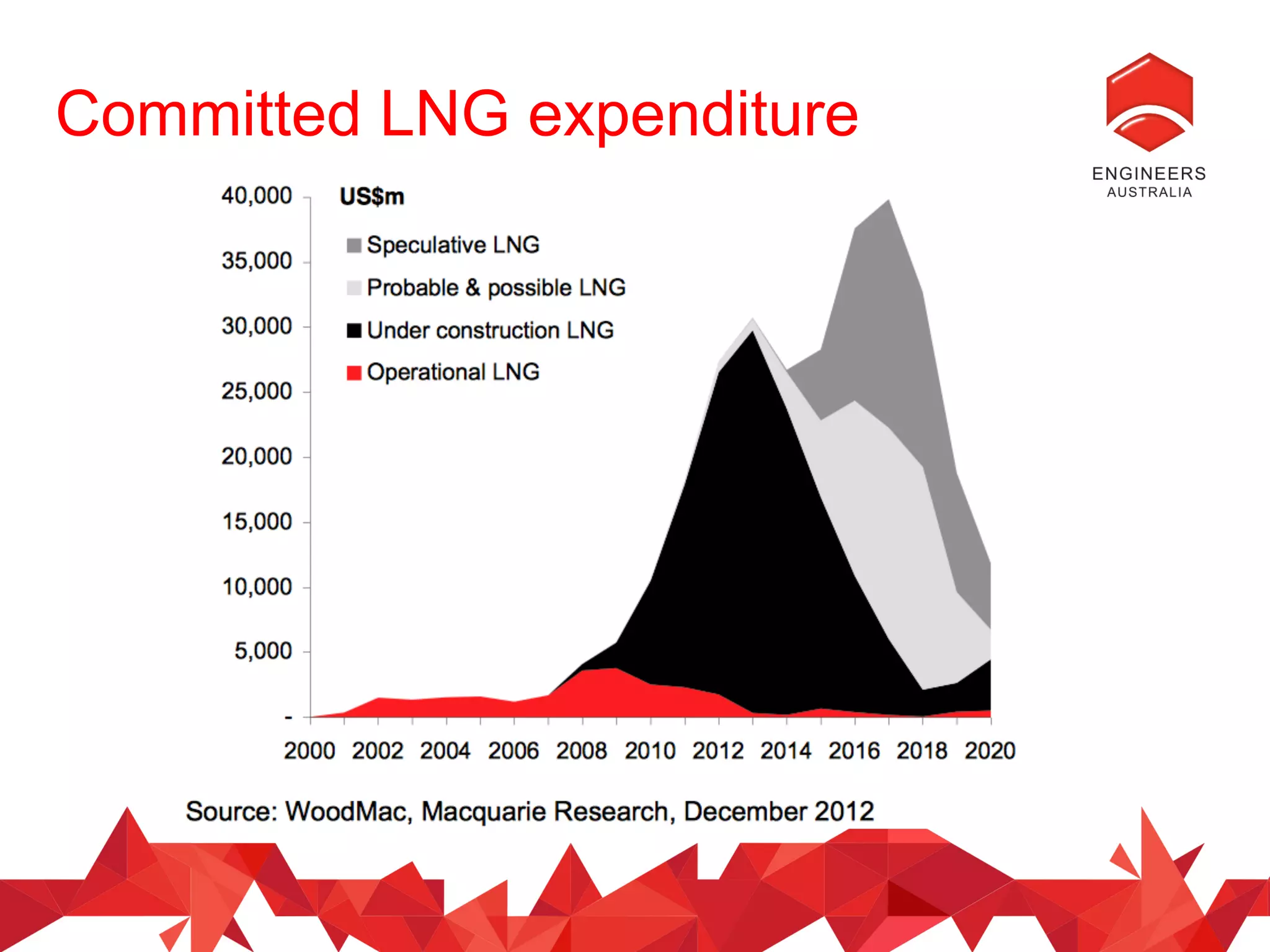

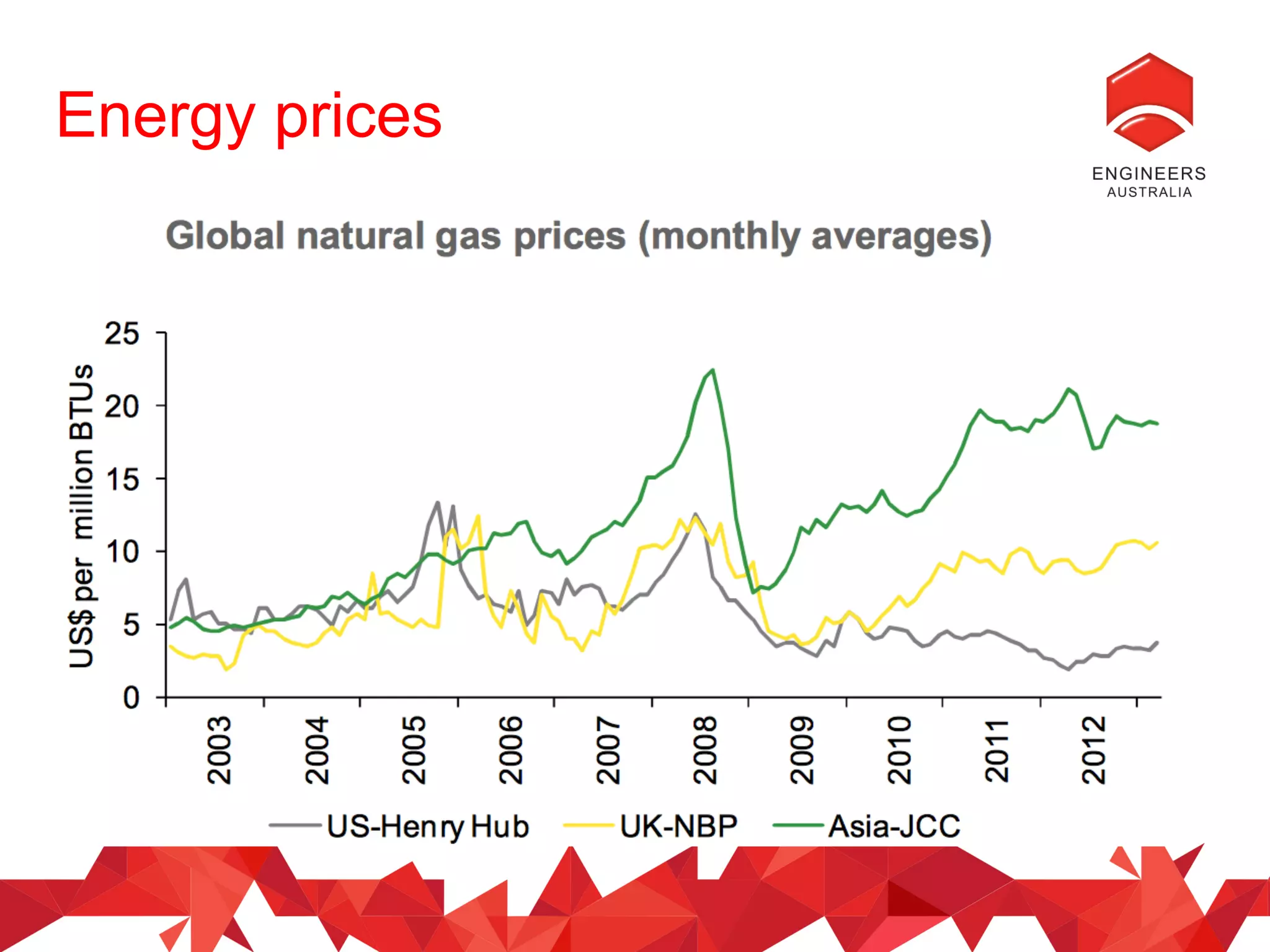

The document discusses the current state and future challenges of the oil and gas industry in Western Australia, focusing on workforce changes and upcoming projects. It highlights the transition from large greenfield developments to smaller brownfield expansions, while emphasizing the importance of local engineering skills and collaboration among stakeholders. Recommendations include enhancing knowledge sharing, supporting local personnel development, and engaging universities in research related to floating liquefied natural gas (FLNG).