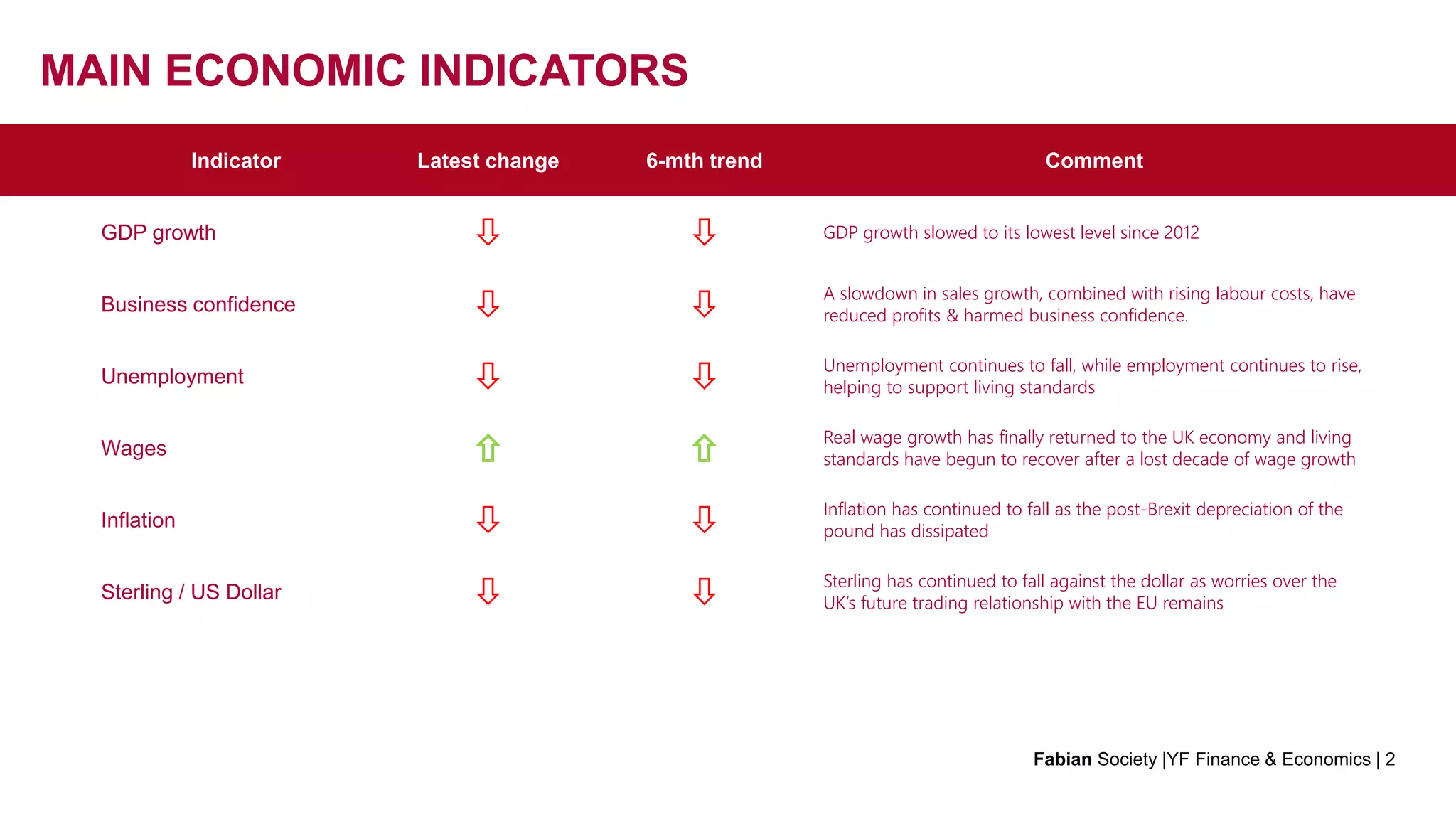

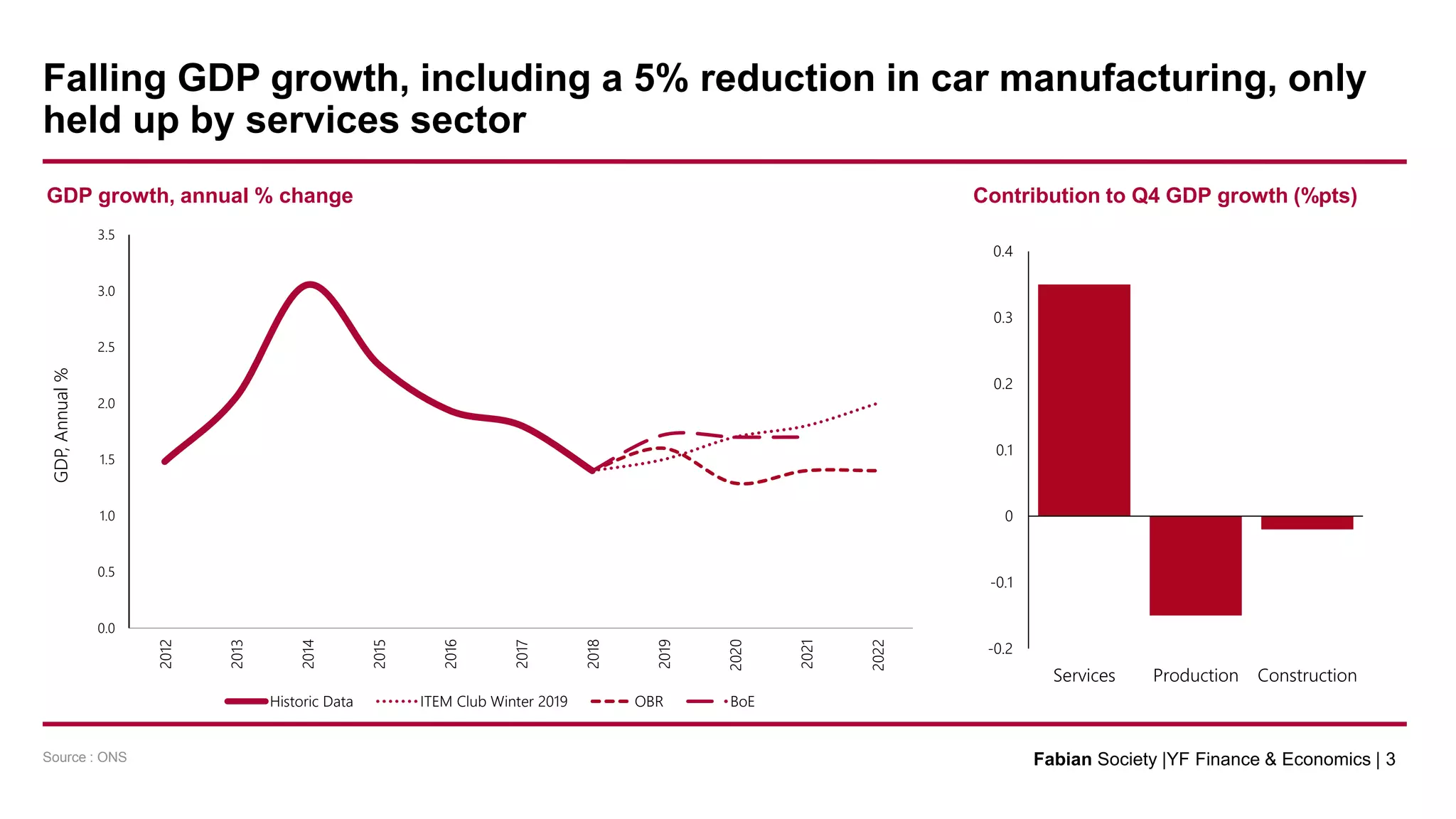

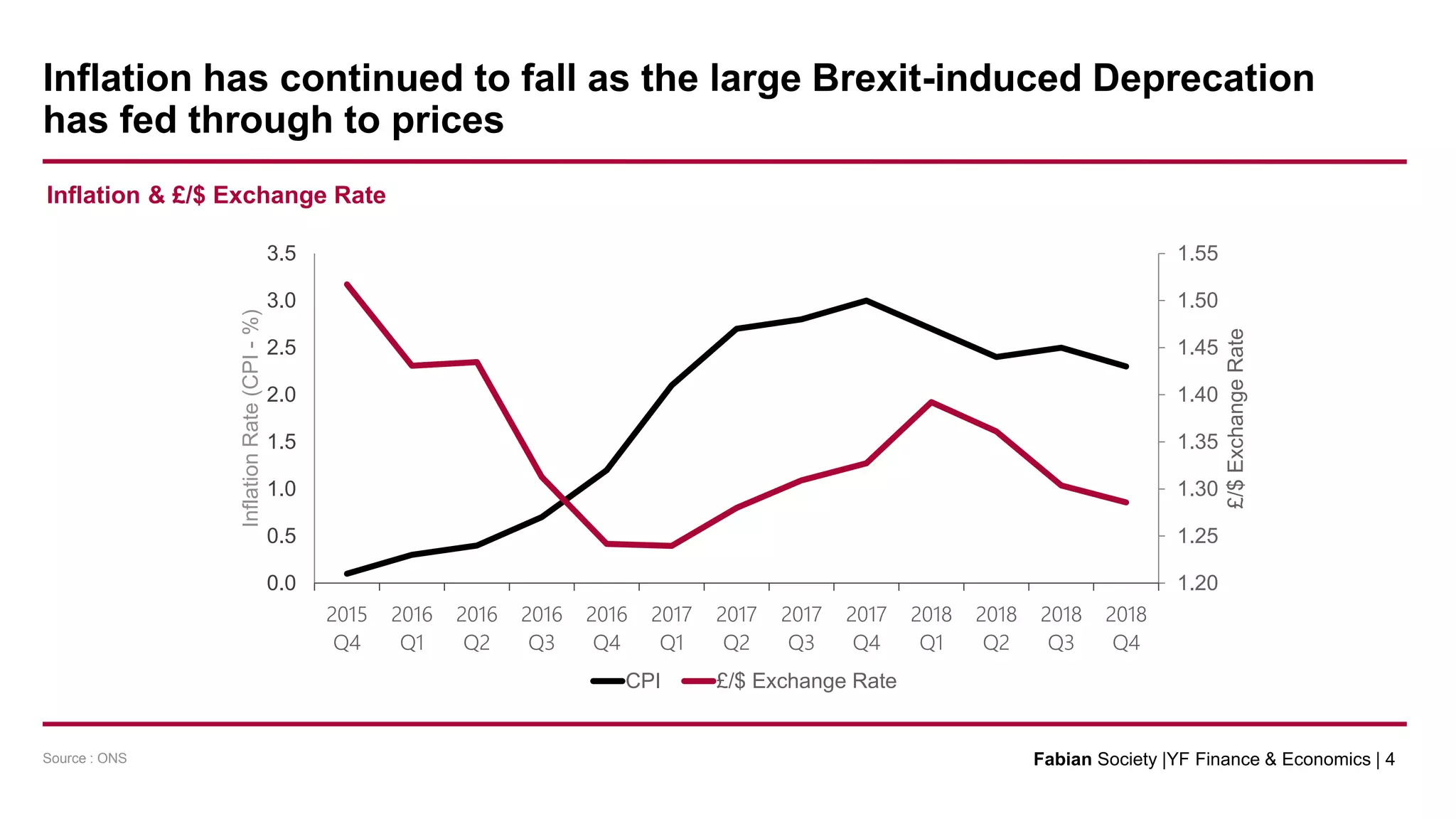

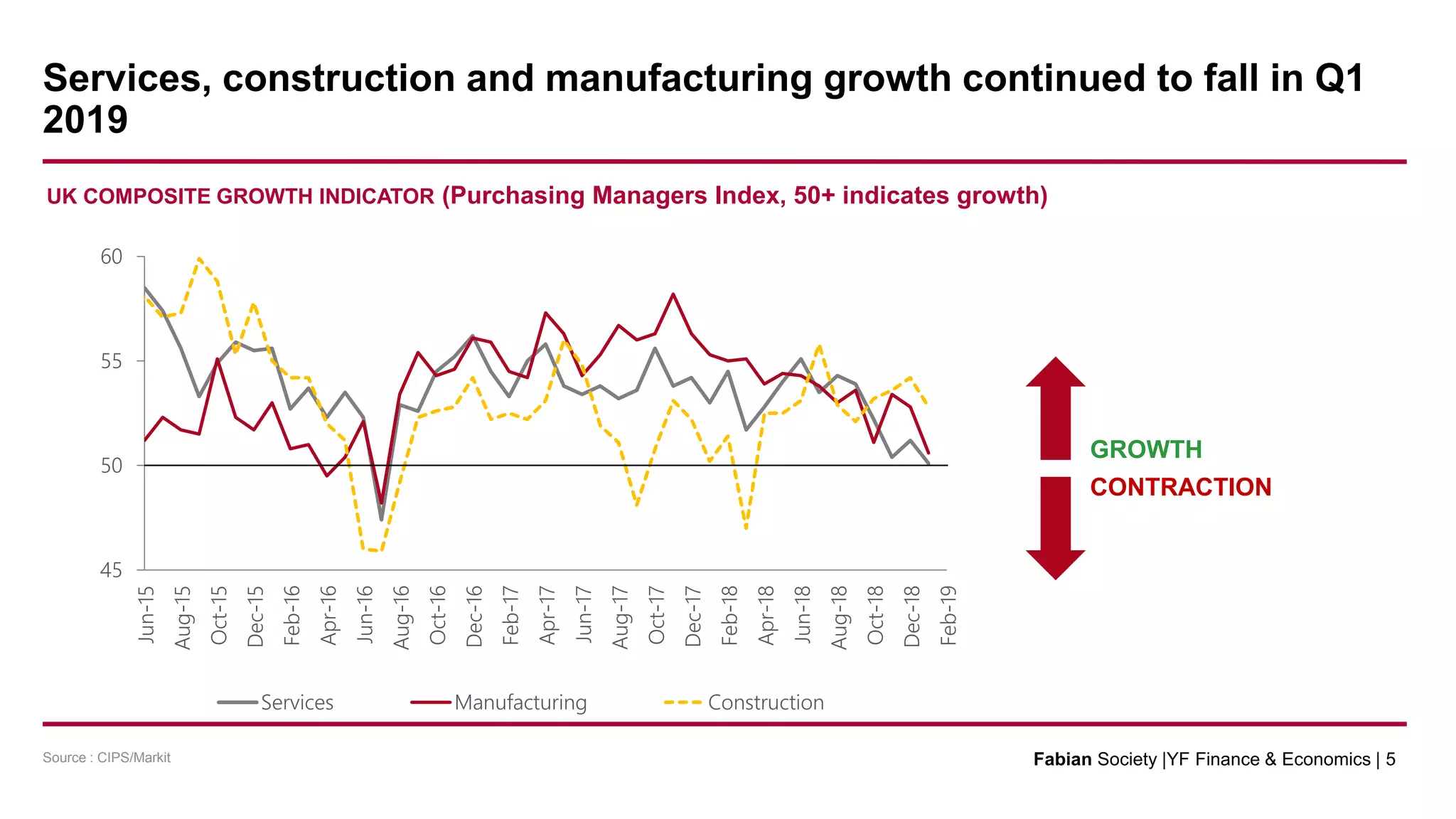

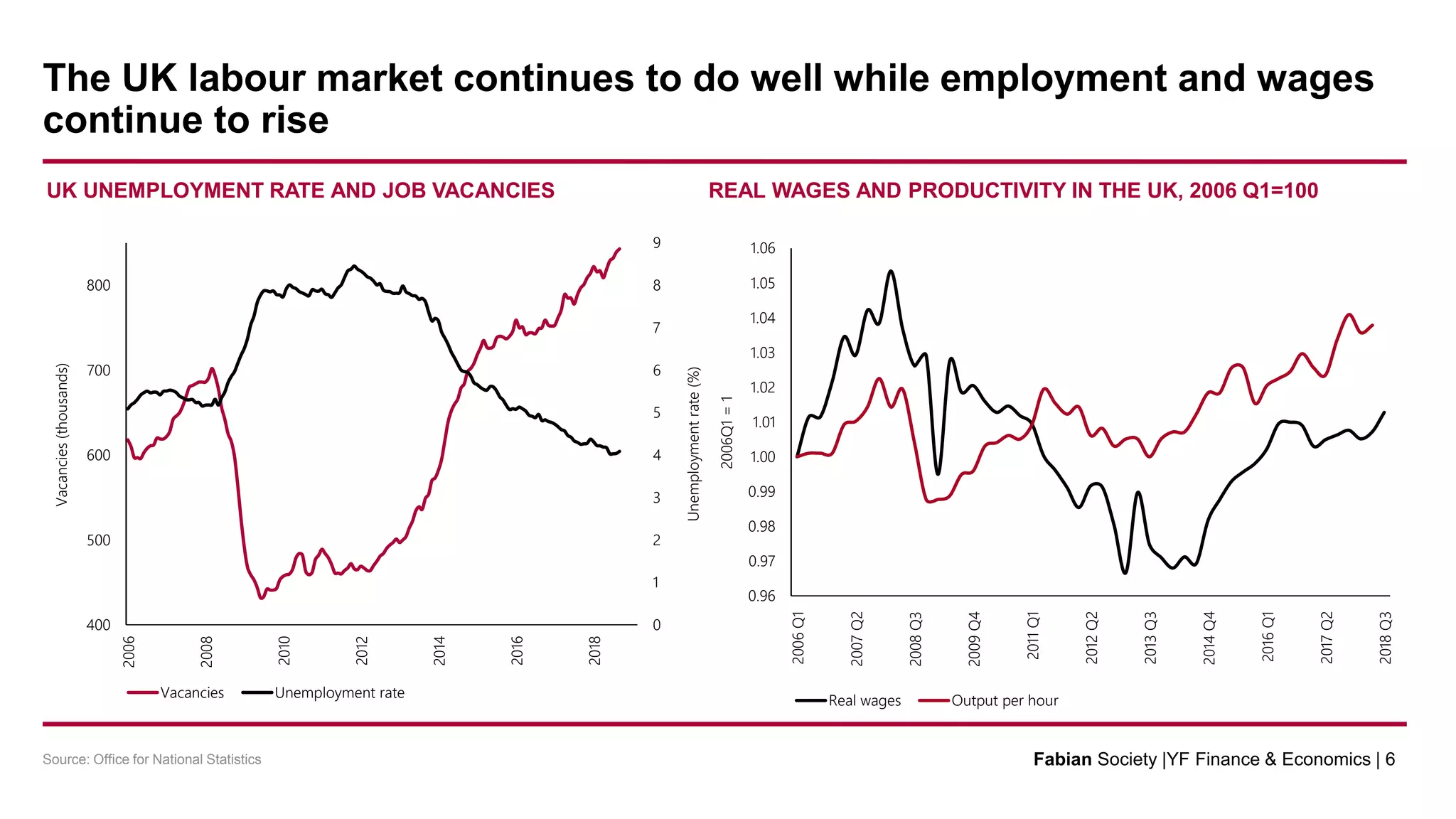

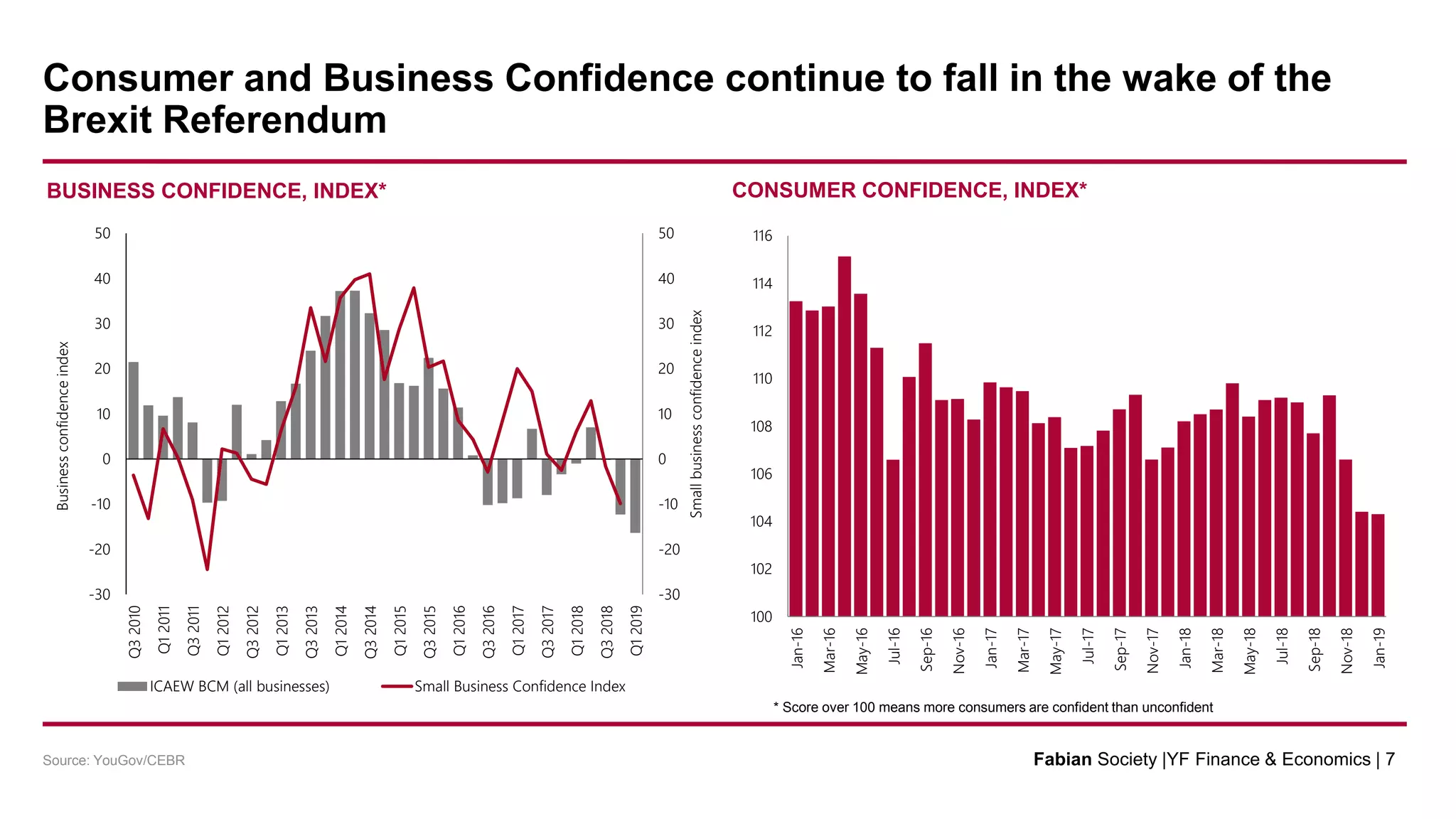

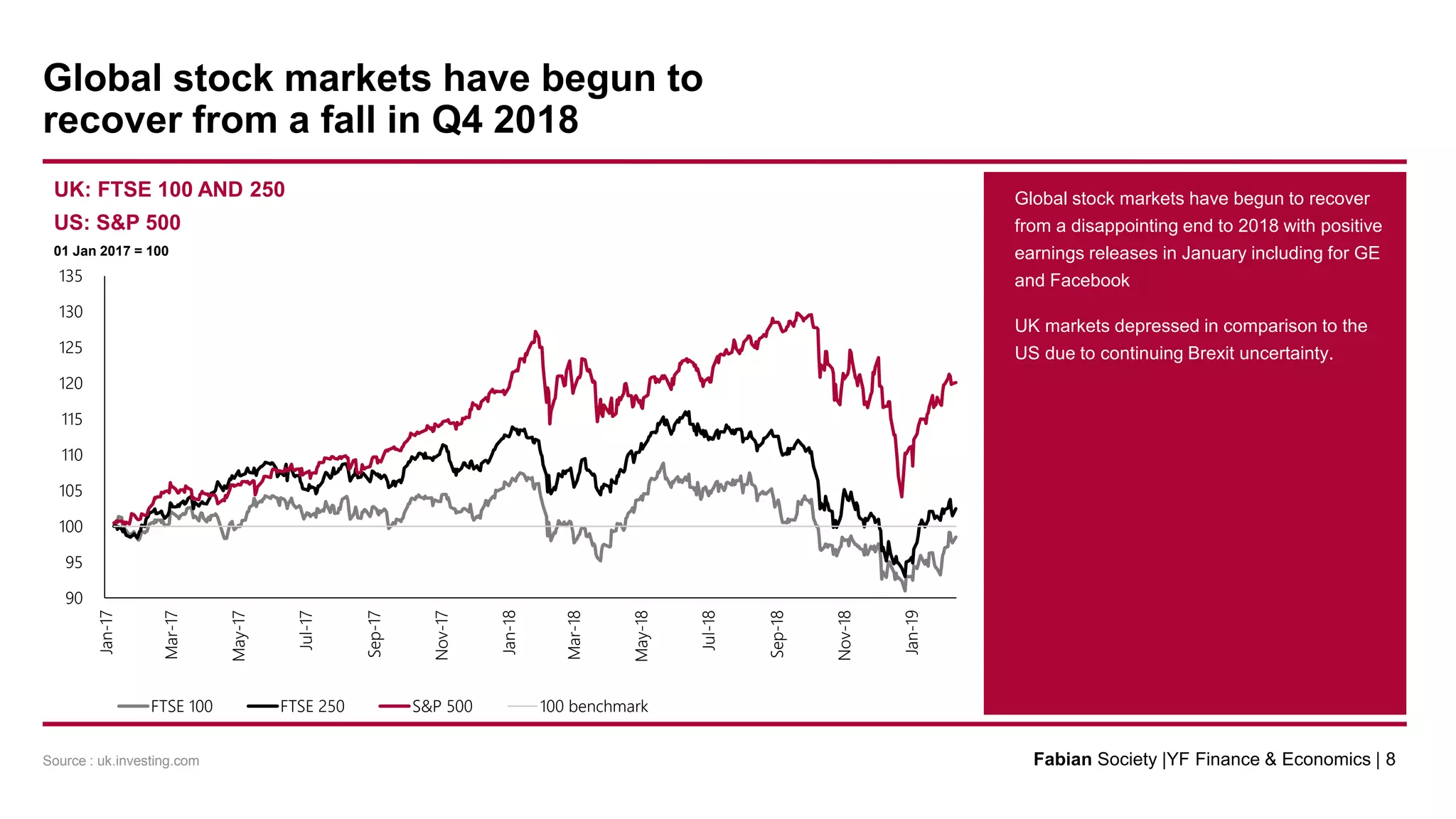

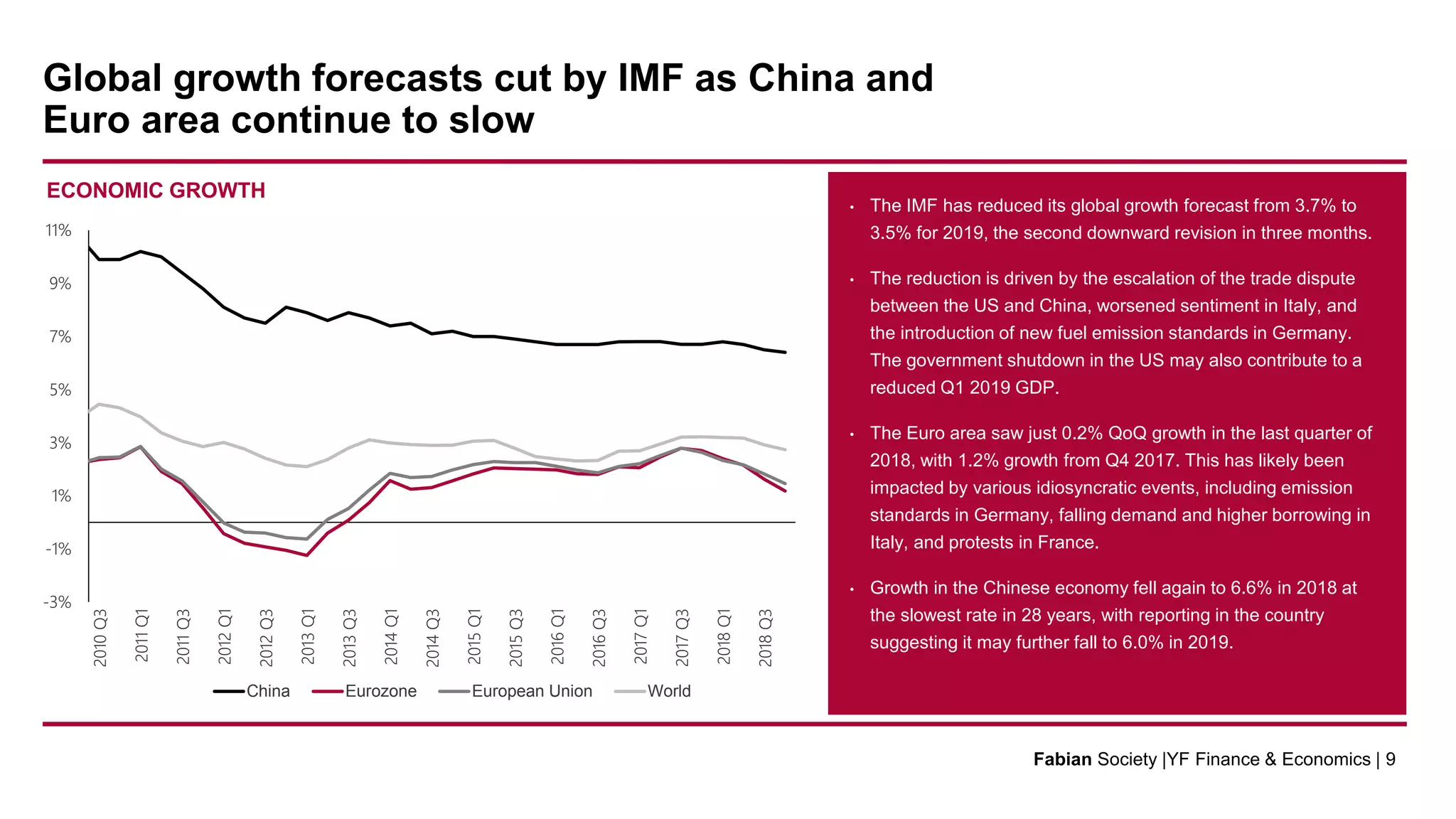

The UK economy is facing contrasting trends, with rising living standards due to falling unemployment and growing wages, but weakness elsewhere such as declining GDP growth, business confidence, and investment. Brexit uncertainty continues to hamper the economy unless a deal is reached. Global economic growth is also slowing due to factors like the US-China trade war and a cooling Chinese economy. The document provides several economic indicators and statistics demonstrating these recent economic developments in the UK and globally.