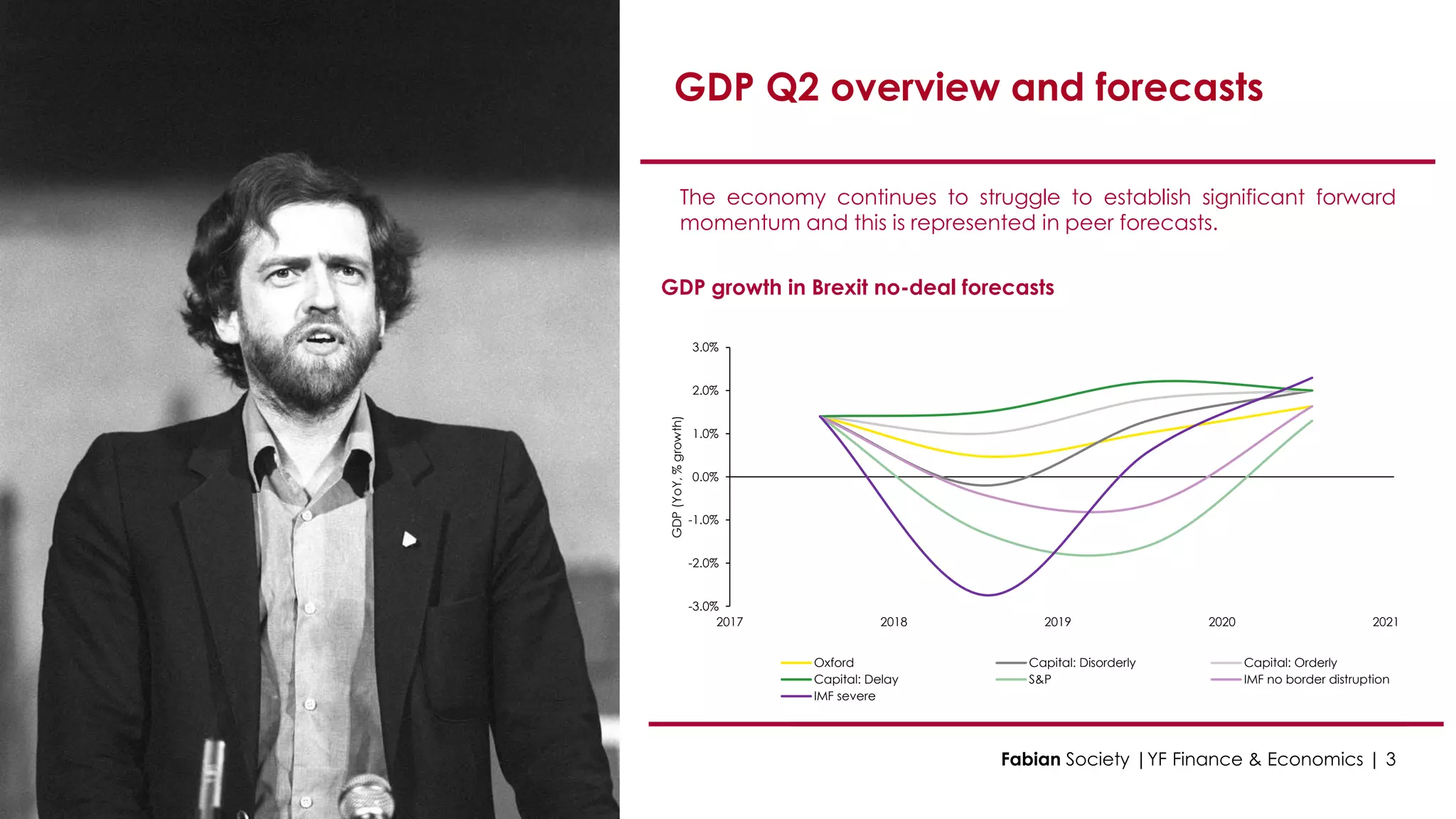

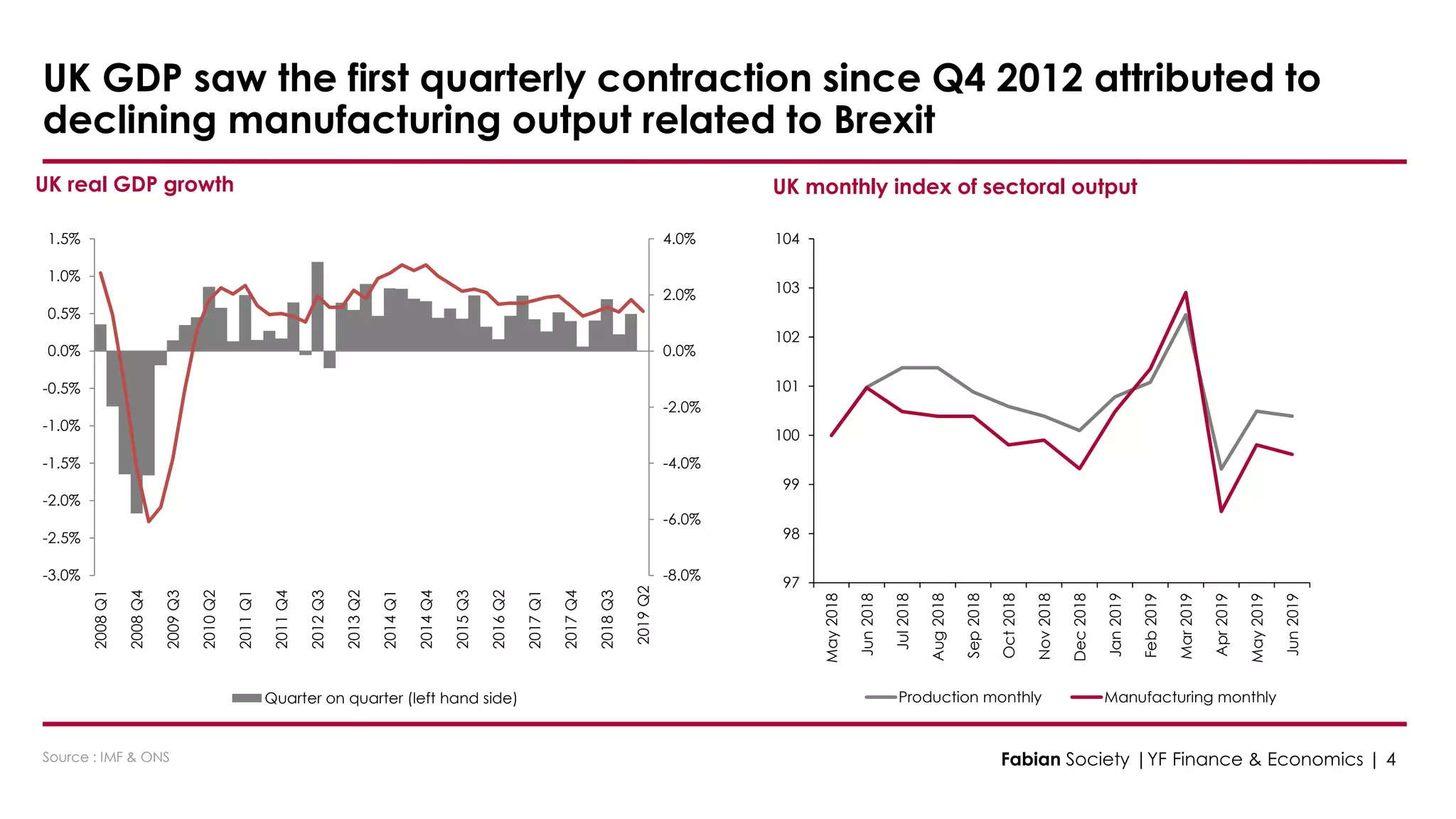

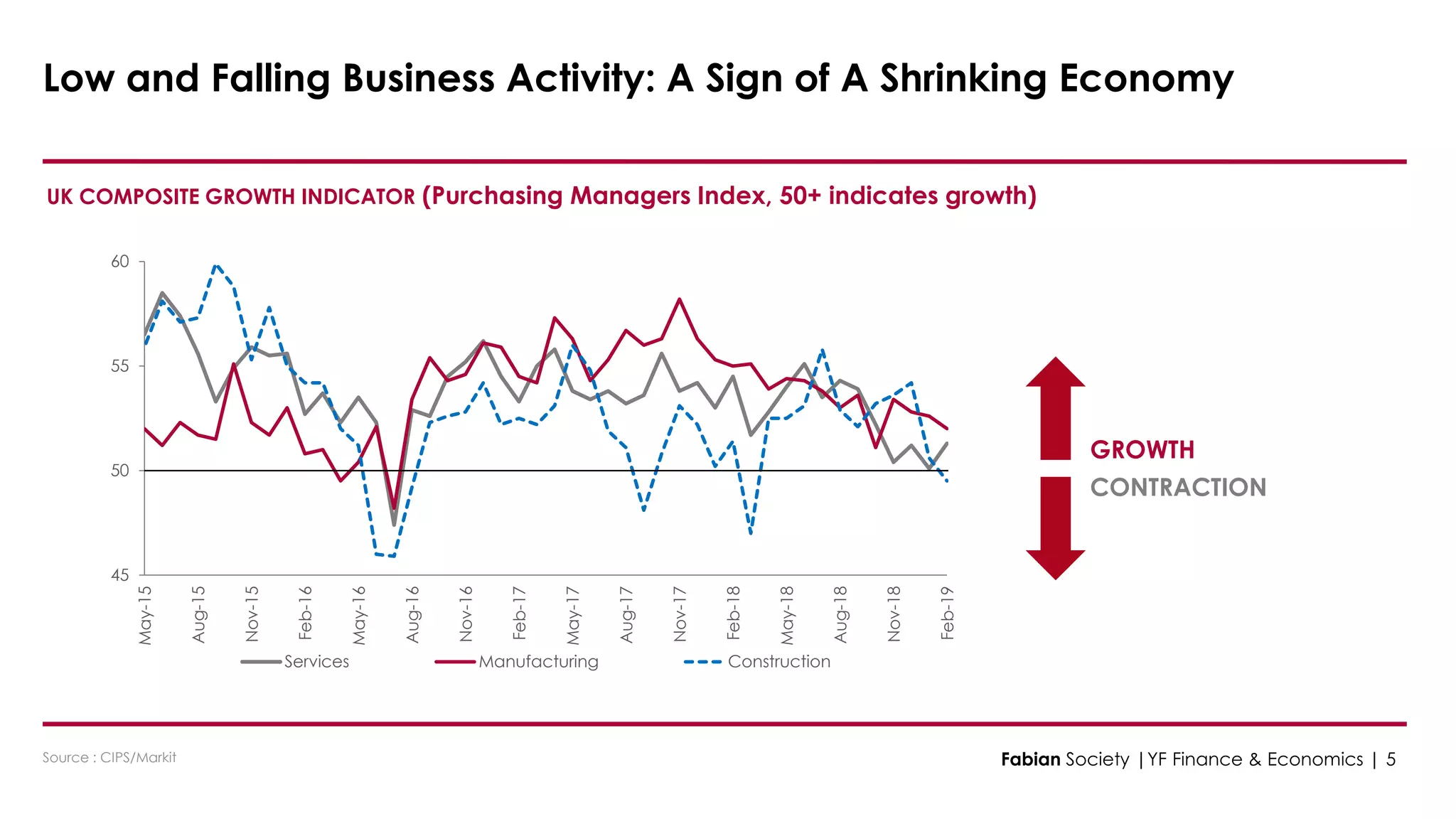

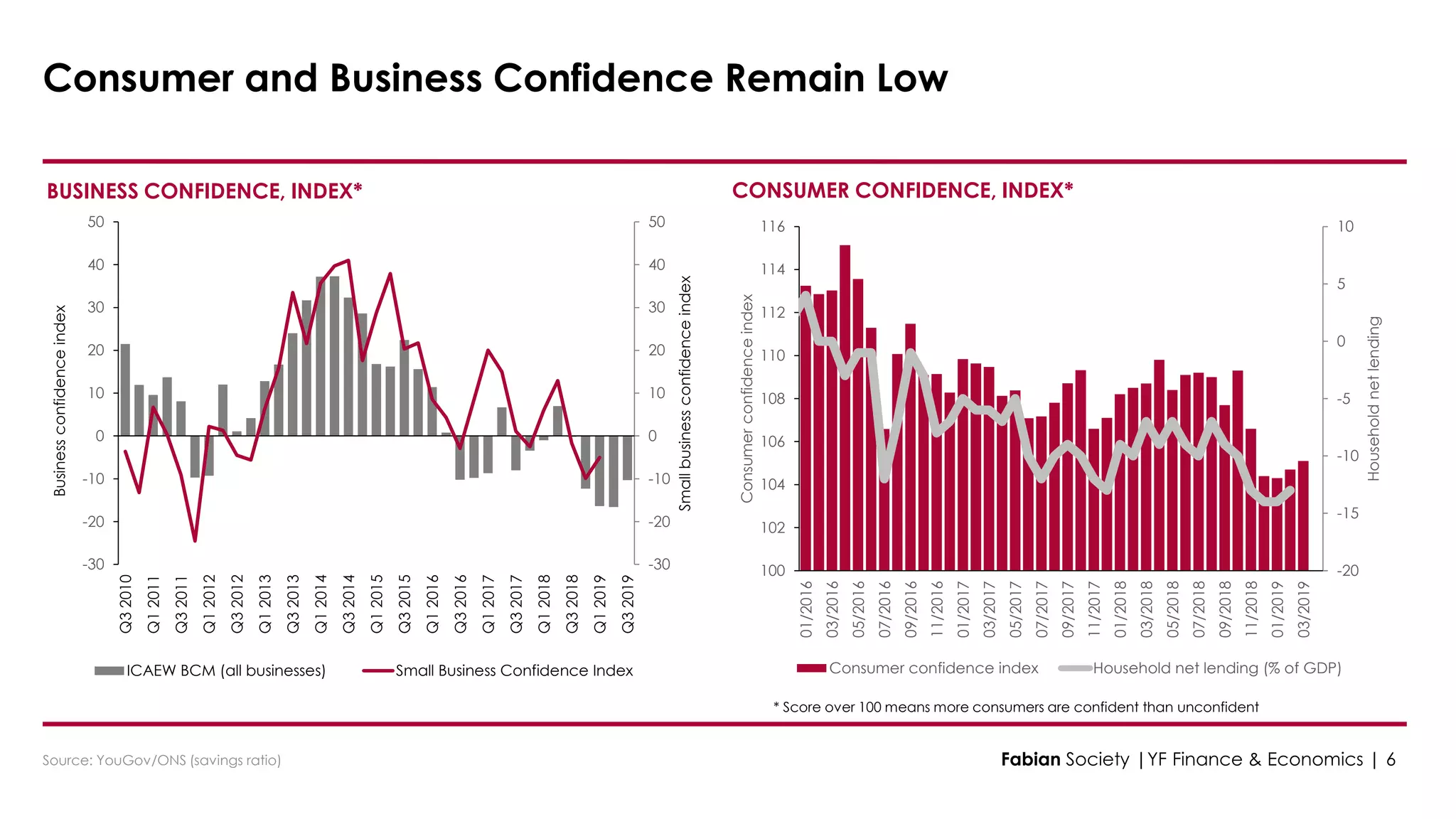

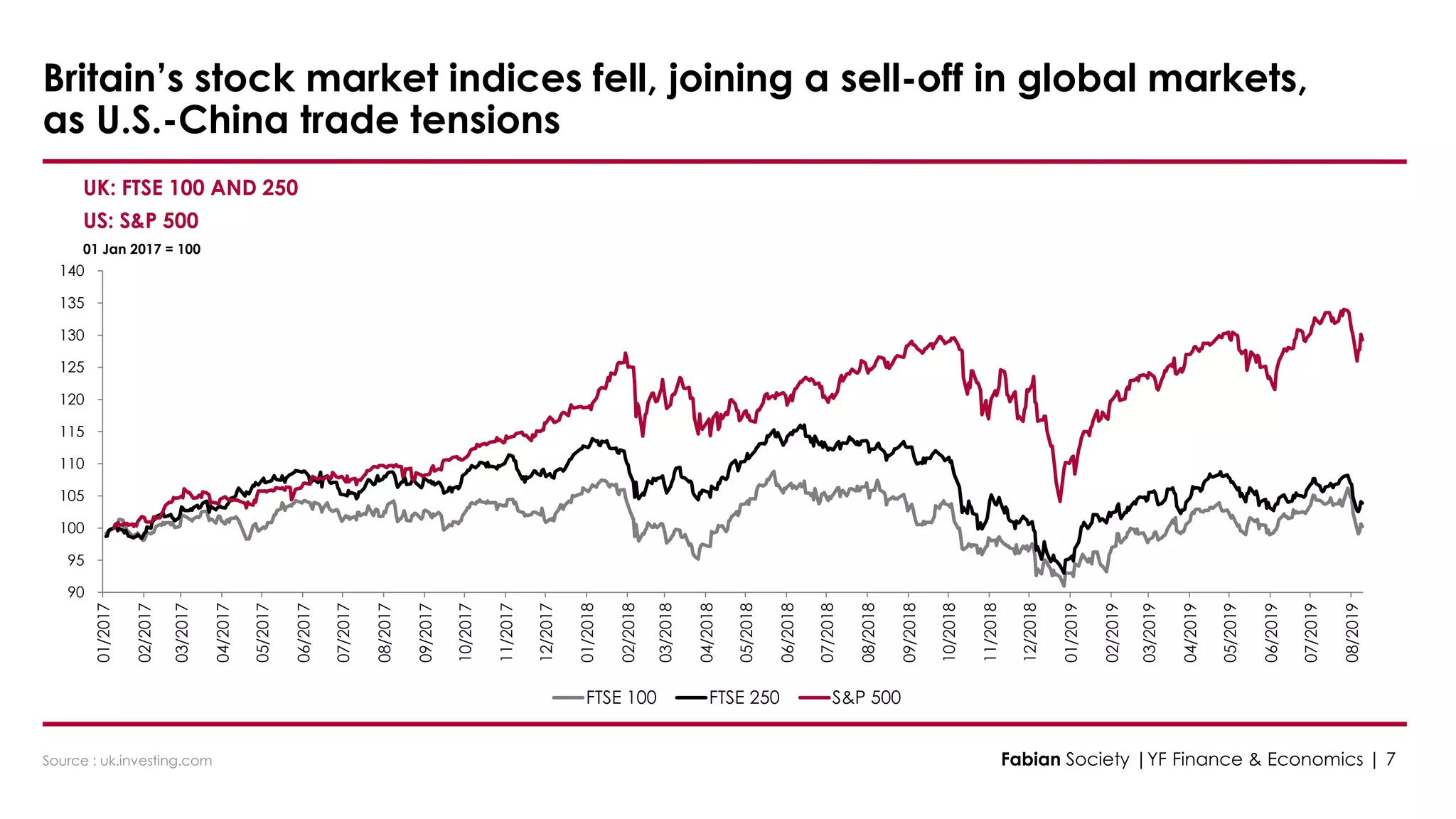

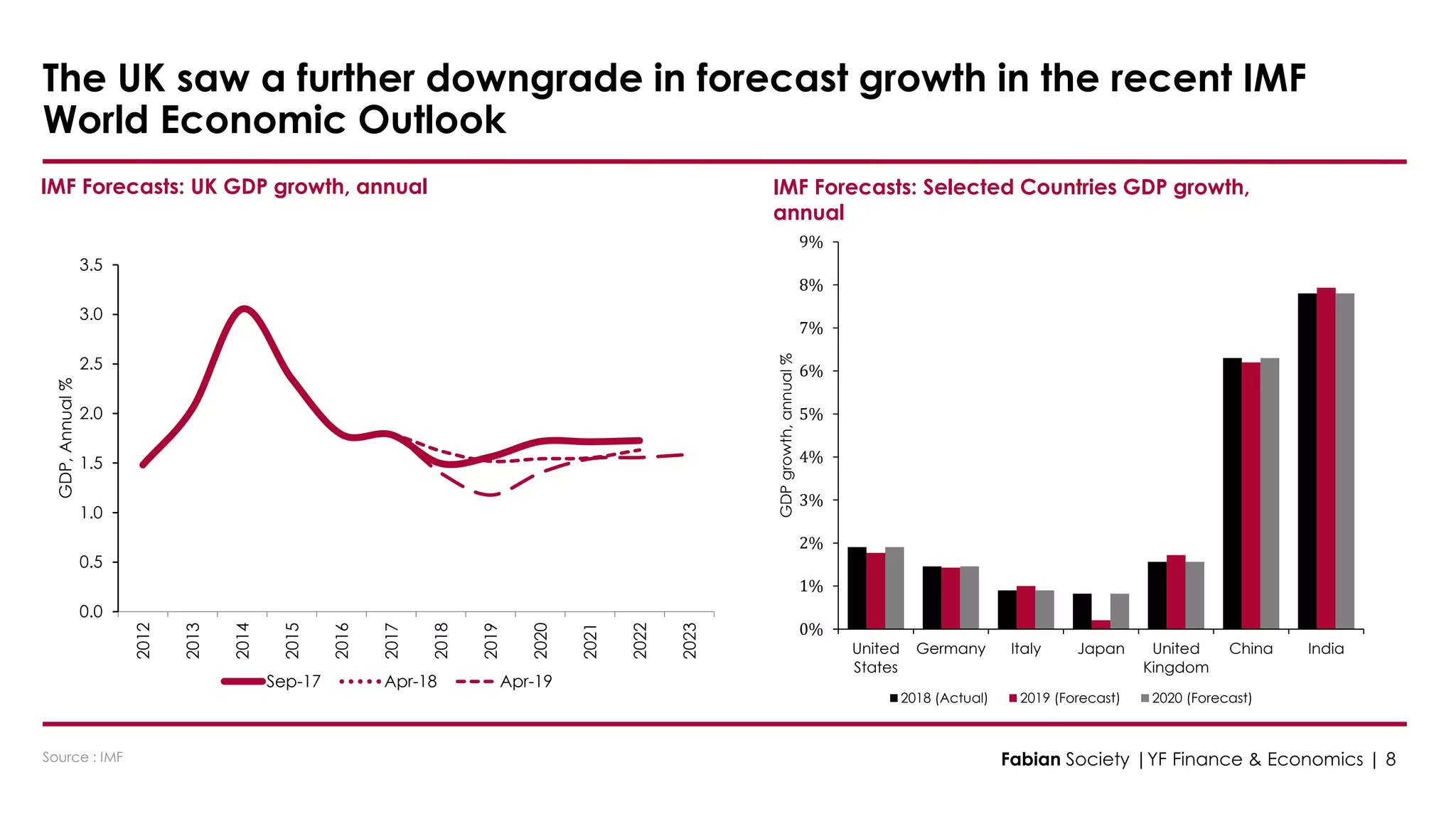

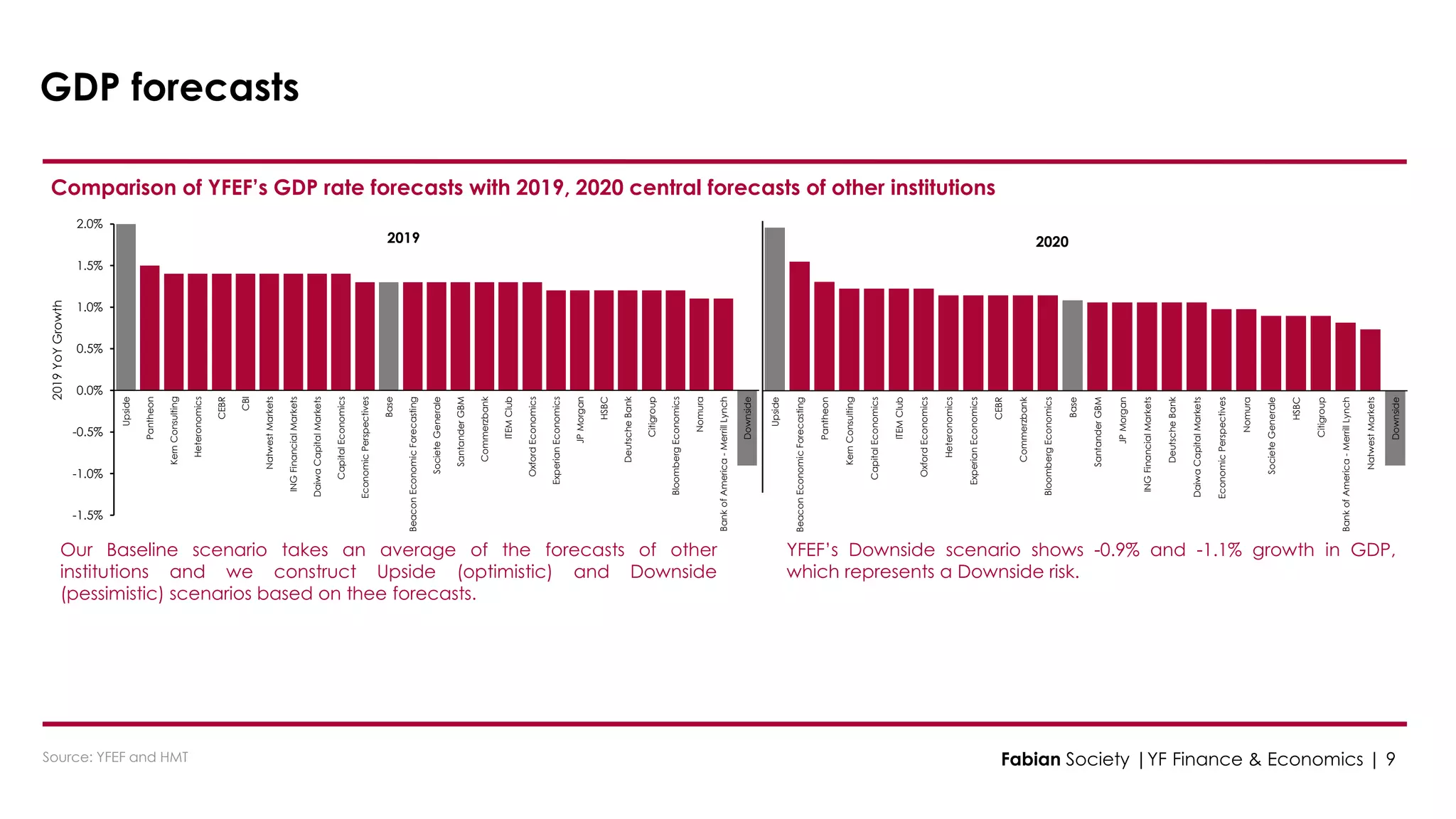

The document provides an economic update from the Young Fabians in August 2019. It summarizes recent UK economic developments, including GDP contracting in Q2 2019 for the first time since 2012, a weakening housing market, and slowing global growth due to trade wars. It then looks forward, noting potential GDP recovery in Q3 but continued trade tensions. Charts show declining business and consumer confidence, falling stock markets, and downgraded GDP and higher unemployment forecasts by the IMF and YFEF compared to other institutions.

![-2

-1

0

1

2

3

4

5

6

2016 2017 2018 2019 2020 2021 2022

GDP-YoYGrowth(%)

Lowest [16- 19%] Low - Medium [15- 25%] Central [19- 29%]

Medium - Optimistic [0- 0%] Optimistic [8- 15%] Highest [21- 35%]

Mode BoE Upside Baseline

Downside

-3.9%

-2.8%

-1.1%

-4.6%

-3.9%

Average

-5%

-4%

-3%

-2%

-1%

0%

1949 - 1975 1976 - 1981 1982 - 1991 1992 - 2009 Downside

Peak-to-Trough(p.p.)

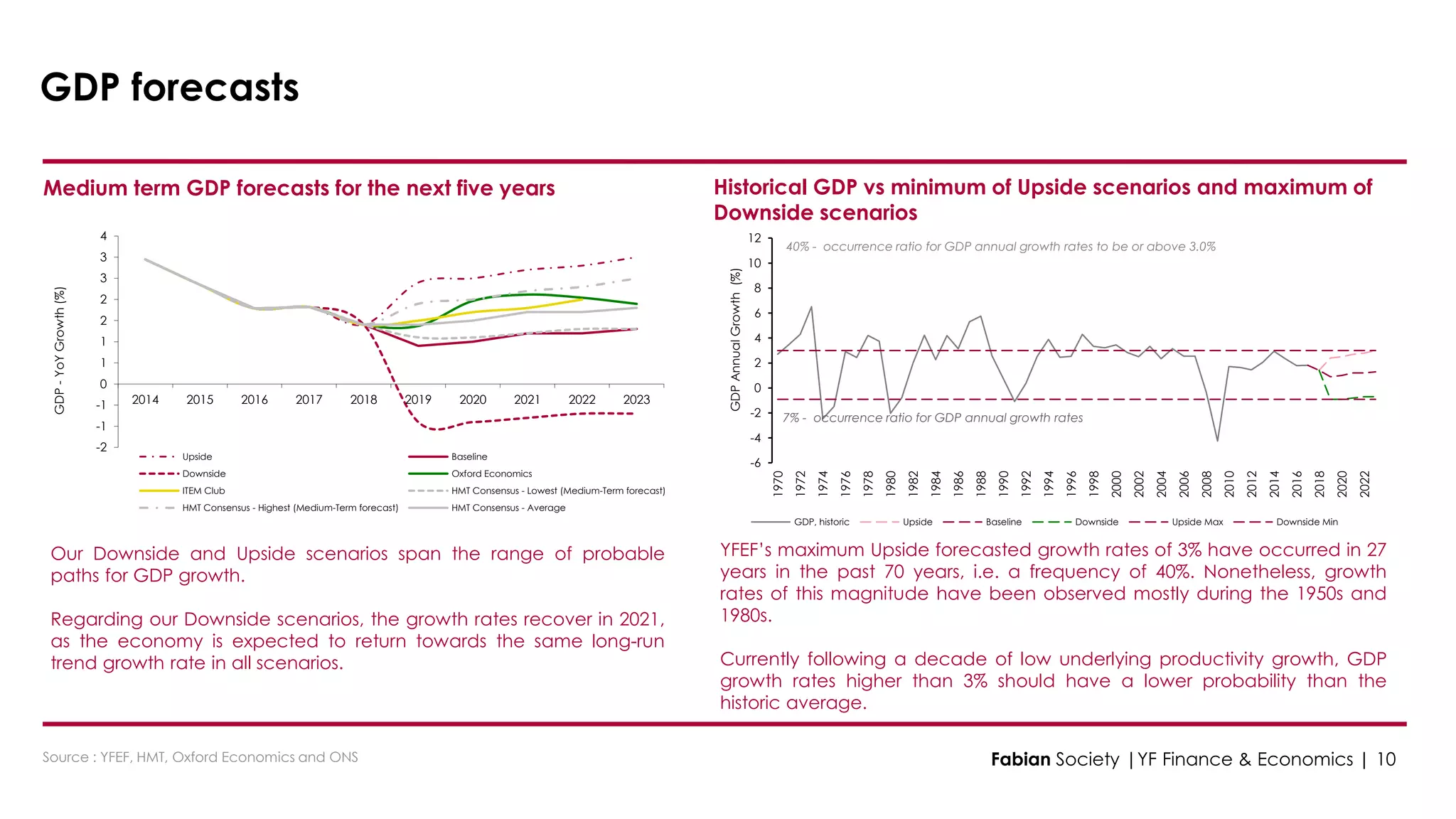

GDP forecasts

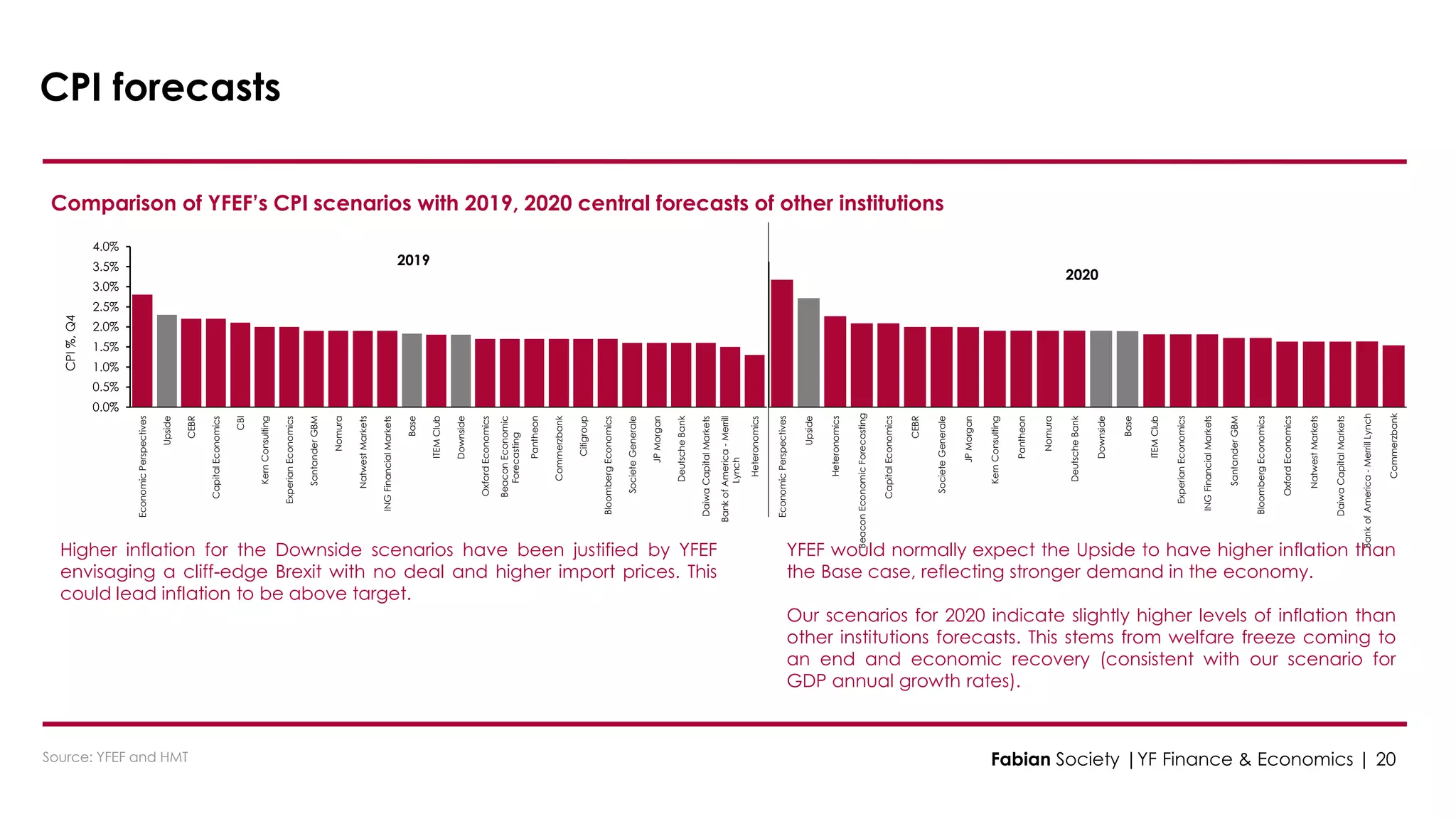

Comparison of YFEF’s GDP forecast scenarios vs BoE’s Fan Chart Peak-to-trough GDP in previous cycles

Our Baseline average of all forecasts falls broadly within the BoE central

forecast range while our extreme Upside and Downside scenarios,

understandably, are at the upper and lower ends of their range

Meanwhile, the Base scenario is largely consistent with the mean of BoE

forecasts. The probabilities assigned to the YFEF’s scenarios would be

expected to broadly align with the probabilities attached to similar

strength outturns in the BoE fan chart.

While the BoE fan chart is symmetrical by design, we believe that the current

risks for the UK economy are skewed toward Downside risks, given the

current risks of a No-Deal Brexit and other risks, such as a Eurozone downturn,

escalation of trade disputes, and a slowdown in China.

Source : YFEF, BoE and ONS Fabian Society |YF Finance & Economics | 11](https://image.slidesharecdn.com/yf-econupdate2019-08v1-200322141724/75/Yf-econ-update-2019-08_v1-0-11-2048.jpg)

![1.0

1.5

2.0

2.5

3.0

3.5

4.0

4.5

5.0

5.5

2015 2016 2017 2018 2019 2020 2021 2022

Unemploymentrate(%)

Min - BoE Lowest [9- 33%] Low - Medium [35- 61%]

Central [24- 35%] Medium - Optimistic [0- 8%] Optimistic [0- 0%]

Highest [0- 0%] Upside Base

Downside Mode BoE

2.10

6.30

3.40

3.20

0.95

2.25

Average

0

1

2

3

4

5

6

7

1973 - 1977 1978 - 1983 1989 - 1992 2007 - 2011 Base Downside

Trough-to-Peak(p.p.)

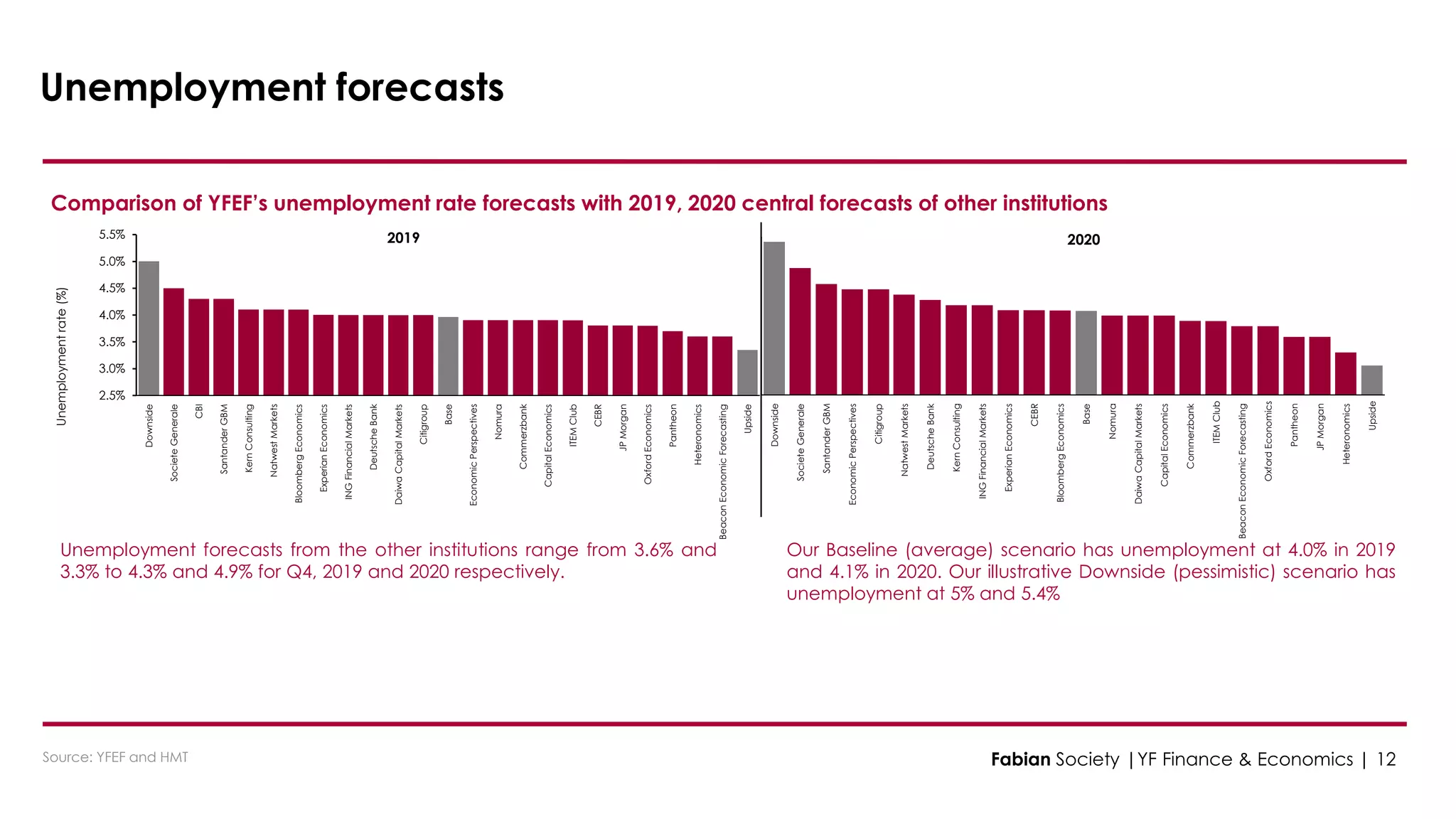

Unemployment forecasts

Comparison of YFEF’s unemployment scenarios vs BoE’s GDP Fan

Chart

Peak-to-trough unemployment in previous cycles

Source : YFEF, BoE and ONS

In past recessions the average increase in the unemployment rate

between the peak and the trough is 3.8 p.p., while for YFEF’s

Downside scenario it is 2.3 p.p. YFEF’s Downside impact is below the

historical average but still broadly consistent with rises seen in previous

recessions if we exclude the rise in the 1978-83 recession.

YFEF’s Downside scenario shows a peak of 5.4% unemployment, whereas

during 2008 and 2009 the unemployment rate rose from 5.2% in 2007 to 8.4%

in 2011. Therefore, given the higher starting point (currently 3.9%

unemployment rate), a maximum of 5.4% unemployment rate in the

Downside scenario seems reasonable.

Fabian Society |YF Finance & Economics | 14](https://image.slidesharecdn.com/yf-econupdate2019-08v1-200322141724/75/Yf-econ-update-2019-08_v1-0-14-2048.jpg)

![-1

0

1

2

3

4

5

2015 2016 2017 2018 2019 2020 2021

CPI(annual)%

Min - BoE Lowest [15- 26%] Low - Medium [11- 16%]

Central [13- 23%] Medium - Optimistic [13- 22%] Optimistic [12- 14%]

Highest [9- 29%] Upside Base

Downside Mode BoE

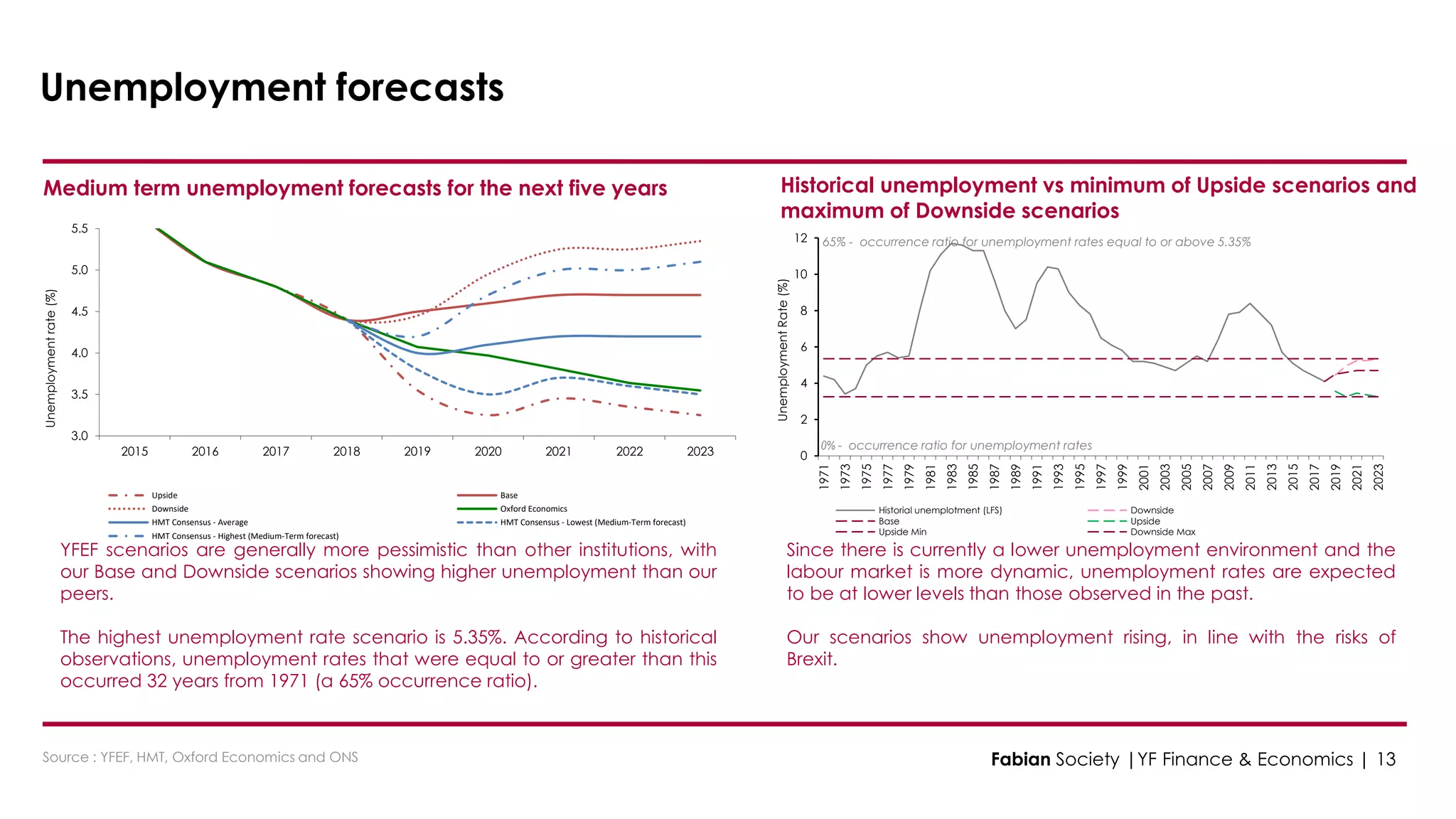

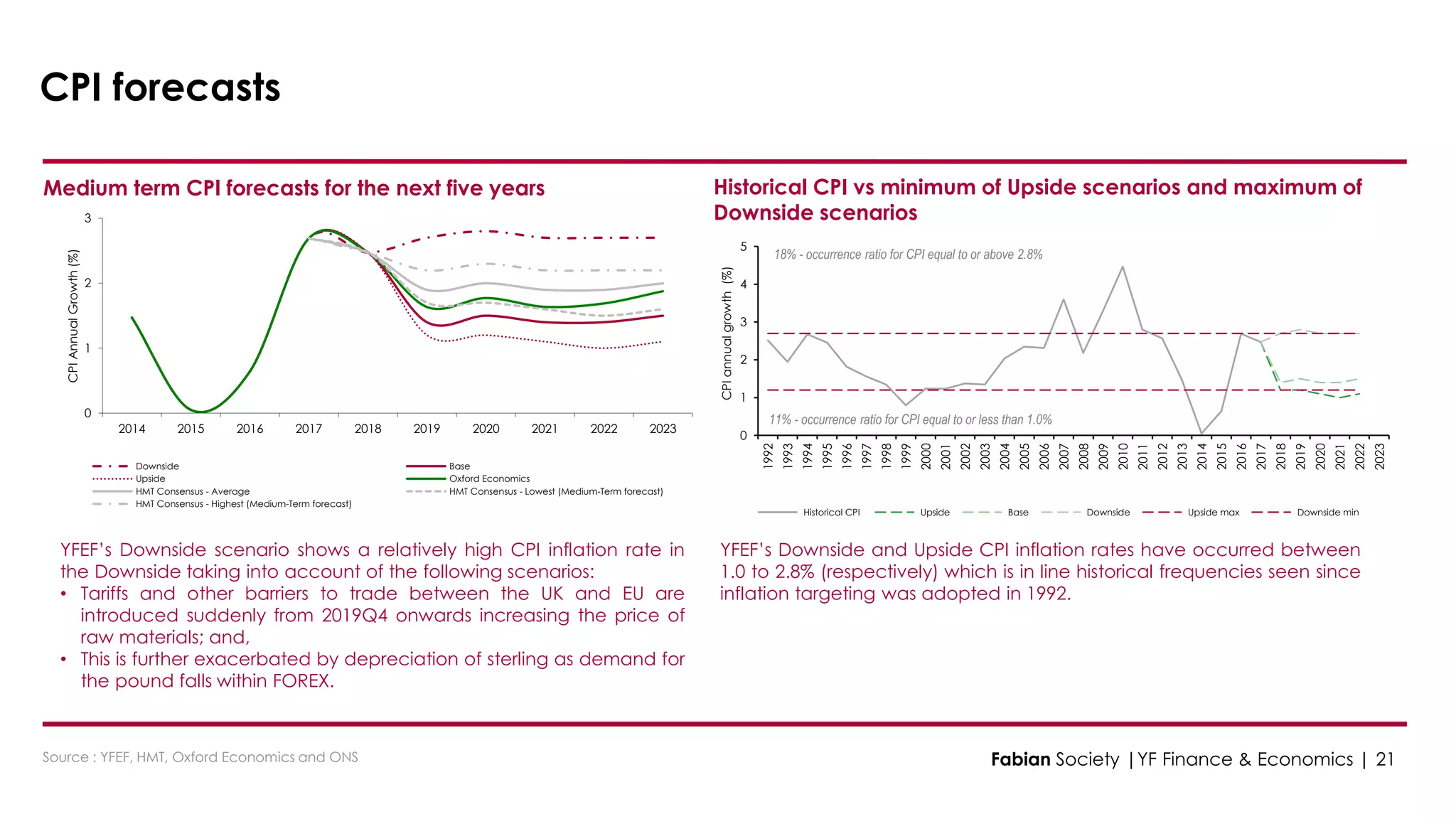

Comparison of YFEF’s CPI forecast scenarios vs BoE’s GDP Fan Chart

CPI forecasts

YFEF’s scenario have been compared against the latest Bank of England (BoE)

CPI forecast fan chart. The fan chart shows that the three scenarios from YFEF

are within a narrow range of the BoE’s fan.

Fabian Society |YF Finance & Economics | 22](https://image.slidesharecdn.com/yf-econupdate2019-08v1-200322141724/75/Yf-econ-update-2019-08_v1-0-22-2048.jpg)