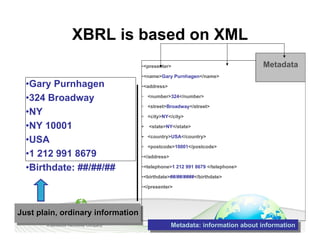

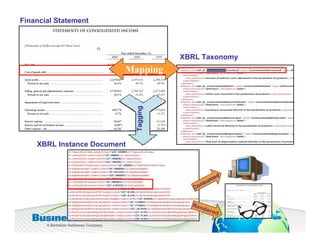

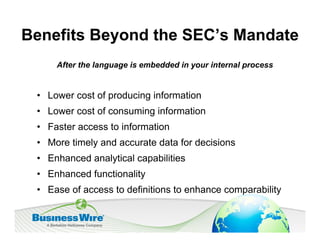

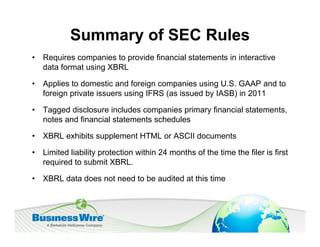

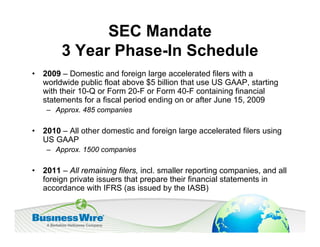

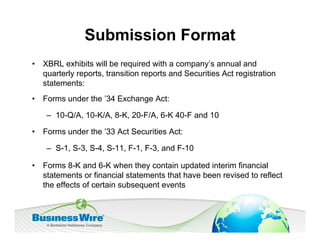

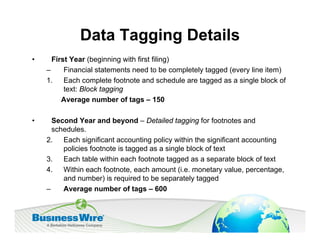

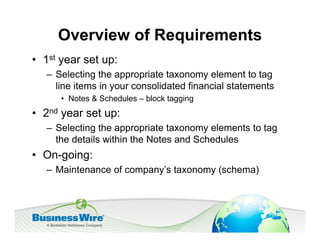

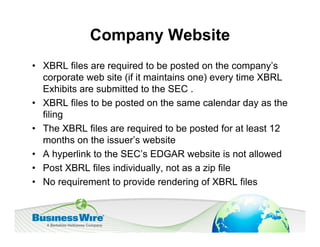

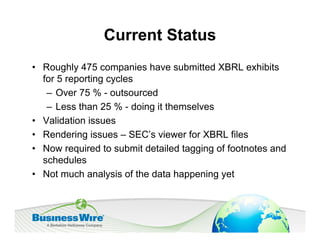

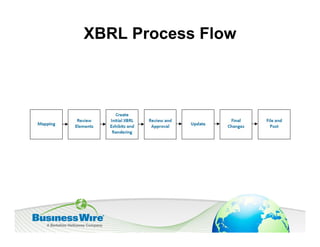

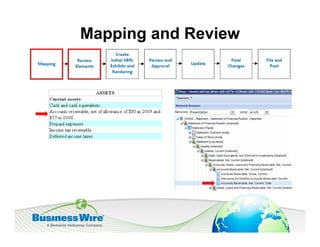

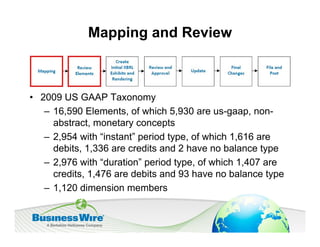

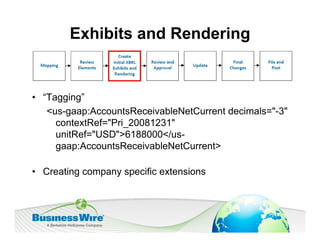

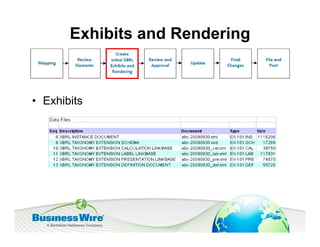

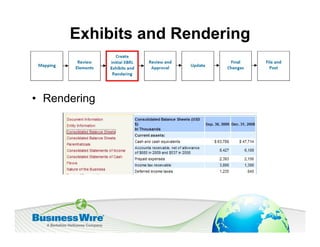

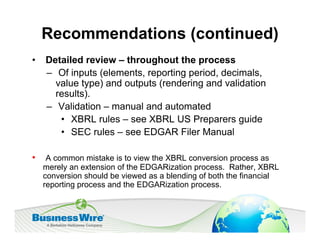

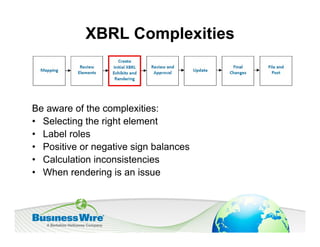

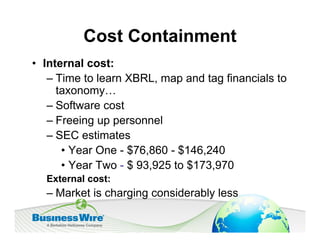

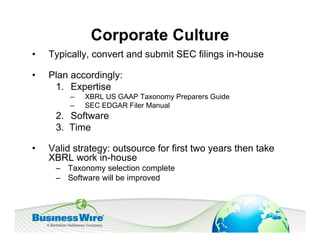

The document discusses the Extensible Business Reporting Language (XBRL) and its mandate from the SEC requiring companies to submit financial statements in this format. It outlines the SEC's rules, the tagging requirements for financial data, and the timeline for compliance, including aspects such as audit considerations and company responsibilities. Additionally, it provides recommendations for companies in handling XBRL conversion, addressing complexities and best practices in the submission process.