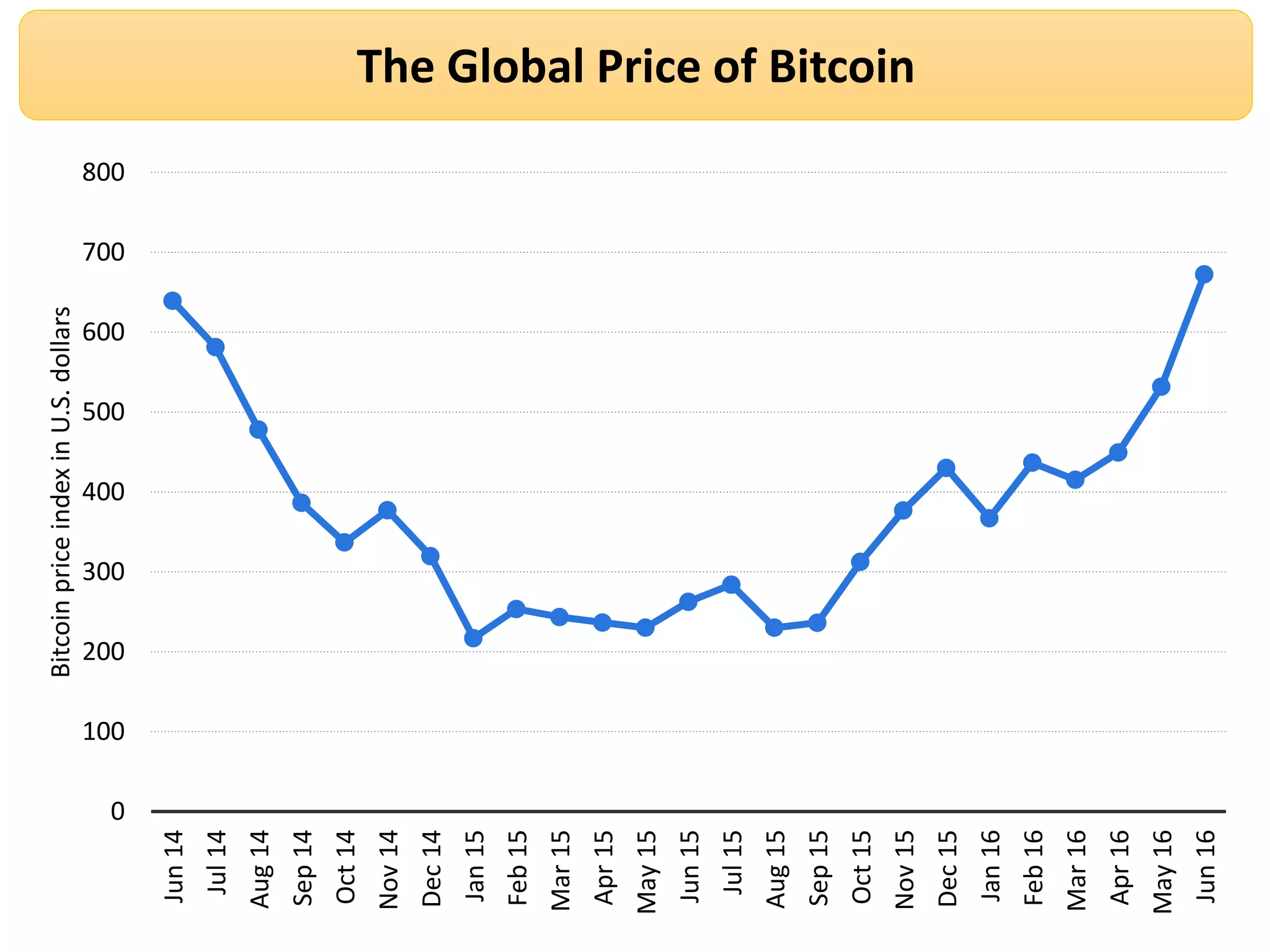

The document provides an overview of financial markets and the characteristics and functions of money, including its role as a medium of exchange, store of value, unit of account, and standard of deferred payment. It discusses different definitions of the money supply, distinctions between narrow and broad money, and introduces Bitcoin as a digital currency, highlighting its value volatility and acceptance. Additionally, the document examines factors affecting the supply and demand for money, as well as the roles of money, capital, and foreign exchange markets in the economy.