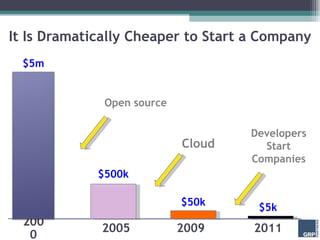

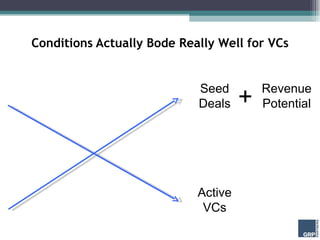

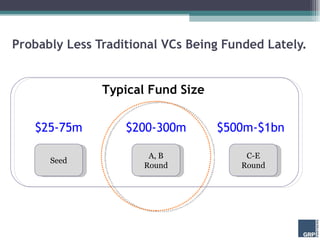

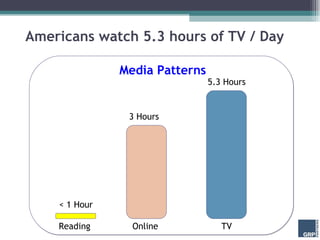

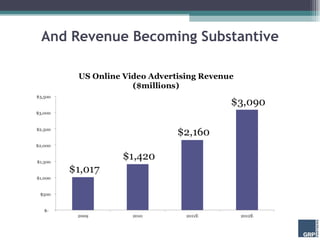

The document discusses the state of the venture capital market and emerging trends. It notes that it has become dramatically cheaper to start a company due to factors like open source software and cloud computing. This has led to more founders being younger and more technical. While the number of venture capital firms has decreased in size, the opportunities for investment have grown larger. New models of venture capital firms have also emerged that focus on specific topics or stages of funding. The document suggests that online video and television content is a major emerging opportunity, as consumers spend more time watching online video than reading online.