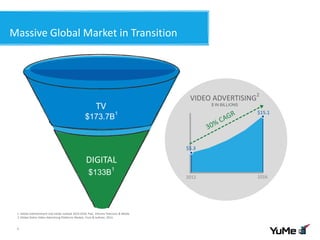

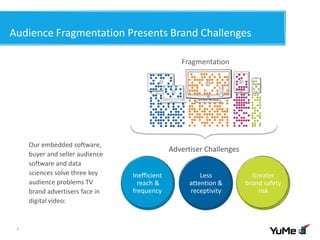

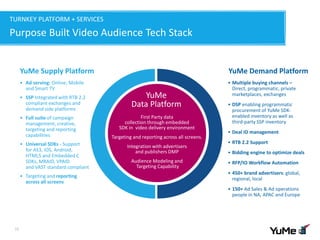

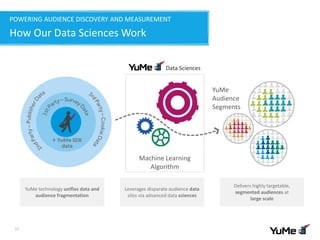

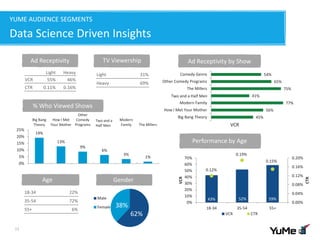

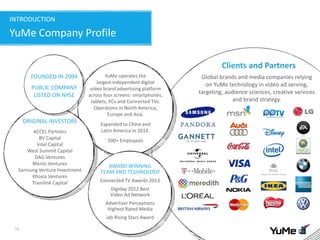

YuMe is a leading digital video advertising platform company that provides an end-to-end solution for advertisers. Its platform combines data sciences and embedded software to deliver targeted advertising campaigns across screens to brand-safe environments. YuMe works with over 450 advertisers and 150 publishers globally. Its data-driven audience segments and cross-screen measurement capabilities help advertisers extend their TV campaigns and maximize their reach in an efficient manner in the fragmented digital video landscape.