Covid's digitization

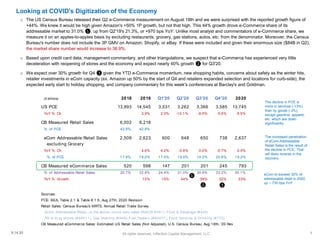

- 1. Looking at COVID's Digitization of the Economy o The US Census Bureau released their Q2 e-Commerce measurement on August 18th and we were surprised with the reported growth figure of +44%. We knew it would be high given Amazon's +50% 1P growth, but not that high. This 44% growth drove e-Commerce share of its addressable market to 31.0% ❶, up from Q2'19's 21.3%, or +970 bps YoY. Unlike most analyst and commentators of e-Commerce share, we measure it on an apples-to-apples basis by excluding restaurants, grocery, gas stations, autos, etc. from the denominator. Moreover, the Census Bureau's number does not include the 3P GMV on Amazon, Shopify, or eBay. If these were included and given their enormous size ($84B in Q2), the market share number would increase to 38.9%. o Based upon credit card data, management commentary, and other triangulations, we suspect that e-Commerce has experienced very little deceleration with reopening of stores and the economy and expect nearly 40% growth ❷ for Q3'20. o We expect over 30% growth for Q4 ❸ given the YTD e-Commerce momentum, new shopping habits, concerns about safety as the winter hits, retailer investments in eCom capacity (ex. Amazon up 50% by the start of Q4 and retailers expanded selection and locations for curb-side), the expected early start to holiday shopping, and company commentary for this week's conferences at Barclay's and Goldman. The decline in PCE is more in services (-13%) than by goods (-3%), except gasoline, apparel, etc. which are down significantly. All rights reserved, Inflection Capital Management, LLC9.14.20 1 The increased penetration of eCom-Addressable Retail Sales is the result of the decline in PCE. That will likely reverse in the recovery. ($ billions) 2018 2019 Q1'20 Q2'20 Q3'20 Q4'20 2020 US PCE 13,993 14,545 3,531 3,262 3,366 3,585 13,745 YoY % Ch 3.9% 2.0% -10.1% -8.0% -5.6% -5.5% CB Measured Retail Sales 6,002 6,218 1,443 1,455 % of PCE 42.9% 42.8% eCom Addressable Retail Sales 2,509 2,623 600 648 650 738 2,637 excluding Grocery YoY % Ch 4.6% 4.2% -0.8% 0.0% -0.7% 0.5% % of PCE 17.9% 18.0% 17.0% 19.9% 19.3% 20.6% 19.2% CB Measured eCommerce Sales 520 598 147 201 201 245 793 % of Addressable Retail Sales 20.7% 22.8% 24.4% 31.0% 30.9% 33.2% 30.1% YoY % Growth 15% 15% 44% 38% 32% 33% Sources: PCE: BEA, Table 2.1 & Table 8.1.5, Aug 27th, 2020 Revision Retail Sales: Census Bureau's MRTS, Annual Retail Trade Survey eCom Addressable Retail...is the above, minus auto sales (NAICS #441), Food & Beverage (#445) RX & drug stores (#44611), Gas Stations (#448), Fuel Dealers (#45431), Food Services & Drinking (#772) CB Measured eCommerce Sales: Estimated US Retail Sales (Not Adjusted), U.S. Census Bureau, Aug 18th, '20 Rev ❶ ❷ ❸ eCom to exceed 30% of addressable retail in 2020, up ~ 730 bps YoY

- 2. ($ billions) 2018 2019 2020 2021 2022 2023 US PCE 13,993 14,545 13,745 14,254 14,681 15,195 YoY % Ch 3.9% -5.5% 3.7% 3.0% 3.5% eCom Addressable Retail Sales 2,509 2,623 2,637 2,509 2,599 2,720 excluding Grocery YoY % Ch 4.6% 0.5% -4.9% 3.6% 4.7% % of PCE 17.9% 18.0% 19.2% 17.6% 17.7% 17.9% CB Measured eCommerce Sales 520 598 793 896 972 1,064 % of Addressable Retail Sales 20.7% 22.8% 30.1% 35.7% 37.4% 39.1% YoY bps Ch 208 bps 729 bps 564 bps 170 bps 169 bps YoY % Growth 15% 33% 13% 9% 9% YoY $ Growth 78 195 103 76 91 Sources: PCE: BEA, Table 2.1 & Table 8.1.5, Aug 27th, 2020 Revision Retail Sales: Census Bureau's MRTS, Annual Retail Trade Survey eCom Addressable Retail...is the above, minus auto sales (NAICS #441), Food & Beverage (#445) RX & drug stores (#44611), Gas Stations (#448), Fuel Dealers (#45431), Food Services & Drinking (#772) CB Measured eCommerce Sales: Estimated US Retail Sales (Not Adjusted), U.S. Census Bureau, Aug 18th, '20 Rev Looking at COVID Digitization Frenzy's Hangover o We expect it will take till 2022 for PCE ❶ to exceed it's prior peak due to persistent high unemployment and job insecurity (resulting in more savings and less spending). Both stem from COVID's likely significant and sustained damage to SMB businesses, the ubiquitous large corporate restructurings that are resulting in significant permanent job losses, and the demand migration to the largest companies from smaller. (Larger companies have higher levels of productivity, thus, less jobs per unit of demand.) o We also expect that a significant amount of PCE shifts back to services and other COVID-impacted consumption categories as the COVID- restrictions are removed and people can return to prior routines and consumption preferences. Our assumed timing for this is Q2'21. As such, we expect eCom Addressable Retail Sales to fall modestly below it's 2018 level to 17.6% ❷ in 2021. We then expect that penetration rate to mean revert to the 2018 levels over the subsequent two years. Consequently, 2021 is likely to be a material down year for these Retail Sales. o The mean reversion years for eCom Addressable Retail Sales for 2022 and 2023 will be reasonably healthy growth years ❸. However, given the now high penetration rate of CB Measured eCommerce Sales at over 36%, it will no longer growth mid- to high-teens and may decelerate to sub-10% growth ❹. 10% is a critical level for an industry to be viewed as "high-growth" with a high-opportunity TAM. Industry growth below-10% usually results in its companies' valuations materially compressing as Wall Street can now understand "how high is the sky." All rights reserved, Inflection Capital Management, LLC9.14.20 2 ❶ ❷ ❸ ❹

- 3. ($ billions) 2018 2019 2020 2021 2022 2023 US PCE 13,993 14,545 13,745 14,254 14,681 15,195 YoY % Ch 3.9% -5.5% 3.7% 3.0% 3.5% eCom Addressable Retail Sales 2,509 2,623 2,637 2,509 2,599 2,720 excluding Grocery YoY % Ch 4.6% 0.5% -4.9% 3.6% 4.7% % of PCE 17.9% 18.0% 19.2% 17.6% 17.7% 17.9% Est Retailer Industry Advertising 63 66 52 63 65 68 % of Addressable Retail 2.5% 2.5% 2.0% 2.5% 2.5% 2.5% Estimated Retail Digital Advertising 23 28 31 44 49 54 % of ttl Advertising 37% 43% 59% 71% 75% 79% Spent on Google 11 13 14 21 23 26 % of eCommerce Sales 2.1% 2.2% 1.8% 2.3% 2.4% 2.5% YoY % Growth 23% 10% 42% 13% 12% Sources: PCE: BEA, Table 2.1 & Table 8.1.5, Aug 27th, 2020 Revision Retail Sales: Census Bureau's MRTS, Annual Retail Trade Survey eCom Addressable Retail...is the above, minus auto sales (NAICS #441), Food & Beverage (#445) RX & drug stores (#44611), Gas Stations (#448), Fuel Dealers (#45431), Food Services & Drinking (#772) Est. Retailer Advertising spend: ICM, LLC Est. Retailer Digital Ad Spend and on Google: eMarketer estimates 2nd-Order Effects from the COVID Digitization o Other industries such as digital advertising are likely more at-the-end-of-the-whip of such large economic and consumption reallocations. During Q2 digital advertising experienced significant reductions in pricing as commercial activity plummeted and ad budgets were cut. For example, for Google's Q2 owned-search-revenue declined 10% (back to even for June) with paid clicks decelerating to +8% YoY and cost-per-click declining by 15% YoY. With economic activity picking in the 2H and advertisers coming out of crises mode and re-engaging, we expect Google's owned search to end the year up 10% ❶. Other advertising verticals and geographies will have their own idiosyncrasies which will sum to Google's reported number. o For 2021, the economic rebound will further propel the end-of-the-whip and digital advertising will further accelerate as more advertising dollars are funneled into digital advertising to follow the digitization of the economy with YoY potentially exceeding 40% growth ❷. This is especially true with the recovery in services industries and their recovery in share of PCE during 2021 (in Q2'20 was -230 bps YoY -> 66.7% and -13% YoY). o However, 2021 should prove to be the apex of digital advertising growth for the retail sector as it now becomes the majority and forces it to over time slow to end market growth, in this example eCom Addressable Retail Sales. Again other advertising verticals and geographies will have their own idiosyncrasies which will sum to additional effects. For example, travel will have a delayed recovery and it will upwardly lift total digital advertising growth during 2022 and 2023 from the numbers shown below. That said, we would be surprised to see the total exceeding 15%. All rights reserved, Inflection Capital Management, LLC9.14.20 3 ❶ ❷