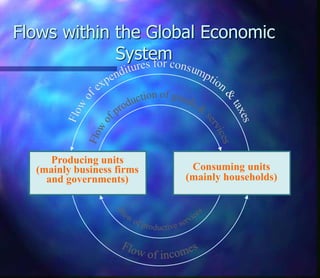

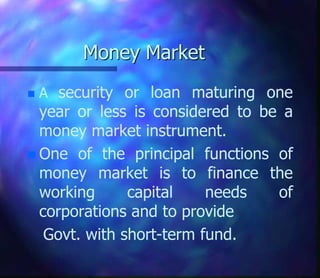

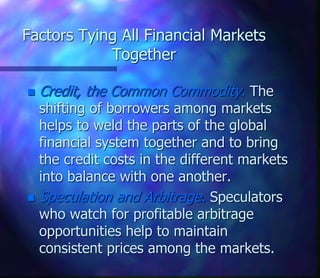

This document provides an overview of the financial system and markets. It defines the financial system as the collection of markets, institutions, and regulations that facilitate the flow of funds from savers to borrowers globally. The financial system performs important functions like facilitating savings, providing liquidity and credit, managing risk, and enabling policy goals. It also describes the various types of financial markets including money markets, capital markets, and derivatives markets; and the key factors like credit, speculation and arbitrage that tie these markets together.