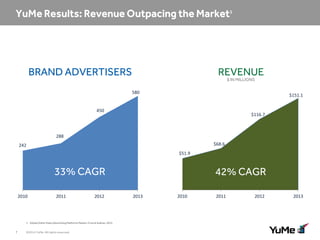

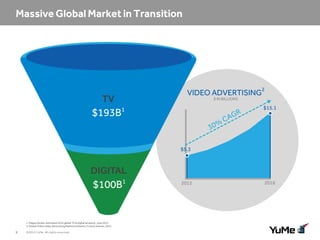

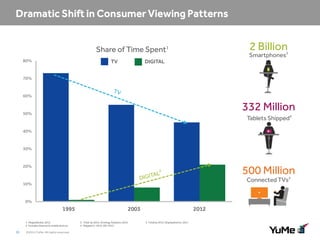

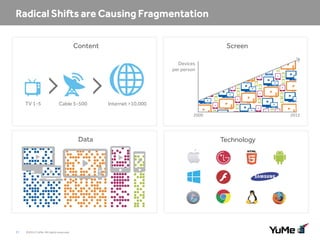

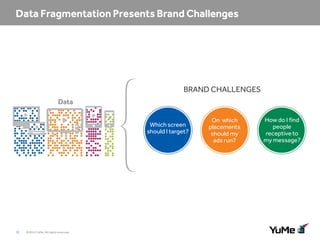

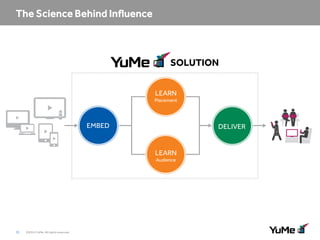

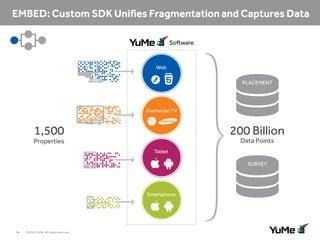

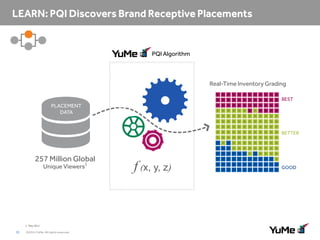

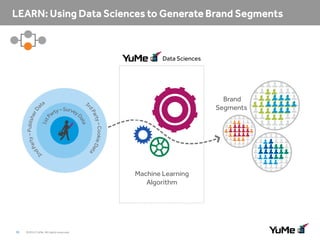

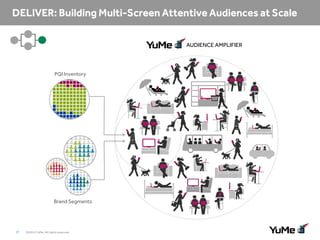

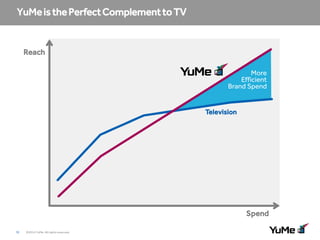

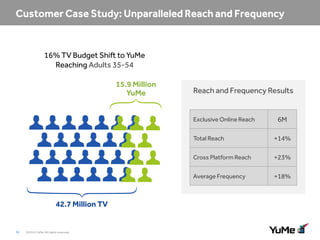

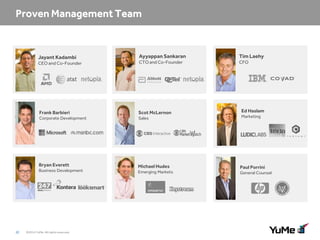

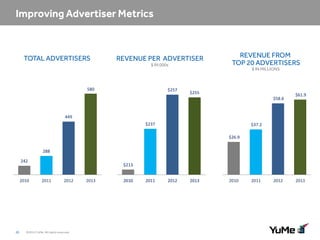

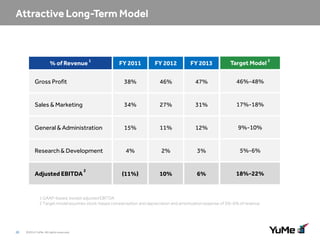

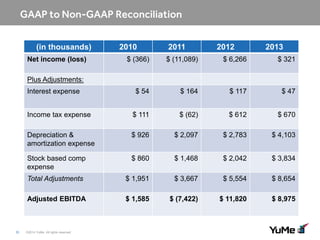

The document provides an investor overview of YuMe, Inc. It discusses YuMe's data sciences platform that uses machine learning algorithms and 200 billion data points to optimize digital video advertising placement and audience targeting for brand advertisers. YuMe has experienced strong revenue growth of 42% CAGR from 2010 to 2013, reaching $151 million in revenue in 2013. YuMe also discusses its goal of continuing revenue growth while improving operating leverage and margins over time.