This document provides market commentary and macroeconomic forecasts for Q3 2010.

The key points are:

1) The sovereign debt crisis in Europe is not contained and big budget cuts are still needed.

2) The US economic recovery is slowing as stimulus winds down. Growth is expected to moderate to 1.5% in Q3.

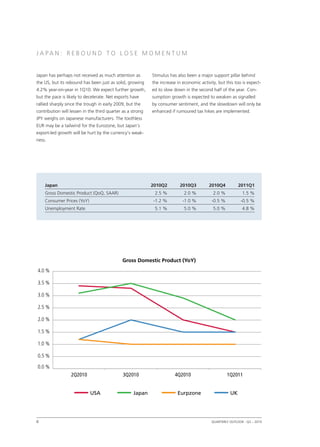

3) The Japanese recovery is also slowing, with exports expected to contribute less as the strong yen weighs on manufacturers.

4) The Eurozone recovery remains fragile due to debt concerns, but the weaker euro is boosting exports and industrial production.