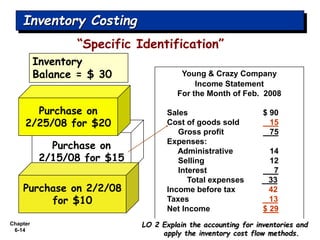

This chapter discusses accounting for inventories. It covers determining inventory quantities through physical counts and ownership considerations. Cost flow methods like FIFO, LIFO, and average costing are explained along with their financial statement effects. The chapter also discusses inventory errors and their impact on income statement and balance sheet. Lower-of-cost-or-market principle for inventory valuation is explained as well as analyzing inventory through turnover ratios.