This document provides an overview of best practices for target company valuation in mergers and acquisitions identified by Stout Risius Ross, Inc. Key aspects include:

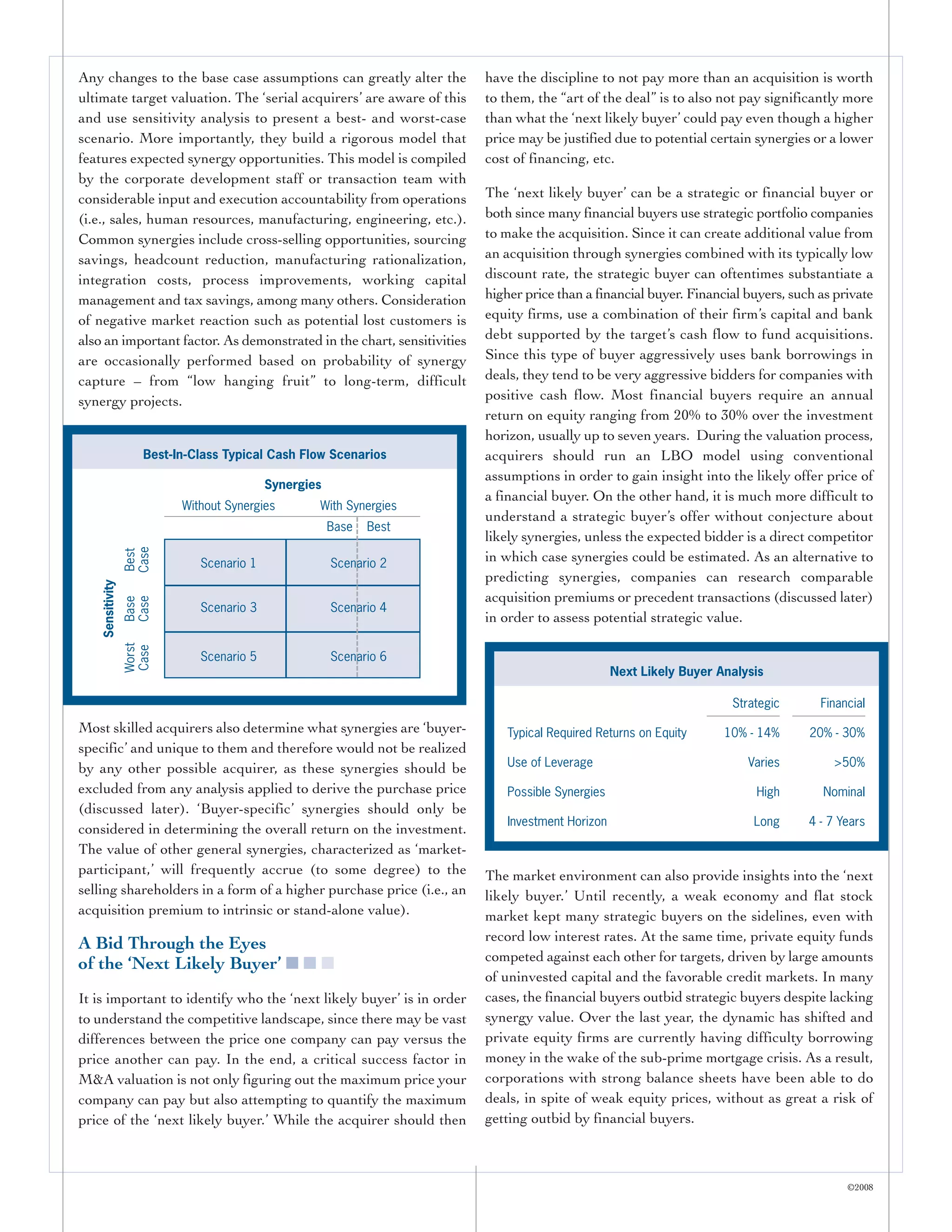

1) Developing detailed cash flow projections including comprehensive synergy and sensitivity analyses which are integrated with financial statements.

2) Identifying the "next likely buyer" to understand competitive bidding landscape.

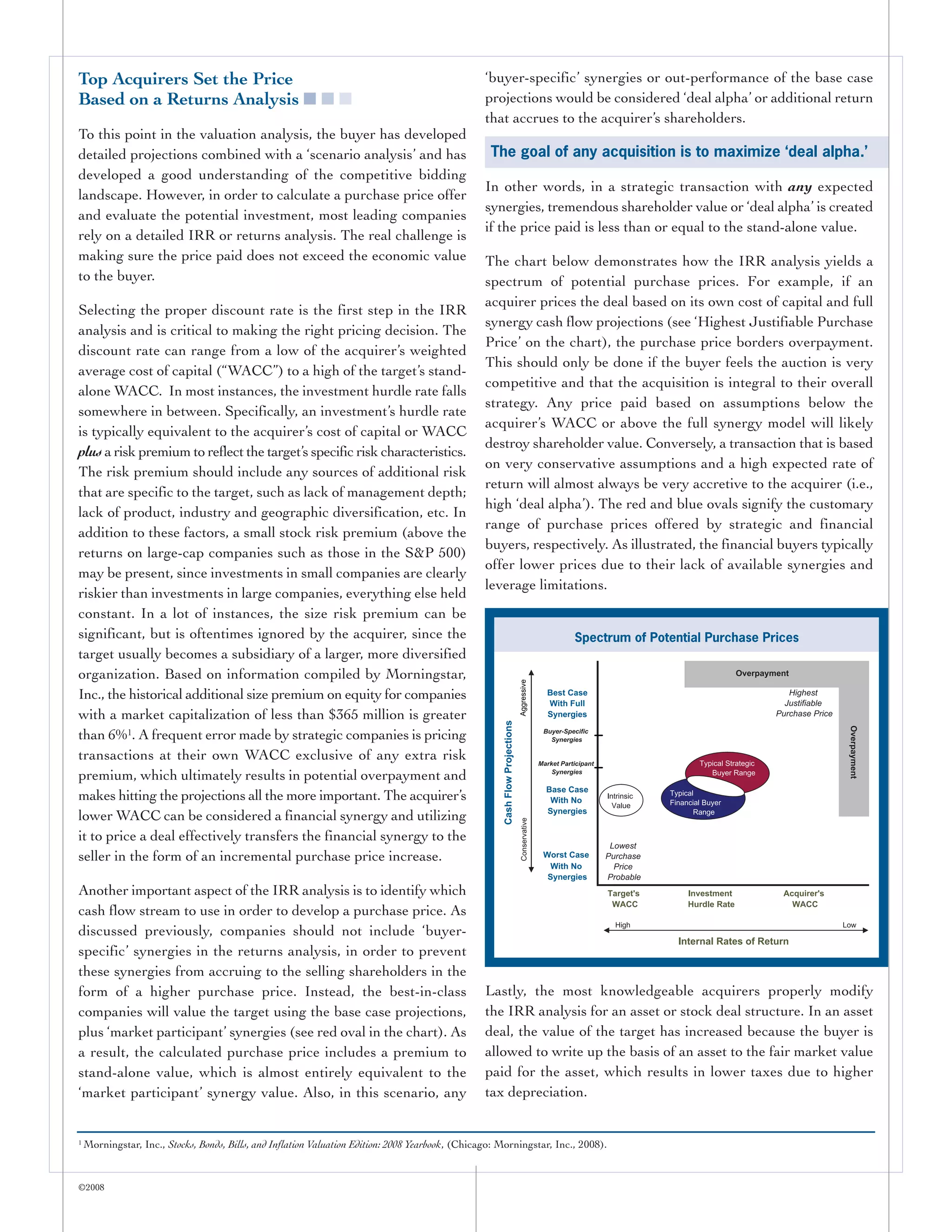

3) Employing thorough internal rate of return analysis and accretion/dilution models to evaluate potential purchase prices.