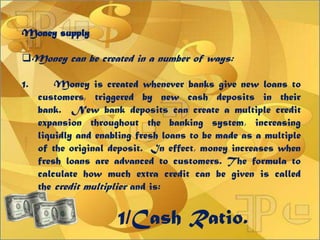

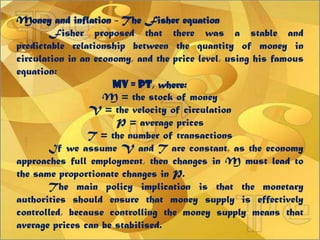

This document discusses the concept of money and monetary policy. It defines money as any object or record that is generally accepted as payment. Modern money systems are based on fiat currency which derives its value from government declaration rather than intrinsic value. The money supply consists of currency and bank deposits. Monetary policy aims to control inflation and the money supply through interest rates and other tools. Different approaches to monetary policy are described, including inflation targeting and using monetary aggregates.