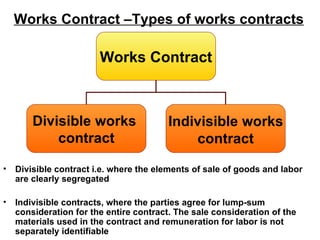

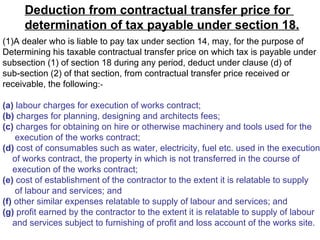

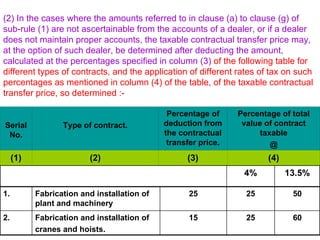

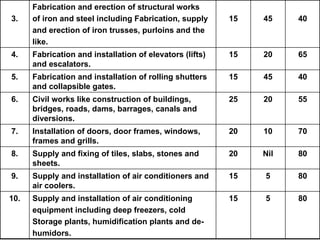

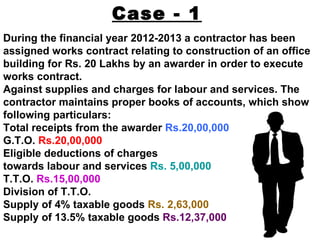

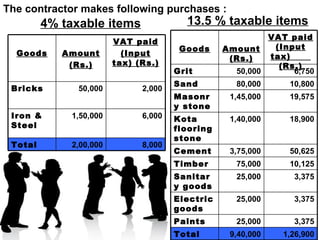

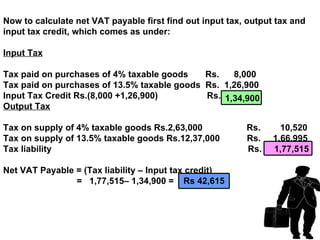

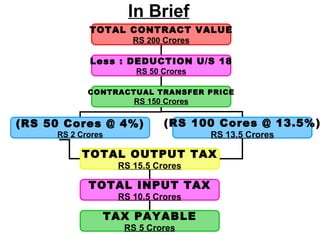

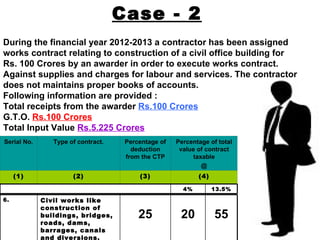

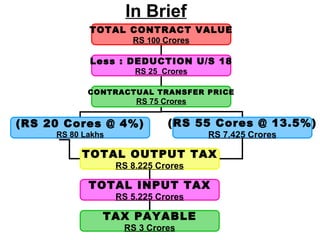

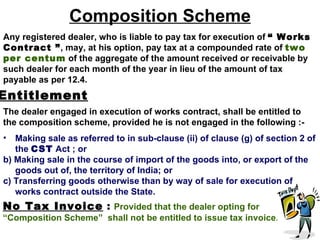

This document discusses works contracts under Indian tax law. It begins by defining works contracts and distinguishing between divisible and indivisible works contracts. It then discusses a key Supreme Court case that determined works contracts do not constitute a "sale of goods" and thus are not subject to sales tax. The document outlines the types of expenses that can be deducted from the contractual transfer price to determine the taxable amount. It provides examples of how tax is calculated for works contracts in two case studies. Finally, it briefly discusses the composition scheme option for works contracts to pay a compounded 2% tax rate instead of the standard rates.