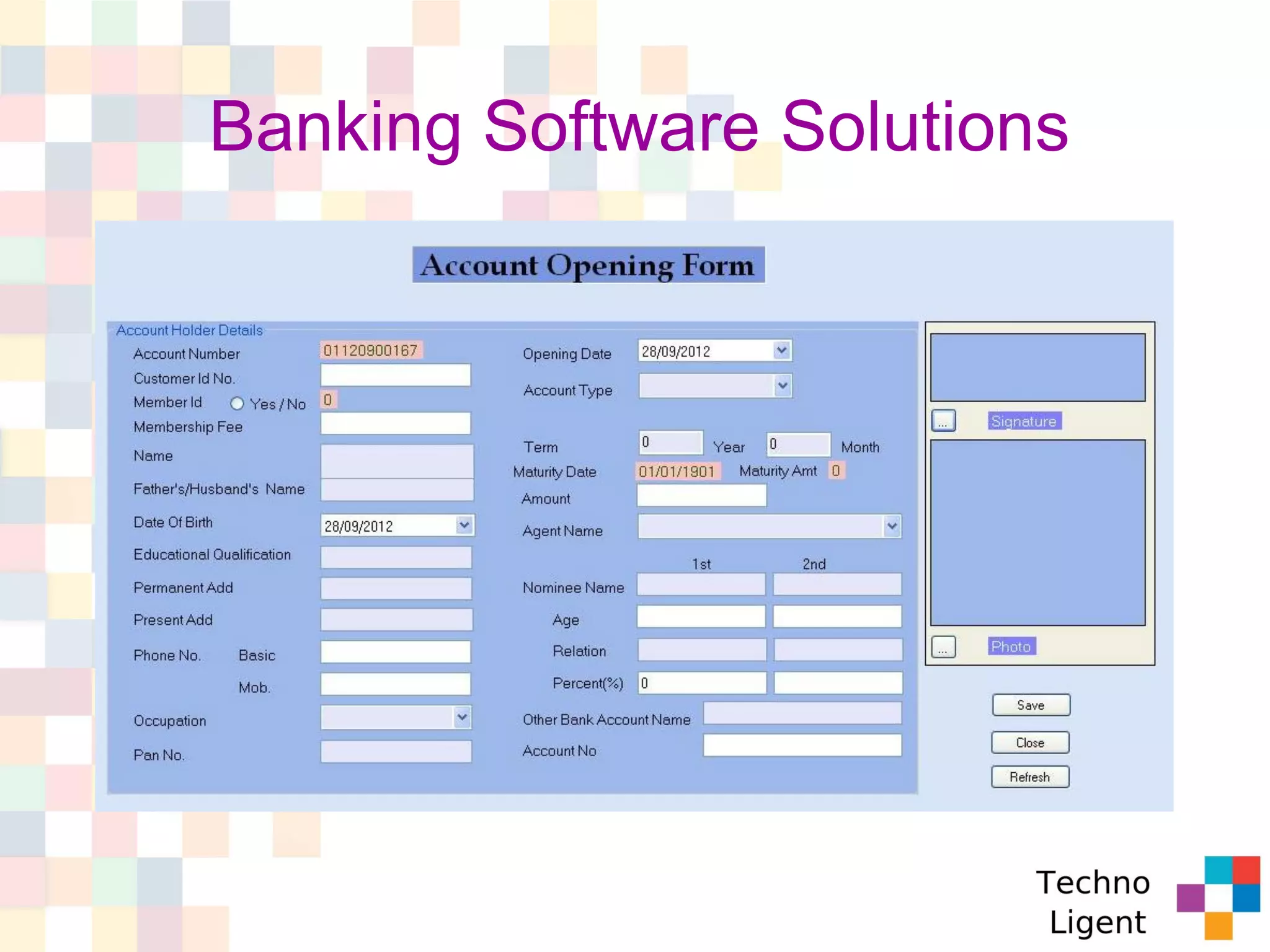

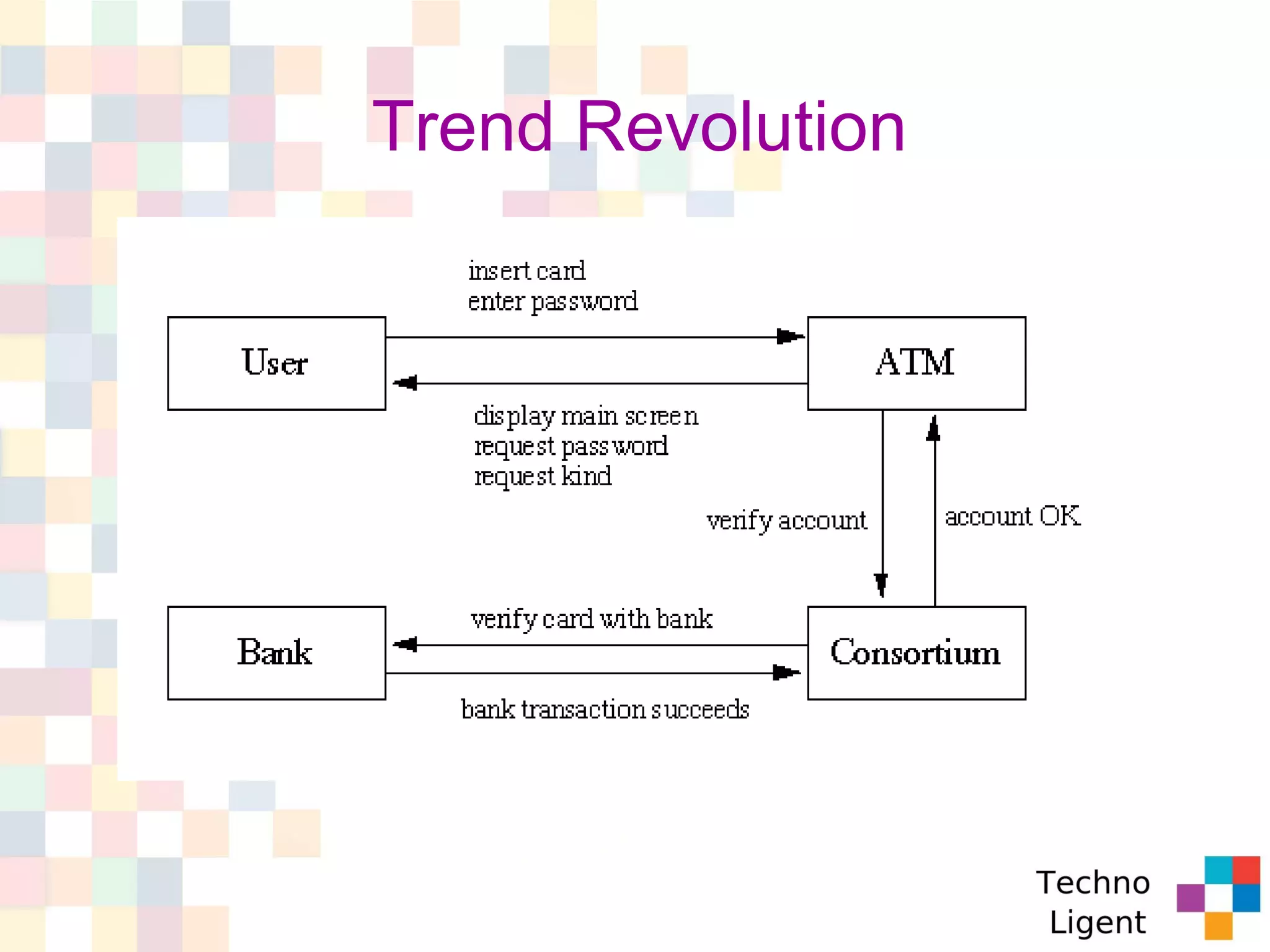

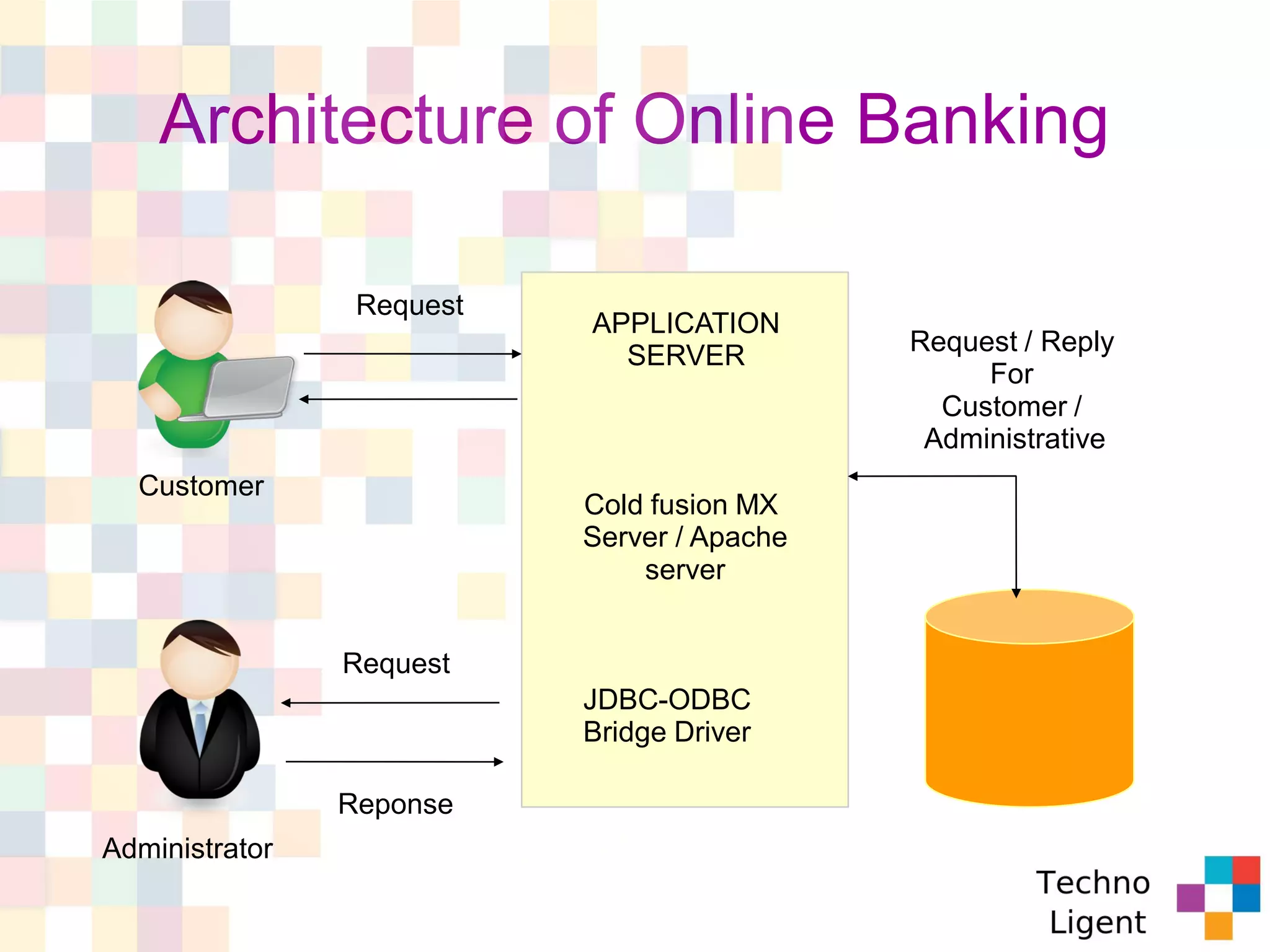

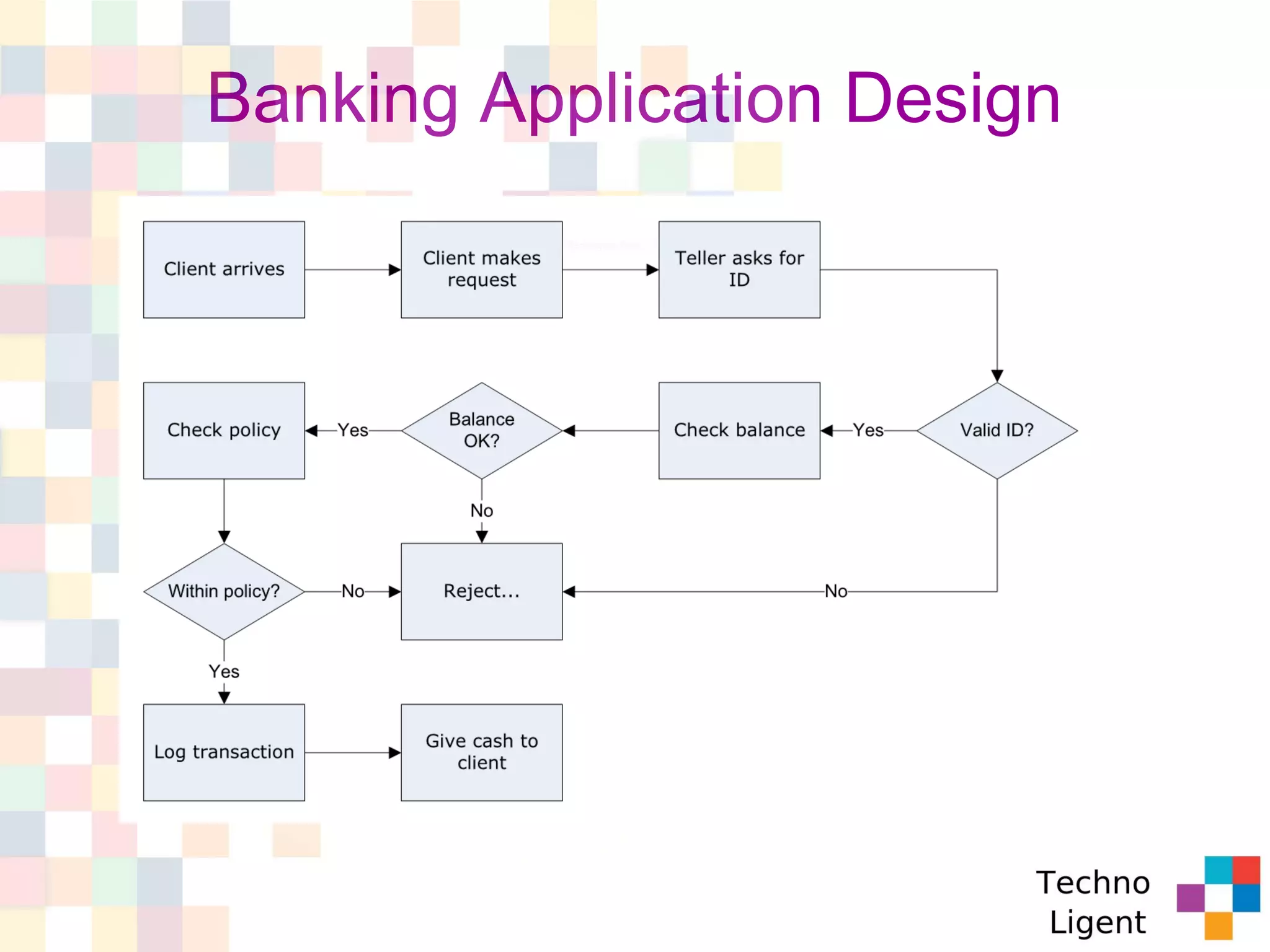

The document discusses the evolution and impact of information technology in the Indian banking sector, highlighting how banking software solutions have streamlined processes and improved customer services through e-banking and automated systems. It details the architecture of online banking applications, including a three-tier model and secure communications via SSL. The document concludes by offering custom application development services for banking solutions.