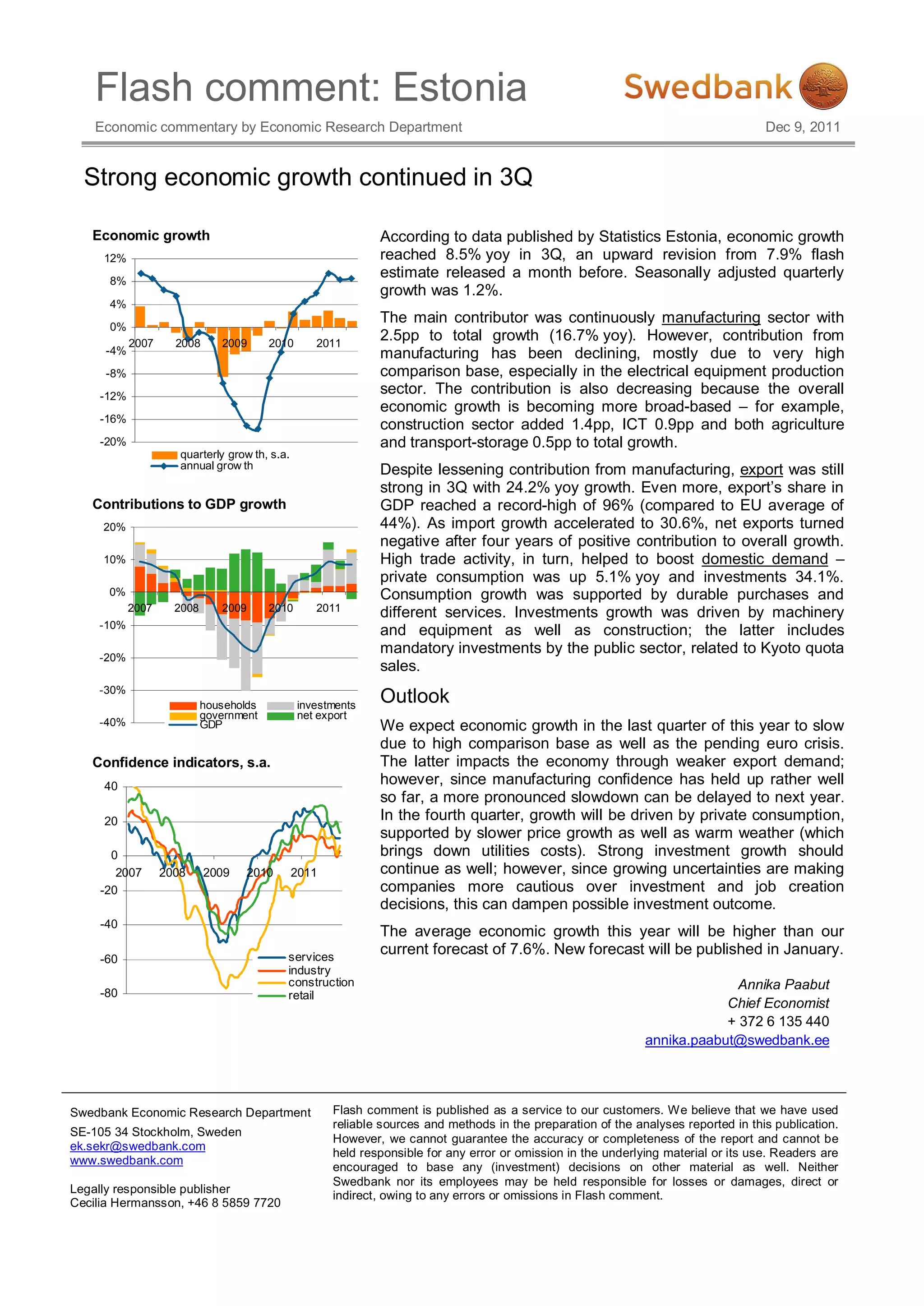

- Economic growth in Estonia reached 8.5% year-over-year in the third quarter of 2011, driven primarily by a strong manufacturing sector and private consumption growth.

- While manufacturing contribution is declining due to high bases of comparison, other sectors such as construction and services are contributing more to overall growth.

- Exports grew 24.2% in the third quarter but imports increased even faster, turning the trade balance negative for the first time in four years.

- The economic growth rate is expected to slow in the fourth quarter due to high comparisons and the ongoing eurozone crisis, with private consumption and investments continuing to support the economy.