Marvin Ellison's Turnaround of Lowe's Pro Business

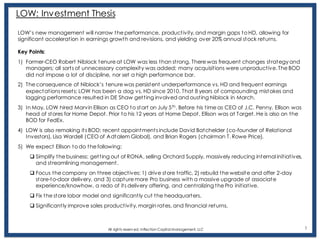

- 1. 1 LOW: Investment Thesis LOW’s new management will narrow the performance, productivity, and margin gaps to HD, allowing for significant acceleration in earnings growth and revisions, and yielding over 20% annual stock returns. Key Points: 1) Former-CEO Robert Niblock tenure at LOW was less than strong. There was frequent changes strategy and managers; all sorts of unnecessary complexity was added; many acquisitions were unproductive. The BOD did not impose a lot of discipline, nor set a high performance bar. 2) The consequence of Niblock’s tenure was persistent underperformance vs. HD and frequent earnings expectations resets; LOW has been a dog vs. HD since 2010. That 8 years of compounding mistakes and lagging performance resulted in DE Shaw getting involved and ousting Niblock in March. 3) In May, LOW hired Marvin Ellison as CEO to start on July 5th. Before his time as CEO of J.C. Penny, Ellison was head of stores for Home Depot. Prior to his 12 years at Home Depot, Ellison was at Target. He is also on the BOD for FedEx. 4) LOW is also remaking its BOD; recent appointments include David Batchelder (co-founder of Relational Investors), Lisa Wardell (CEO of Adtalem Global), and Brian Rogers (chairman T. Rowe Price). 5) We expect Ellison to do the following: ❑ Simplify the business: getting out of RONA, selling Orchard Supply, massively reducing internal initiatives, and streamlining management. ❑ Focus the company on three objectives: 1) drive store traffic, 2) rebuild the website and offer 2-day store-to-door delivery, and 3) capture more Pro business with a massive upgrade of associate experience/knowhow, a redo of its delivery offering, and centralizing the Pro initiative. ❑ Fix the store labor model and significantly cut the headquarters. ❑ Significantly improve sales productivity, margin rates, and financial returns. All rights reserv ed, Inflection Capital Management, LLC

- 2. 2 Is Marvin Ellison the right guy? We think so because: 1) Lowe’s CEO position is a plumb job given the company’s competitive moats, macro tailwinds, the large size of the business, the brand’s popularity, and the hole that Niblock put the business in creates a lot of opportunity. Consequently, the LOW BOD and DE Shaw likely had a very attractive set of candidates to select from. Marvin probably presented them with the most compelling strategyfor climbing out of the hole and got the job. 2) Marvin was very well regarded internally at Home Depot as head of stores. He was also well regarded at Target (15 years) where he ran global logistics. 3) Marvin’s stint as J.C. Penny’s CEO was a disappointment, but it was not marked by controversy. His initiatives moderated the decline of the business, but theydidn’t resolve its structural problems. We ourselves believe there is no fix for J.C. Penny. We believe that it is an obsolete business and a failed brand, and that it will go away in two to three years. 4) Our only criticism of Marvin is that he thought himself clever enough to fix J.C. Penny’s; that was either foolishness or hubris, or a combo of the two. Consequently, what we are watching for from Marvin is realism, insight, and humility. Should he not impress on all three characteristics, that would be a signal that he is not the right fit for the Lowe’s CEO role. All rights reserv ed, Inflection Capital Management, LLC

- 3. 3 LOW vs. HD: The Pro Business The table below shows the performanceof LOW’s Pro business over the past eight years in contrast to HD’s. There is a significant performance gap that new management can address. Our key points are: 1) Everyone knows that LOW’s store locations are in less convenient, lower density, more suburban, less-affluent (- cy gaining), and newer housing-stock trade areas/locations. Those differences are reflected in the starting point CY2010 and they may have had some moderating impact on the growth, but not to the degree that HD is able to more than double the business during this period vs. only a 45% gain at LOW. 2) In 2010, HD’s per store performance was 15% above LOW’s; now the outperformance is 86%. 3) Factors contributing to HD’s improvement include: better and faster service desks, more knowledgeable/helpful sales/service employees, better sales recruitment, better store-to-site delivery, better assortment of Pro brands (Milwaukee & Ridgid), and more consistent program execution. None of these should be unresolvable to Marvin Ellison. 4) The combined share of LOW’s and HD’s total business is around 40% of the addressable market as tightly defined (NAICS 444), or 26% of a broader $600B TAM as defined by HD which includes services and commercial MRO. Should LOW grow its Pro business by $15B over the next 5 years that would be 2% share of the growing larger TAM. That 2% figure strikes us as “manageable” for HD; i.e. the increased performance and share gains at LOW are not likely to spur an outright price/service war between the retailers. 5) Specific to Pro, HD claims that it only has 20% wallet share of its Pro customers’ business and that increasing that by several times is a reasonable expectation (in addition to winning more commercial customers.) HD also claims that only 20% of Pros use its delivery. This suggests, that HD and LOW can make significant share gains by delivering more bulk building materials to contractors, taking share from smaller regional players Allrightsreserved,InflectionCapitalManagement,LLC CY 2010 CY 2018e Delta Lowe's ex. Orchard Supply & Rona Pro $13,724 $19,944 $6,220 Per Store $7.8 $11.0 Per Sq $70 $97 Home Depot Pro $20,261 $46,935 $26,674 Per Store $9.0 $20.5 Per Sq $86 $198

- 4. 4 LOW vs. HD Pro Allrightsreserved,InflectionCapitalManagement,LLC Lowe’s Home Depot Below are images of one Lowe’s store and one Home Depot store in Plymouth, Minnesota between 8-9 am on July 5th, 2018. (The stores are 8 miles apart.) The Lowe’s Pro serv ices area had three associates andno customers for 30 minutes. Moreov er, there were no customer trucks parked near the Pro entrance and only one order pickup from the Pro bay. In contrast, there were a dozen customers at the Home Depot desk within the second 30 minutes. In addition, seven trucks were parked near the Pro entrance and five trucks were in the bay. (We get that this is one anecdote.)

- 5. 5 LOW vs. HD: The Pro Business All rights reserv ed, Inflection Capital Management, LLC Shown on this page is LOW’s website pitch to the Pro.

- 6. 6All rights reserv ed, Inflection Capital Management, LLC Shown on this page is HD’s website pitch to the Pro. We have circled the four areas of differentiation: rental, assortment, delivery, and purchase tracking LOW vs. HD: The Pro Business

- 7. 7All rights reserv ed, Inflection Capital Management, LLC LOW vs. HD: Delivery Shown on this page is a side-by-side of an order for 100 sheets of plywood. Of note: ✓ LOW does not provide a delivery time. HD provides a 2-hour window for today! ✓ LOW will call the customer at some point during the day and schedule the delivery. This means that the customer has no certainty on the delivery when making the order and has to be present for the call-back. These are unrealistic expectations. ✓ The HD price does not show $200 in sales tax; including that makes the total $2941, or 2.4% cheaper (i.e. immaterial). ✓ Conclusion, LOW is “ok” on price, but not competitive on service.

- 8. 8All rights reserv ed, Inflection Capital Management, LLC LOW vs. HD: Delivery Shown is a side-by-side of an order for 100 sacks of shingles. The same conclusions as the prior can be reached here.

- 9. 9 ProjectedMarvin Ellison’s Pro Program All rights reserv ed, Inflection Capital Management, LLC Below wesketch out our expectations for what LOW is likely to do to make significant gains in its Pro business: 1) Create a Pro-specific management-line, similar to what HD did with Bill Lennie (EVP of Outside Sales & Service). 2) Pros state that HD’s associates have superior knowledge and experience which allows them to quickly get through the store with what they need. LOW needs to significantly upgrade the sales and service associate base to a meaningfully higher amount of skill and experience. This could be up to a $1.2B investment (see below). 3) Roll-out 2- & 4-hour window same- & next-day delivery to a substantial portion of the US. This took HD around 5 years and $1.2B to deploy. This would involve additional DCs, cross-dock centers, and other fulfilment assets. LOW will have to move substantially faster than HD did, but it benefits from being able to replicate a model vs. invent one. 4) Significantly enhance its dedicated B2B website. 5) Meaningfully increase the assortment of Pro-focused brands, building materials, and hardware, 6) Add tool rental to substantially more locations. 7) Introduce significantly more business process productivity tools for the Pro. 8) Meaningfully step-up serving commercial MRO (apartments/condo complexes, schools, hospitals, etc.) LOW’s Store Associate Upgrade Higher Skilled Talent Hourly Rate $40 Annual Cost $80,000 Benefit Cost $20,000 # per Store 10 Subtotal $1,000,000 Replaced Associates Hourly Rate $15 Annual Cost $30,000 Benefit Cost $5,000 # per Store 10 Subtotal $350,000 Annual Investment/Store $650,000 Stores 1,800 Annual Cost $1,170

- 10. Lowe's CY 2018 CY 2019 CY 2020 CY 2021 CY 2022 CY 2023 Comment Existing Pro Business $19,944 $20,941 $21,988 $23,088 $24,242 $25,454 Organic Growth 5% 5% 5% 5% 5% Initiative 2- & 4-Hour Windows Stage-1 25% of Stores $524 $1,374 $3,463 $4,848 10% initial lift going to 80% Stage-2 50% of Stores $524 $1,374 $3,463 Stage-3 75% of Stores $524 $1,374 Stage-4 100% of Stores $524 Subtotal $524 $1,898 $5,361 $10,209 Pro-Dedicated Website $1,047 $2,094 $2,408 $2,769 5% initial lift Streamlined Pro Organization & More SKUS $209 $419 $1,256 $1,885 1% initial lift Subtotal of Initiatives $0 $0 $1,780 $4,411 $9,026 $14,864 YoY $ Change $0 $1,780 $2,631 $4,615 $5,838 Upgraded Lowe's Pro Business $20,941 $23,768 $27,498 $33,268 $40,318 LOW Total Business $66,592 $69,256 $73,806 $79,318 $86,929 $95,883 Base Growing @ 4% ex. Orchard & Rona Initatives' Boost to the comp 0% 3% 4% 6% 7% YoY $ Change of Initiative/base Underlying LOW Comp 4% 4% 4% 4% 4% Total Comp 4% 7% 8% 10% 11% HD's Pro Business $43,865 $47,813 $52,116 $56,806 $61,919 $67,492 9% CAGR LOW / HD 45% 44% 46% 48% 54% 60% 10 Quantification of MarvinEllison’s Pro Program All rights reserv ed, Inflection Capital Management, LLC ✓ Our modeling of these initiatives shows at least a $15B lift in LOW’s Pro business over the next 5 years from these initiativ es. We have not modeled specific benefits from expanding the selection, centralizing management, etc. These are a WAG. ✓ The lift provides a meaningful lift to the comp and allows it to build to +double-digits on top of an underlying comp of +4%. ✓ The lift narrows the underperformance gap of LOW vs HD from 45% to 60%.

- 11. 11 LOW vs. HD: The e-Commerce Business The table below shows the performanceof LOW’s e-Commerce business over the past eight years in contrast to HD’s. There is a significant performance gap that Marvin can address. Our key points are: 1) The factors about market differences between LOW and HD will be reflected in the difference in the base period-2010, but the factors are most likely only modest in explaining how HD was able to grow this business by $7.4B vs. LOW by only $2.5B, or nearly 3X more. 2) Lowes.com suffers from less traffic and a materially lower conversion rate. 3) Lowes.com’s traffic is 40% less than HomeDepot.com’s despite competitive search marketing (see subsequent pages). Our hypothesis is that this is due to inferior direct traffic and natural search results. Said differently, LOW is investing a similar amount for customer acquisition as HD, but only getting 60% of the return. We do not have the expertise to know what is required to resolve this deficiency, but it seams like a ripe area for feasible improvement. 4) The conversion rate is meaningfully lower due to inferior product, inferior merchandising, and an inferior commerce site. In summary, a substantial portion of the material underperformance at LOW is execution- related, i.e. addressable by Marvin. All rights reserv ed, Inflection Capital Management, LLC CY 2010 CY 2018e Delta Lowe's ex. Orchard Supply & Rona Online $547 $3,073 $2,526 Home Depot Online $913 $8,298 $7,385

- 12. 12 LOW vs. HD e-Commerce: Delta in search requests All rights reserv ed, Inflection Capital Management, LLC

- 13. 13 LOW vs. HD e-Commerce:Delta in Site Traffic All rights reserv ed, Inflection Capital Management, LLC Bounce rate is an Internet marketing term used in web traffic analysis. It represents the percentage of visitors w ho enter the site and then leave ("bounce") rather than continuing to view other pages w ithin the same site. Source: SimilarWeb 7.5.2018

- 14. 14 LOW vs. HD e-Commerce:Delta in Site Traffic All rights reserv ed, Inflection Capital Management, LLC

- 15. 15 LOW vs. HD: Paid-Search All rights reserv ed, Inflection Capital Management, LLC These panels show keyword campaigns for different relevant terms. While we only show three terms here, a larger selection of terms show similar findings. Those findings are as follows: ✓ LOW is just as likely to be ranked #1 as HD. ✓ LOW and HD are typically ranked #1 & #2. ✓ The competition for most terms is high as measured by the Competition score and the CPC price. ✓ Conclusion: LOW isn’t underspending in search.

- 16. 16 LOW vs. HD e-Commerce All rights reserv ed, Inflection Capital Management, LLC Lowe’s Experience: • 12 clicks to completed purchase • 5 day delivery period • Item price hid till seventh click. Home Depot Experience: • 7 clicks to completed purchase • 4 day delivery period • Item price hid till 2nd click. Inferior Experience

- 17. 17 LOW vs. HD e-Commerce Returns All rights reserv ed, Inflection Capital Management, LLC Lowe’s Experience: • No ability to cancel order from order-confirm e-mail. • Required to call customer service (20 minutes). • If order shipped. See info below. Home Depot Experience: • 4 clicks to canceled from order-confirm e-mail. Inferior Experience

- 18. 18 Quantification of MarvinEllison’s e-Commerce Program Allrightsreserved,InflectionCapitalManagement,LLC Below wesketch out the revenuelift frommaterial improvements in traffic and conversion rate. 1) Invest more in the brand informing consumers about where “The New Lowe’s” is going. 2) Engineer more direct site visits and natural search via social media and other magic. 3) Significantly improve category navigation to rid unnecessary clicks and reduce the necessary clicks to a completed transaction to under five clicks. 4) Make significant improvements to the supply chain to reduce delivery times to two days, or less. 5) Automate order changes and cancellations. Remove friction, remove friction, remove friction. 6) Should LOW improve the traffic gap from 60% to 77% and the close-rate gap from 50% to 81%, while maintaining 20% underlying revenue growth (benefiting from a lower penetration rate than HD), then the sales gap between the two would materially close over the next five years from 63% (1-37%) to 18% (1-82%). Lowe's CY 2018 CY 2019 CY 2020 CY 2021 CY 2022 CY 2023 Existing Online Business $3,073 $3,688 $4,425 $5,310 $6,372 $7,647 Organic Growth 20% 20% 20% 20% 20% Traffic Improvement 5% 5% 5% 5% 5% Gap to HomeDepot.com 60% 63% 66% 69% 73% 77% Conversion Improvement 10% 10% 10% 10% 10% Gap to HomeDepot.com 50% 55% 61% 67% 73% 81% Total Growth 35% 35% 35% 35% 35% Upgraded Online Business $3,073 $4,149 $5,601 $7,561 $10,207 $13,779 Incremental Revenue $0 $461 $1,175 $2,251 $3,835 $6,133 HD's Online Business $8,298 $9,958 $11,658 $13,358 $15,058 $16,758 Assumed Growth 20% 17% 15% 13% 11% LOW Upgrade / HD 37% 42% 48% 57% 68% 82%

- 19. 19 Labor Model Differences Between LOW & HD HD has a superior staffing model to LOW that allows for a better match between labor hours and peak selling periods yielding higher customer satisfaction, close rates, customer loyalty, labor productivity, and employee satisfaction. Key points are: 1) HD’s store employee mix is 40% PT/60% FT each day of the week. This allows HD to flex-up hours during the peak weekend selling period; it also allows HD to adjust for surges in demand due to weather, market conditions etc. In contrast, LOW is over 60% FT Monday-Friday and then all PTduring the weekend. This results in less knowledgeable, less productive (sales-wise) employees being used for the peak weekend period. 2) HD has also more distinctly separated the roles of selling from tasking. Selling-associates are paid more than tasking-employees. Separating the roles also makes it clear that the customer comes first. This change has allowed HD to attract and retain better quality and more knowledgeable selling-associates. That it turn has improved customer satisfaction, close rates, sales productivity and costs. All rights reserv ed, Inflection Capital Management, LLC

- 20. 20 Other Cost Structure Differences Between LOW & HD 1) For those that have visited both companies’ HQs, there is little doubt that LOW suffers from excess. LOW’s massive HQ was started in 2006, demonstrating how oblivious management was to the forthcoming housing crises. 2) Most benchmarking work between the two have suggested 200-300 bps in excess costs at LOW. We suspect that these numbers are distorted by RONA, Orchard Supply, and other Niblock projects. Our benchmarking of the two companies from the year-2010 suggests around 160 bps in excess costs at LOW. Projecting that 160 bps on the Lowe’s store revenue suggests $1.3B in potential savings. 3) LOW’s prior CFO, Bob Hull, has told folks he had line-of-sight on over $1.0B in additional savings before “going into retirement” at age-52 in early 2017. All rights reserv ed, Inflection Capital Management, LLC

- 21. 21 Other Business Differences BetweenLOW & HD 1) In early 2016, LOW acquired the Canadian retail chain RONAfor $2.4B. RONA has roughly $4.5B in sales from 539 stores. These stores are a totally different store and model from a traditional Lowe’s store, in size, merchandise, trade areas, margin rate, etc. LOW has shared little about the chain since the close. We expect Marvin to find a buyer of the business for around $2B and take a loss. This would allow management and the LOW enterprise to devote more focus onto the US and the Lowe’s brand. 2) In early 2013, LOW acquired California-based Orchard Supply for $205m. Orchard Supply has roughly $700m in sales from 70 stores. These stores are also a totally different store and model from a traditional Lowe’s store, in size, etc. LOW has shared little about the chain since the close. We also expect Marvin to find a buyer of the business. This would also allow for more focus onto Lowe’s stores. All rights reserv ed, Inflection Capital Management, LLC

- 22. 22 What Marvin Ellison Is Likely To Do 1) Simplify the business: getting out of RONA, selling Orchard Supply, massively reducing internal initiatives, and streamlining management. ❑ In our modeling, we remove the revenue from both RONA and Orchard from company-wide revenue; we also assume that these segments operate at break-even levels of profitability. ❑ We remove $1.5B in central costs and other initiative expense. 2) Focus the company on three objectives: 1) Drive store traffic, ❑ We assume $100m in added marketing expense. ❑ Tie incentive compensation to metrics like traffic, NPS, and “willingness to shop.” 2) Rebuild the website and offer 2-day store-to-door delivery: ❑ We incorporate our revenue model and assume 20% incremental margins. ❑ We assume $500m (WAG) in added expense for the website and delivery network. 3) Capture more Pro business with an upgrade to associate experience & knowledge, a redo of the delivery offering, and a centralizing of the Pro initiative. ❑ We incorporate our revenue model and assume 20% incremental margins. ❑ We assume $1.2b in added expense for upgrading the associate base. ❑ We assume $500m (WAG) in added expense for the supply chain. 3) Fix the store labor model and significantly cut headquarter’s costs ❑ We assume that these changers, along with traffic and the sales-associate investments yield a consistent +4% sales comp. ❑ We assume HD’s level of 30% incremental margins on sales. ❑ HQ cuts already incorporated. 4) Significantly improve LOW’s sales productivity, margin rates, and financial returns. All rights reserv ed, Inflection Capital Management, LLC

- 23. 23 Impact on the Financial Statements Allrightsreserved,InflectionCapitalManagement,LLC CY 2018 CY 2019 CY 2020 CY 2021 CY 2022 CY 2023 Lowe's Revenue $66,592 $69,256 $72,026 $74,907 $77,903 $81,019 Comp Growth 4% 4% 4% 4% 4% Rona & Orchard Revenue $5,279 Pro Initiatives $0 $0 $1,780 $4,411 $9,026 $14,864 .com Initiatives $0 $461 $1,175 $2,251 $3,835 $6,133 Total Company Revenue $71,871 $69,717 $74,981 $81,568 $90,764 $102,016 Lowe's EBIT $6,609 $6,609 $6,609 $6,609 $6,609 $6,609 Base-busines incremental margin $799 $1,630 $2,494 $3,393 $4,328 Pro incremental margin $0 $356 $882 $1,805 $2,973 .com incremental margin $92 $235 $450 $767 $1,227 Rona & Orchard $0 Cost Cuts $500 $1,000 $1,500 $1,500 $1,500 Added marketing -$100 -$100 -$100 -$100 -$100 Labor Upgrade -$600 -$1,200 -$1,200 -$1,200 -$1,200 Supply Chain Upgrades -$500 -$500 -$1,000 -$1,000 -$1,000 Total Company EBIT $6,609 $6,800 $8,030 $9,636 $11,774 $14,336 Operating Margin 9.2% 9.8% 10.7% 11.8% 13.0% 14.1% Interest Expense -$650 -$620 -$620 -$620 -$620 -$620 PBT $5,959 $6,180 $7,410 $9,016 $11,154 $13,716 Taxes -$1,430 -$1,360 -$1,630 -$1,983 -$2,454 -$3,018 Net Income $4,529 $4,821 $5,780 $7,032 $8,700 $10,699 Fully Diluted Shares 825 791 761 731 700 669 EPS $5.49 $6.09 $7.60 $9.62 $12.42 $16.00

- 24. 24 Impact on the Financial Statements All rights reserv ed, Inflection Capital Management, LLC CY 2018 CY 2019 CY 2020 CY 2021 CY 2022 CY 2023 Total Company EBIT $6,609 $6,800 $8,030 $9,636 $11,774 $14,336 Lowe's Rent $500 $525 $551 $579 $608 $638 Adj. NOPAT $5,545 $5,714 $6,694 $7,967 $9,658 $11,680 Assets $35,291 $32,791 $35,267 $38,365 $39,708 $41,098 Non-interest liabilities -$8,687 -$9,556 -$10,511 -$11,562 -$12,719 Excess Cash $0 $0 $0 $0 $0 Capitalized Rent $4,200 $4,410 $4,631 $4,862 $5,105 Adj. Invested Capital $28,304 $30,122 $32,485 $33,008 $33,484 Rent Adj. ROIC (avg.) 22.9% 25.5% 29.5% 35.1%

- 25. 25 What Solid Execution Could Mean for the Stock All rights reserv ed, Inflection Capital Management, LLC The table below shows the projected performance of LOW’s shares based upon a forward market P/E, a premium/discount to the market, and our NTM EPS estimate. 1) Obviously should interest rates spike, the US economy enter a recession, or US housing crack, things will be a lot lower—the market multiple, the relative multiple, and earnings. 2) We assume that once Marvin declares his 3-year plan in late-2018, that the Street will mark-to-mark the guidance’s end-point, and the stock’s forward multiple will expand to reflect the potential, up to 1.30X 3) However, as the plan is executed resulting in strong margin expansion and EPS growth, we would expect that relative multiple to contract back towards a market multiple as speculation subsides. 4) Consequently, the peak-return period for LOW is likely now to mid-2021. CY 2018 CY 2019 CY 2020 CY 2021 CY 2022 CY 2023 S&P 500 NTM 16.5 X 16.5 X 16.5 X 16.5 X 16.5 X 16.5 X Premium/Discount 1.30 X 1.30 X 1.30 X 1.20 X 1.10 X 1.00 X LOW's NTM P/E 21.5 X 21.5 X 21.5 X 19.8 X 18.2 X 16.5 X LOW EPS NTM $6.09 $7.60 $9.62 $12.42 $16.00 $18.56 Year-End PO $131 $163 $206 $246 $290 $306

- 26. • Mgmt Incompetence and channel leakage. • CY’13 EPS est falls to $2.12/sh from $3.76 • Valuation falls to 5X NTM P/E from12X. • New management with real strategies. • Major cost cutting. • Street neglects that its still a difficult category • Mgmt’s strategies gain traction. • Company gains share again. • Sears hemorrhages share. • EPS estimates hold steady. What Happened To Best Buy: 1) Only pure-play competitor Circuit Cityvanished. Vendors woke-up in 2013 to the realizationthat Best Buyneeded to survive for the consumer electronics industryto introduce innovationandgrow. 2) Best Buy attractedverystrong senior management after being led for years by incompetents. 3) Best Buy evolvedfroma retailer to a hands-on showroom mall, withSamsung shops, Microsoft shops,Apple shops, etc. 4) Best Buy’s stores intertiarylocations were closed. 5) Best Buy’s sales found its base of “store-loyal” consumption. Net Savings ~$600m Example for LOW: Best Buy—The Gift of Bad Management New Management’s Strategy: 1) Downsize the infrastructure for amore limitedcompany. 2) Walkawayfrom markets withlimitedprofits. 3) Turn the store into a vendor marketplace/mall making them deeply investedinthe selling process. 4) Significantlyup-weight the customer experience and satisfactionw/inthe store comp structure. 5) Rebuild the e-commerce business to enhance the shopping experience and leverage in-store pick-up. Rebuilt the online presence to move Best Buy to the top page of search results. Return To Contents Growth vs. the Category But still stuckwith the category’s cycles All rights reserv ed, Inflection Capital Management, LLC 26

- 27. 27 DownsideRisks 1) Macro 2) Key-Man risk with Marvin. 3) Lots of heavy lifting ahead. 4) Home Depot aggressively responds. All rights reserv ed, Inflection Capital Management, LLC

- 28. All rights reserv ed, Inflection Capital Management, LLC 28 The Amazon Risk The Amazon risk is the principle concern for investors in LOW aside fromthe housing cycle. We think that this risk is moderate for the following reasons: 1) “Does it deserve to exist?” This is a question that we ask about any stock that we consider to invest in. Does the presence of a Lowe’s improve the utility of a neighborhood? If a neighborhood’s Lowe’s went away (without an alternative like Home Depot) would people care? Yes & yes are our answers to these two questions. The way we monitor this risk, is to watch DIY-store comps at Home Depot. The DIY retail channel’s competitive moat is healthy as long as store traffic by DIYs is healthy; it demonstrates that the consumers highly value the store’s existence. (We use HD, because LOW’s disclosure and inconsistent performance makes it a poor test for this metric.) 2) Vendor Alignment: Lumber and other categories totaling 65%+ of the store mix are not suitable for online ordering given their volume or weight. If the remaining 35% went away (or its merchandising margin went down) that would make LOW a horrific stock. Thus far, the higher risk categories like power tools, etc. have been growing consistently with total sales. (Shown in two subsequent slides is LOW and HD sales mix). If tools, fashion plumbing, electrical were trailing total company sales at both companies for several consecutive quarters that would be the signal to get out. This is unlikely to happen because the vendors want a healthy competitive mix between Amazon, Lowe’s, Home Depot, and specialists to keep innovation vibrant, pricing healthy to support brand investment, and private brands at bay. (There is the Best Buy precedent that we touched on earlier.) 3) In-store expertise versus YouTube? Both: As we touched on earlier, HD’s Pro business leads LOW’s because of better sales associate product and project knowledge. That is also true for the DIY business. Doing a DIY project is demanding both financially and time-wise. Screwing up is a big deal. Consequently, DIY shoppers tend to want to get a lot of advice, both in-the-store and via YouTube. 4) Immediacy: A broken water pipe needs to be fixed now, as does a failed water heater. Many projects begin and then metastasize into bigger, more involved, and more costly projects. Having a go-to store and a go-to guy becomes the way. However, Home advisor/consultations are an area of risk. Should Amazon, or HomeAdvisor/Angie’s List figure out how to scale massive consultations along with providing the service, materials, and components for those projects, that would be disruptive to the incumbents. Thus far, HomeAdvisor doesn’t appear to be having success. Additionally, bothLOW’s and HD’s installed sales programs have flatlined. Consequently, we would describe this risk as a “legitimate but theoretical risk.”

- 29. All rights reserv ed, Inflection Capital Management, LLC 29 Both Pro and DIY Retail Sales are Up The table below shows the performanceof HD’s sales by channel. Management has noted that Pro Sales are around 40% of total sales and growing +HSD. Thus, the most that Pro can add to total sales growth in a year is up to 4.0%. The brick & mortar sales growth above that rate indicates that the DIYbrick & mortar business is also growing. The Home Depot 2014 2015 2016 2017 Sales Breakdown e-Commerce $3,703 $4,728 $5,626 $6,726 YoY $ Ch $974 $1,025 $898 $1,572 Brick & Mortar Sales $79,473 $83,791 $88,969 $94,178 YoY % Ch 4.5% 5.4% 6.2% 5.9%

- 30. All rights reserv ed, Inflection Capital Management, LLC 30 LOW’s Sales Mix Shows No Leaky Buckets

- 31. All rights reserv ed, Inflection Capital Management, LLC 31 Home Depot’s Sales Mix Shows No Leaky Buckets

- 32. All rights reserv ed, Inflection Capital Management, LLC 32 A Different Perspectiveon the Cycle Without question, LOW and HD are cyclical businesses and the US is nearly eight years into the recovery. The topic is broadly covered by housing specialists and economist at nauseumand we are not going to pretend that we have an edge on the topic. Based upon our read fromspecialists and economists, we believe that housing is going to motor ahead along with the US economy. If one has a negative view, LOW as a “long” isn’t for you. Our more nuanced view on housing is as follows: 1) Most of the analyses of the housing cycle question are based upon national averages: private-fixed- residential-investment (PFRI), PFRI/GDP, national housing stats, the housing affordability index, etc. However, this housing recovery has not been an even recovery; it’s been highly localized and marked as urban-gentrification and coastal. Vast tracks of middle-America and outer-suburban regions didn’t see a material rebound until 2015. Additionally, US consumers havebeen bifurcated in income and wealth growth, with householdsbelow $150K/year in income experiencing little growth since 2005, while those aboveexperienced substantial growth (+8% annually). Lower income HHs have migrated to more affordable suburban housing as they are unable to remain in gentrifying urban neighborhoods. Lastly, there has been the delay in household formation given student debt, etc. which is a crusher to house ownership and a negative to the DIYmarket. Given that HD laid down its store base earlier in choice metro and coastal communities, whereas, LOW was forced to take the sloppy seconds, this recovery has so far been significantly more beneficial to HD. 2) This housing recovery isn’t going to fully benefit LOW until: 1) housing price gains in outer-suburban regions move ownersout of negative-equity and generate substantial owner equity, 2) non-coastal regions receivethe same, and 3) HHs below $150K begin to generate material income growth. One marker that these are occurring would be stronger home equity loan demand. Thus far, the demand for home equity loans has been anemic.

- 33. Below is the text from the Joint Center for Housing Studies of Harvard

- 35. Point here is that affordabilitylooks good in middle-America. However, it requires confidence in those regions’ income growth outlook. Is Trump a (+) or a (–) here? Source: http://harvard-cga.maps.arcgis.com/apps/MapSeries/index.html?appid=c3cae00cb1c84af88c2c3774e0808a12

- 36. Point here is that manylarge markets are still well below peak. Interestingly, HD says that stores well above peak (Portland, LA, Denver, etc) are still booming.

- 40. It looks like confidence to “own” is building. Where can theybuy? Lowe’s markets!

- 41. Series Id: Series Title: Super Sector: Industry: NAICS Code: Data Type: Years: Year Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 2008 284.0 280.3 284.5 283.3 288.5 295.0 290.9 292.2 285.4 284.1 273.9 267.2 2009 252.9 248.5 241.2 242.0 246.9 254.6 254.9 255.8 250.7 249.2 243.9 237.1 2010 222.0 216.1 222.6 227.4 235.1 243.1 241.8 244.6 243.2 241.9 240.2 237.0 2011 220.8 221.3 226.7 230.5 238.8 247.4 248.7 248.1 246.7 253.8 252.9 250.6 2012 234.6 236.7 238.2 242.4 249.4 257.7 261.6 261.8 260.8 261.5 259.9 259.7 2013 242.7 245.0 249.0 256.5 263.7 272.7 277.8 277.7 275.1 278.3 277.9 274.8 2014 266.0 265.0 265.6 272.9 280.0 287.0 295.4 295.0 296.5 291.4 293.9 286.6 2015 278.6 275.9 281.9 290.7 299.4 309.3 313.8 311.8 311.3 312.5 313.4 311.7 2016 299.0 298.1 303.7 312.0 318.9 326.4 329.4 328.9 330.0 332.5 329.7 323.3 2017 313.5 317.2 315.8 317.6 323.6 332.3 333.8 333.1 332.8 336.4 334.0 332.5 2018 321.3 325.3 331.2 341.3 351.0 2016 7.3% 8.0% 7.7% 7.3% 6.5% 5.5% 5.0% 5.5% 6.0% 6.4% 5.2% 3.7% 2017 4.8% 6.4% 4.0% 1.8% 1.5% 1.8% 1.3% 1.3% 0.8% 1.2% 1.3% 2.8% 2018 2.5% 2.6% 4.9% 7.5% 8.5% 2008 to 2018 All employees, thousands, residential remodelers, not seasonally adjustedConstruction Residential remodelers 236118 ALL EMPLOYEES, THOUSANDS Employment, Hours, and Earnings from the Current Employment Statistics survey (National) Original Data Value CEU2023611801 Not Seasonally Adjusted The June employment report shows that demand for remodelers has significantly strengthened in 2018 after a soft 2017.

- 42. Series Id: Series Title: Super Sector: Industry: NAICS Code: Data Type: Years: Year Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 2008 623.3 628.9 647.8 669.9 686.9 681.1 664.0 661.5 650.0 647.6 641.3 629.9 2009 619.3 621.6 626.1 644.0 659.2 652.9 633.5 617.8 607.1 603.6 601.9 597.9 2010 595.3 610.7 638.1 662.0 675.5 649.8 630.8 621.5 611.3 605.7 602.8 601.2 2011 600.1 605.6 638.8 672.1 678.9 666.7 648.7 634.0 622.0 620.2 621.4 619.0 2012 618.8 632.9 667.6 696.8 703.6 690.4 673.6 655.8 641.8 635.6 636.1 635.2 2013 635.4 651.9 675.7 706.2 717.7 706.1 692.2 674.3 664.1 664.1 662.4 655.8 2014 645.8 658.7 683.7 716.2 723.3 714.0 697.8 673.6 659.1 655.0 655.7 652.2 2015 645.3 660.6 682.2 714.5 722.9 708.9 691.3 667.4 652.6 651.1 653.2 652.2 2016 645.4 665.9 704.2 733.0 740.6 732.6 711.8 692.2 671.5 668.0 666.4 662.0 2017 656.3 668.9 706.0 728.3 736.3 727.8 712.6 685.9 675.5 681.9 683.6 681.6 2018 676.0 702.9 743.3 759.4 767.0 2016 0.0% 0.8% 3.2% 2.6% 2.4% 3.3% 3.0% 3.7% 2.9% 2.6% 2.0% 1.5% 2017 1.7% 0.5% 0.3% -0.6% -0.6% -0.7% 0.1% -0.9% 0.6% 2.1% 2.6% 3.0% 2018 3.0% 5.1% 5.3% 4.3% 4.2% 2008 to 2018 All employees, thousands, home centers, not seasonally adjustedRetail trade Home centers 44411 ALL EMPLOYEES, THOUSANDS Employment, Hours, and Earnings from the Current Employment Statistics survey (National) Original Data Value CEU4244411001 Not Seasonally Adjusted The June employment report shows that demand for home-improvement center labor has strengthened in 2018 after a soft 2017.

- 43. All rights reserv ed, Inflection Capital Management, LLC 43 Conclusion The opportunityin LOW shares is significant over the next four years. We have mapped-out the path to over 20% annualized returns over this period. Our points were: 1) LOW was run by incompetents for 12 years which allows for significant improvement by incoming CEO Marvin Ellison. However, heavy lifting is required. 2) We expect Marvin to simplify the business by cutting RONA, Orchard Supply, and other tangential initiatives, and streamlining the company. 3) The two most significant opportunities for Marvin are Pro and e-commerce. Capturing these will require significant investments in store talent, supply chain, store-to-door delivery, and the website. The costs of such will be much larger than an expected $1.5B in expense savings from HQ and elsewhere. 4) The housing recovery to date has disproportionately benefited HD. Should the recovery broaden, LOW will experience an incremental lift and its performance gap to HD should narrow, independent from the above noted initiatives.

- 44. All rights reserv ed, Inflection Capital Management, LLC 44 Marvin Ellison CEO Richard Maltsbarger Chief Operating Officer Head of Online TBD Michael McDermott Chief Customer Officer X Unfilled Chief Development Officer Brian Pearce Corp Admin Executive X XX Store Operations Pro Services WilliamBoltz (new) Hd of NA Chervon Previously at HD EVP Merchandising To Be Hired (new) ? ? EVP Stores (new) X To Be Hired (new) ? ? EVP SupplyChain (new) SupplyChain X Unfilled Chief FinancialOfficer Paul Ramsey (NC) SVP CIO Bill McCanless(NC) EVP, Gen Counsel Jennifer Weber (NC) EVP, HR