The summary provides the following key points in 3 sentences:

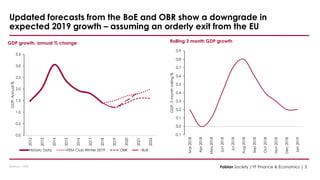

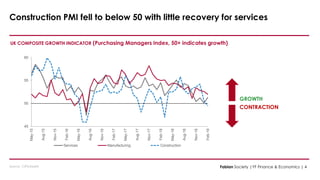

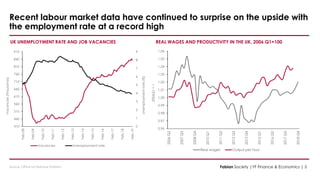

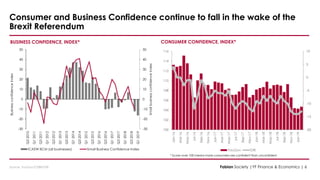

UK economic growth continued slowing down in early 2019, with construction contracting and limited growth in other sectors. Both the Bank of England and Office for Budget Responsibility downgraded their 2019 GDP growth forecasts, even assuming an orderly EU exit. While the unemployment rate remains low, risks to the global economy include escalating US-China trade tensions and tightening monetary policy pressures on emerging markets.