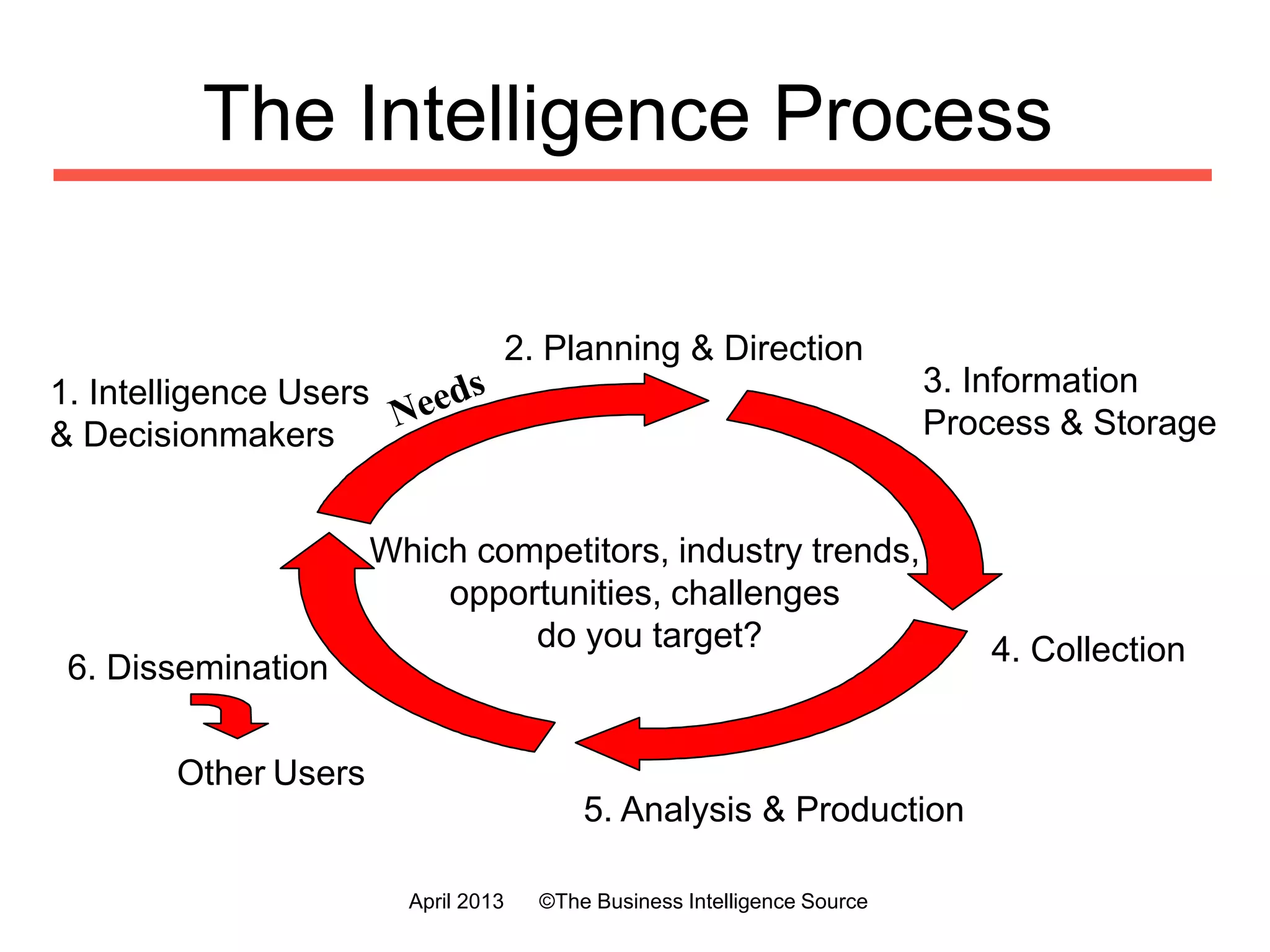

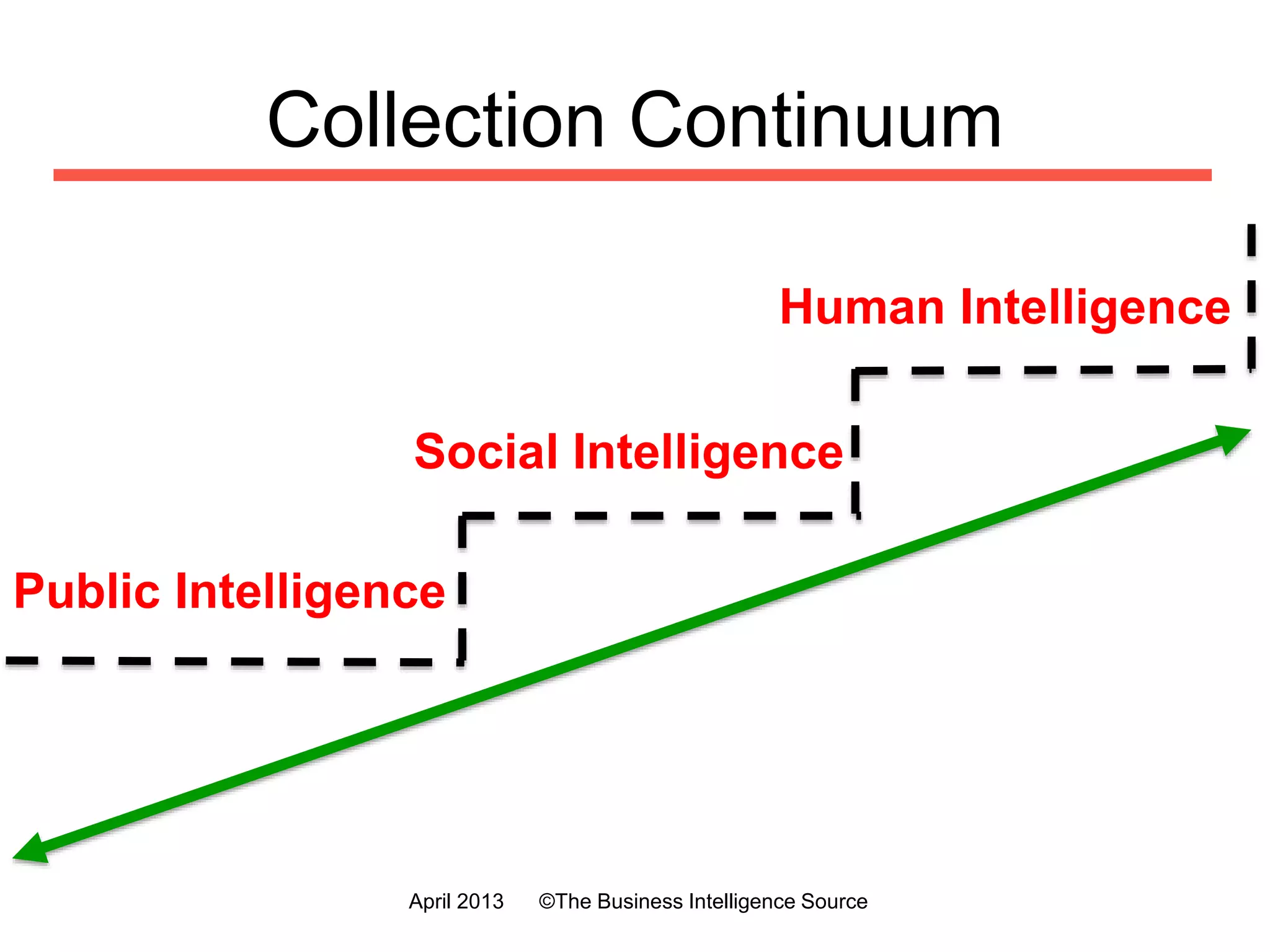

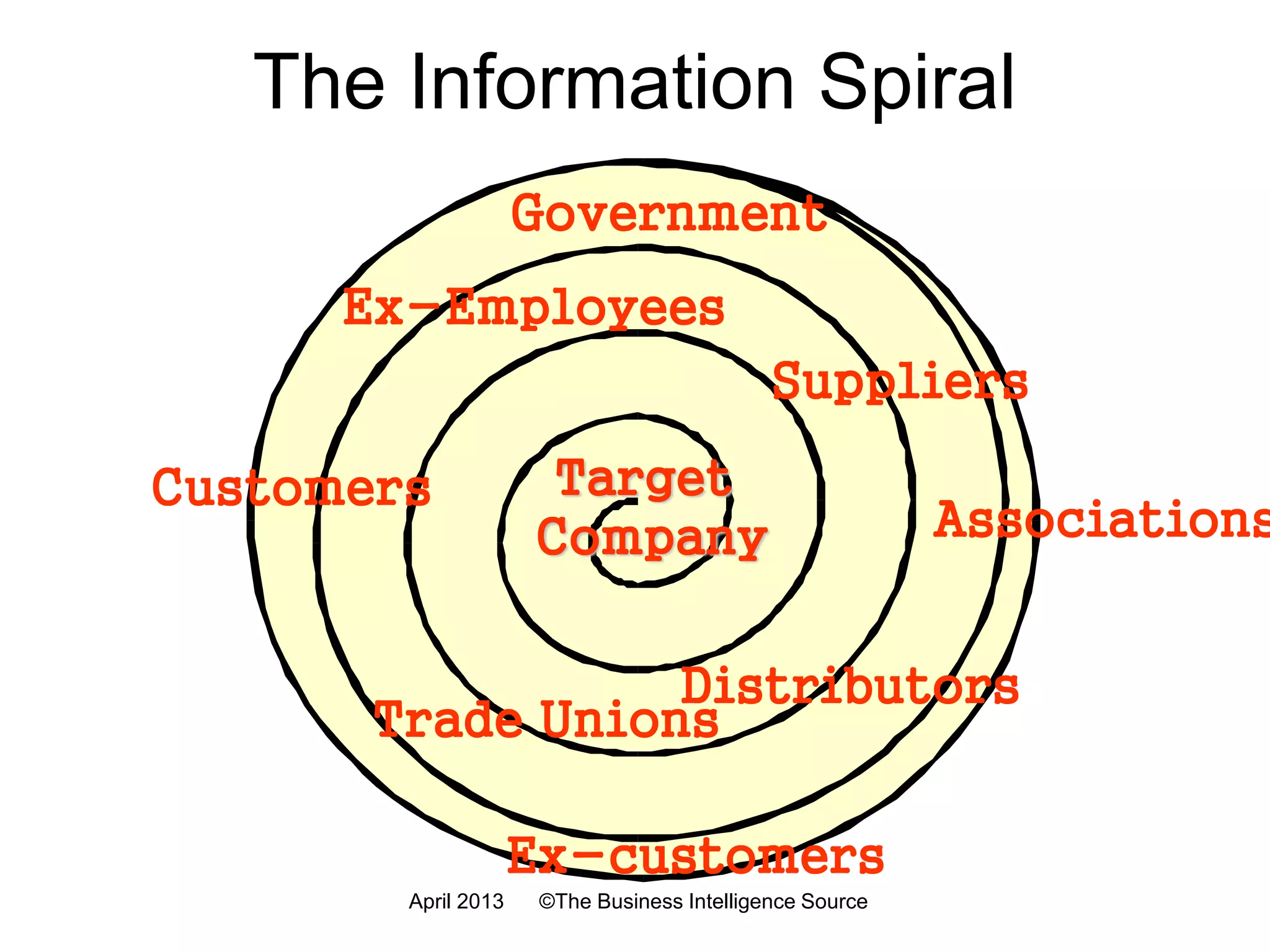

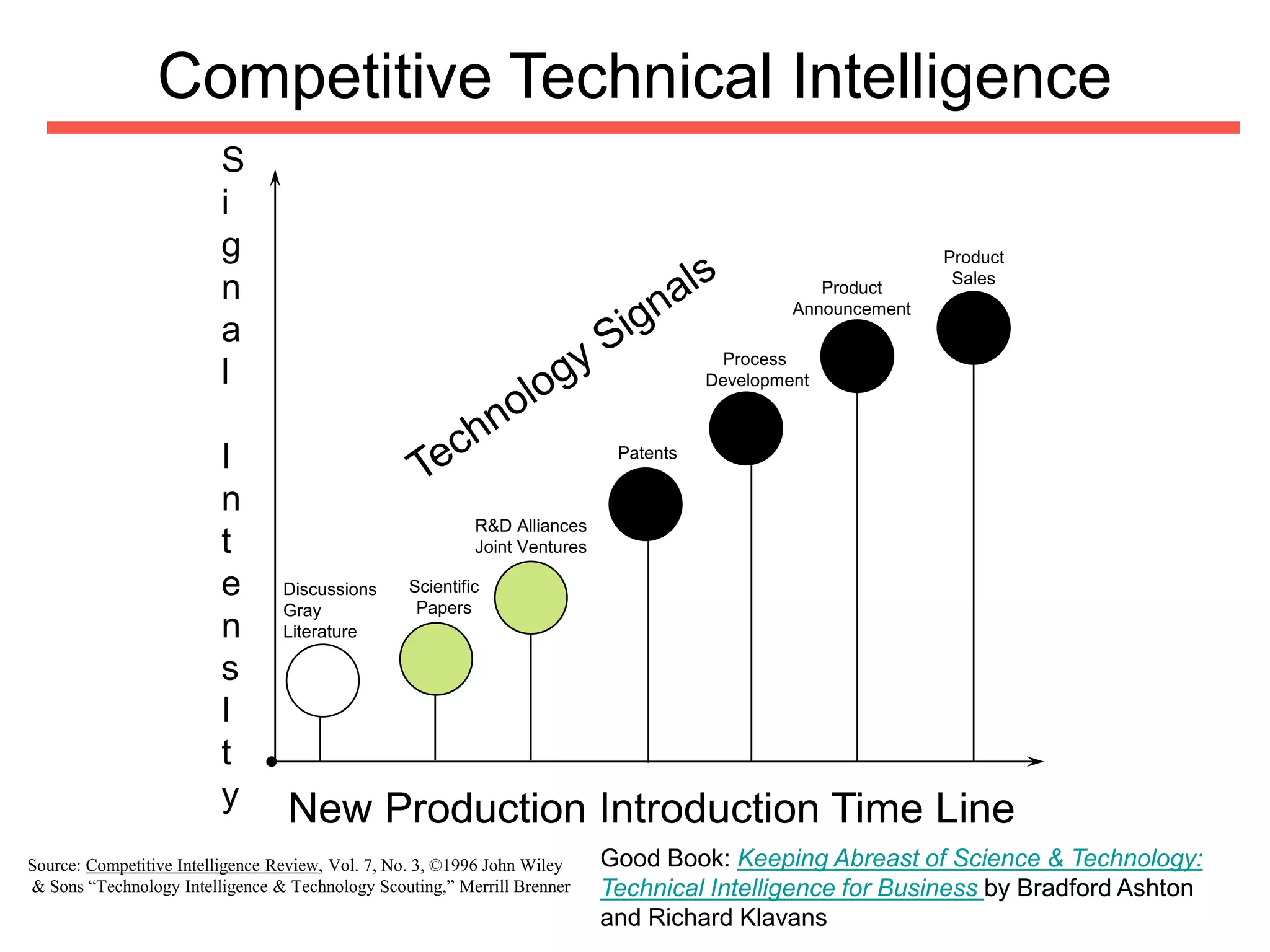

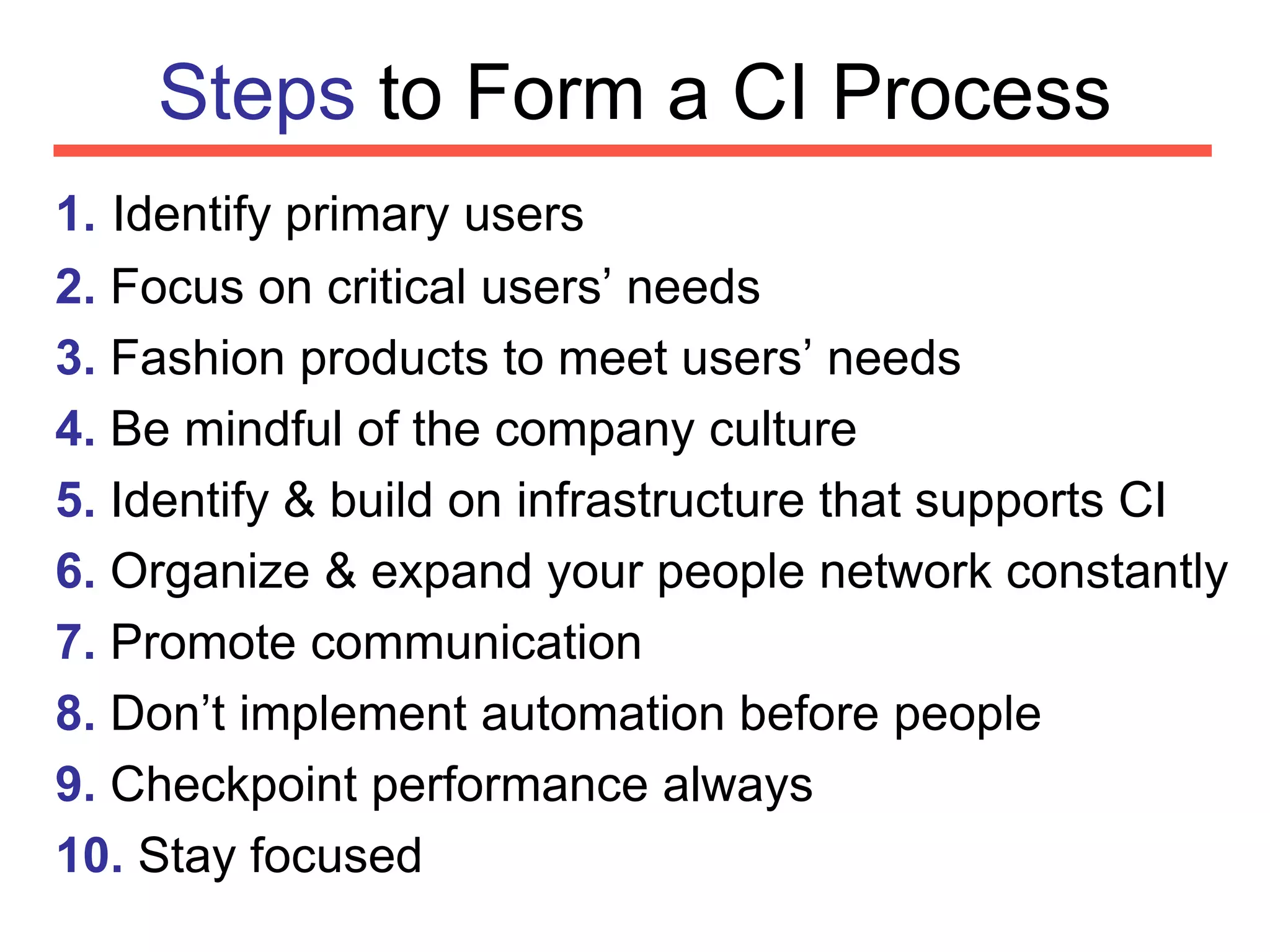

The document outlines the process of developing competitive intelligence (CI) skills, emphasizing the importance of gathering and analyzing information related to competitors and market conditions. It explores various forms of intelligence, such as strategic, tactical, and benchmarking, along with methodologies for effective analysis and communication. Additionally, it highlights the significance of human networks in CI and includes practical steps for creating a robust CI process.