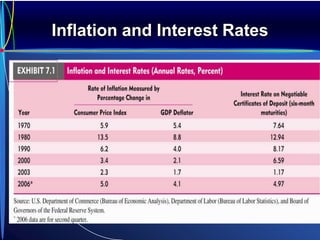

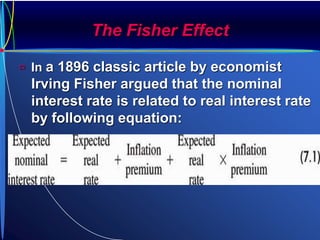

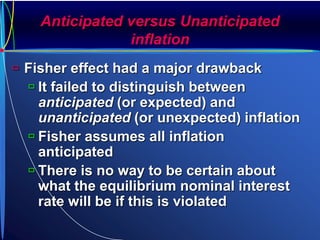

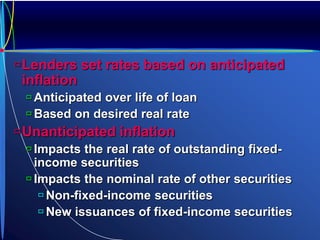

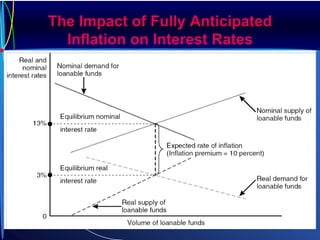

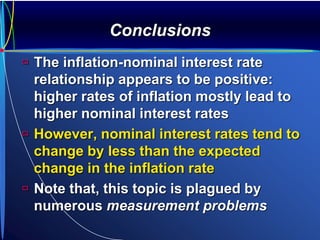

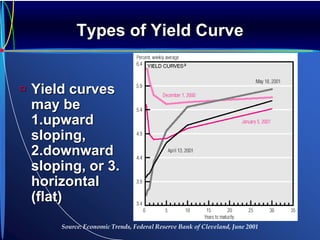

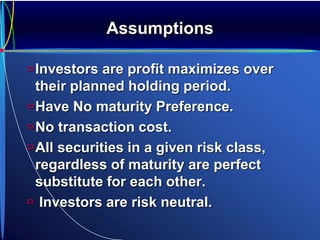

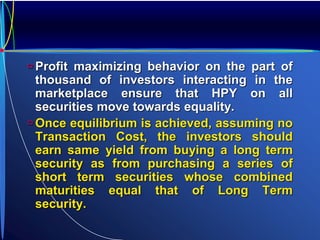

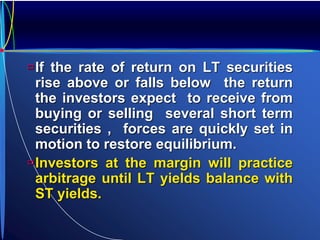

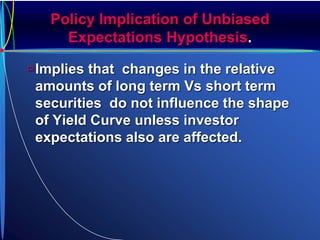

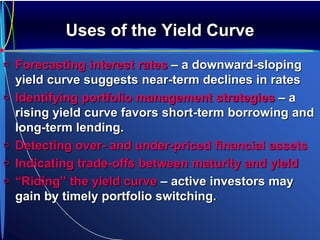

This document discusses inflation and interest rates. It explains that nominal interest rates tend to rise with inflation, as predicted by the Fisher effect. However, the relationship between inflation and real interest rates or stock prices is more complex, with some studies finding they may fall with higher unexpected inflation. The document also covers yield curves and term structure of interest rates, explaining how expectations of future short-term rate changes can determine the current yield curve shape according to the unbiased expectations hypothesis. Duration is introduced as an alternative measure to maturity for assessing a debt security's price sensitivity.