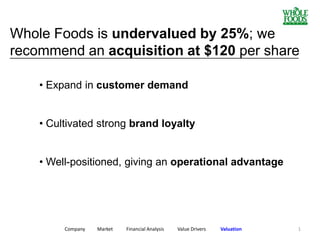

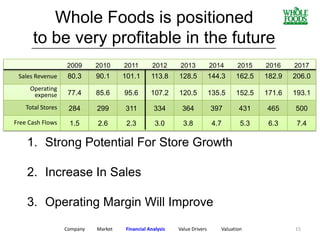

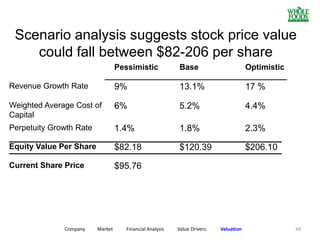

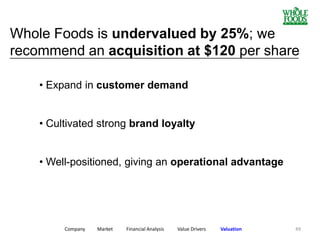

Whole Foods is undervalued by 25% according to the valuation team. They recommend an acquisition of Whole Foods at $120 per share based on the following key value drivers:

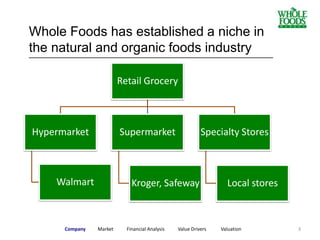

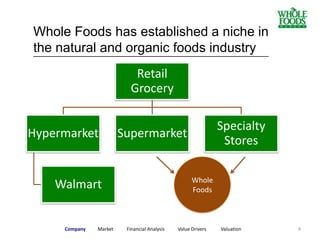

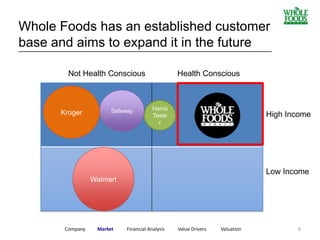

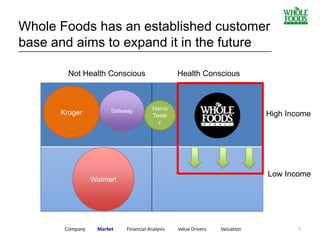

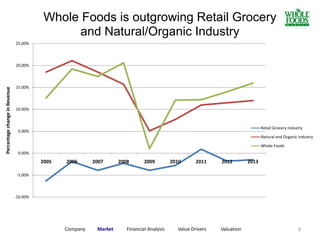

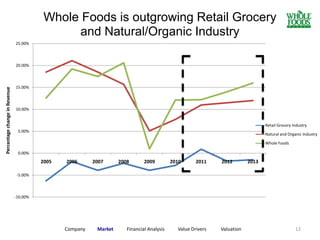

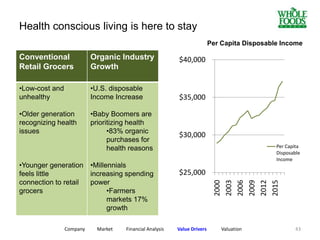

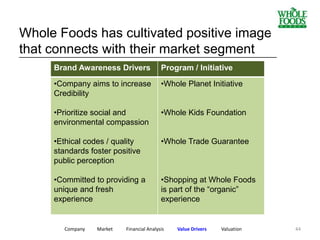

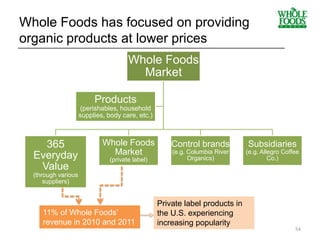

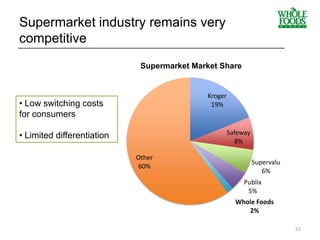

1. Whole Foods has established a niche in the natural and organic foods industry and has cultivated strong brand loyalty.

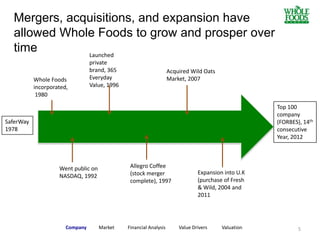

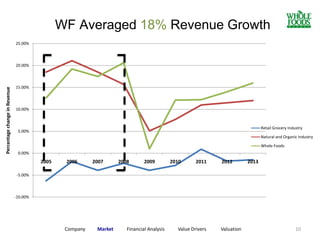

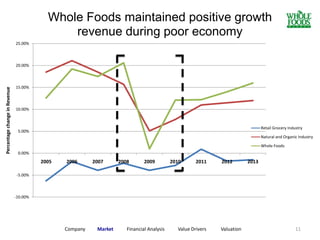

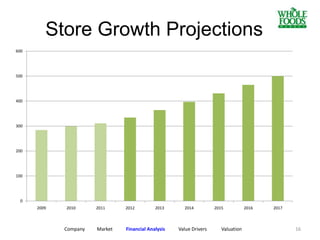

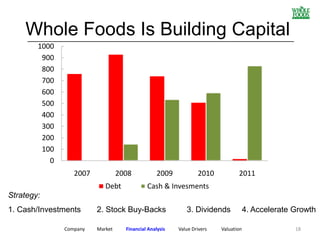

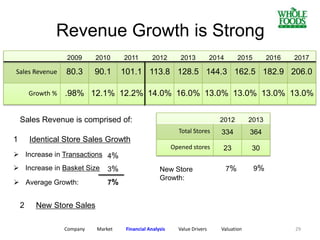

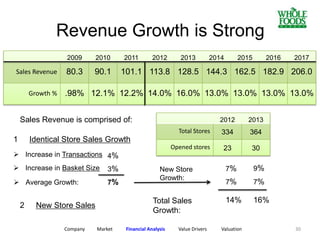

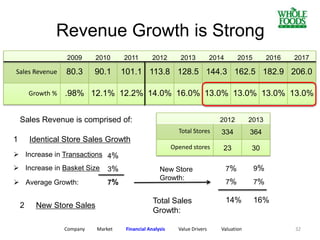

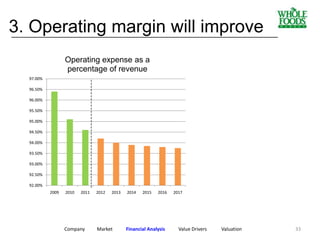

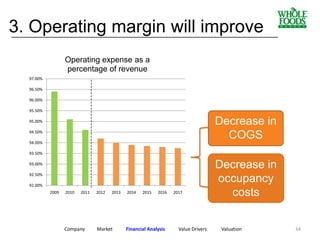

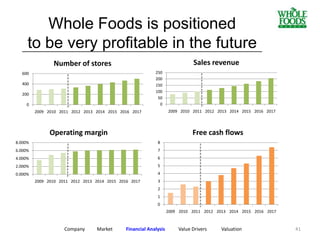

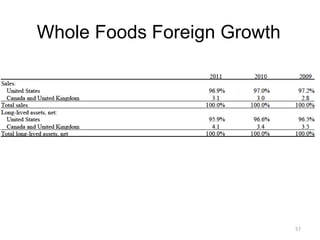

2. Their financial analysis shows Whole Foods is well-positioned for continued growth, with projections of increasing sales revenue, expanding operating margins, and growing their store count to 500 locations by 2017.

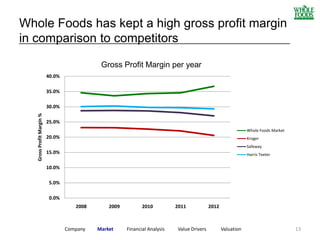

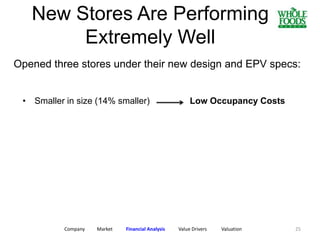

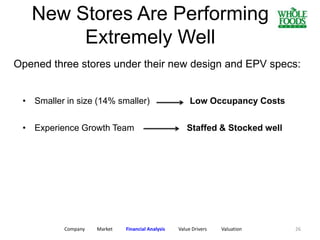

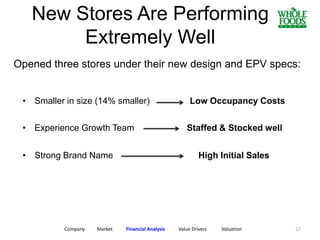

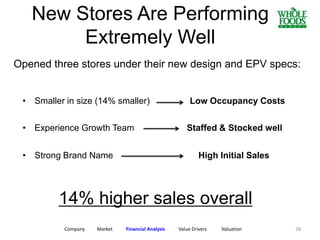

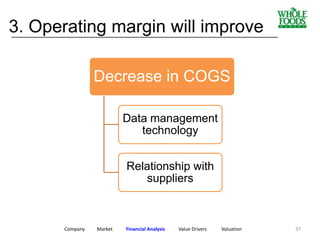

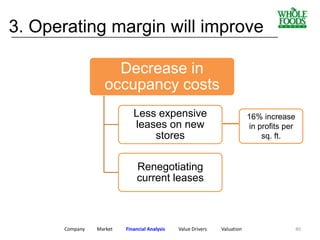

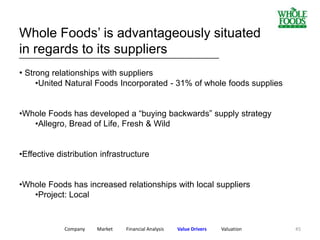

3. Key value drivers include their ability to expand their customer base further, new stores performing strongly out of the gate, and opportunities to decrease costs of goods sold and occupancy expenses over time.