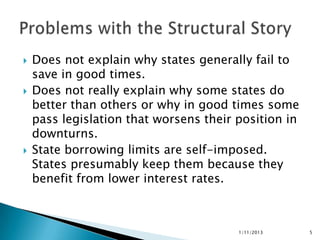

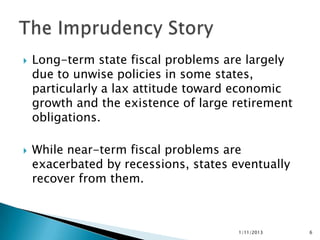

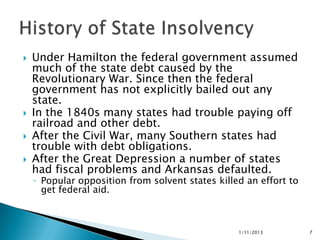

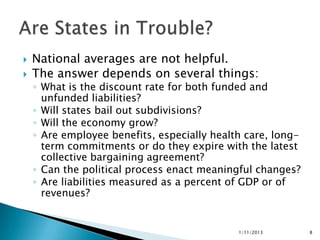

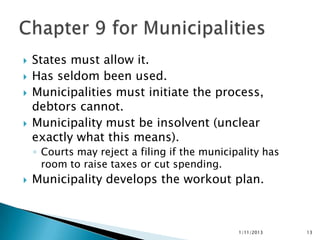

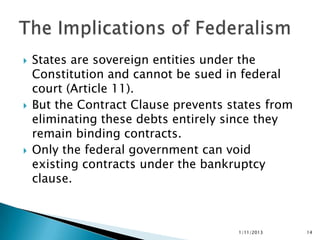

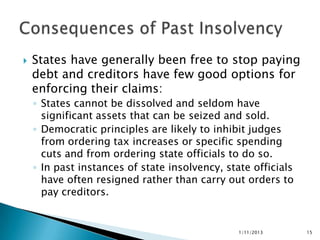

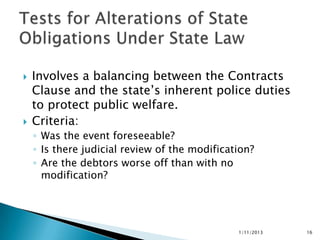

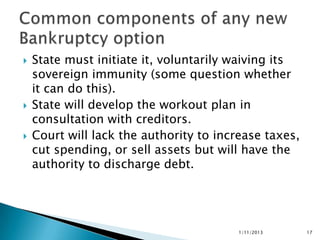

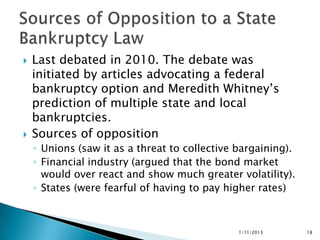

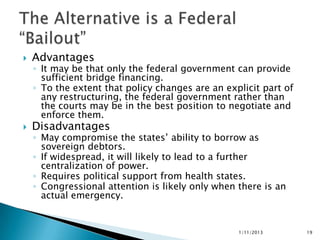

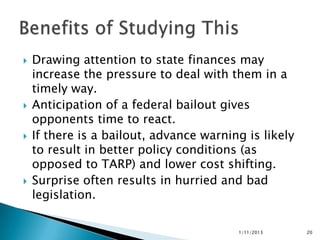

The document outlines the challenges of state financial insolvency, emphasizing its impact on various stakeholders including bondholders and retirees. It identifies the causes of insolvency as a mix of structural imbalances, poor policy decisions, and unfunded retiree obligations, highlighting the political nature of these issues rather than merely fiscal ones. Additionally, it discusses the complexities of potential federal intervention, the prerequisites for state bankruptcy, and the implications for both state and federal fiscal responsibilities.