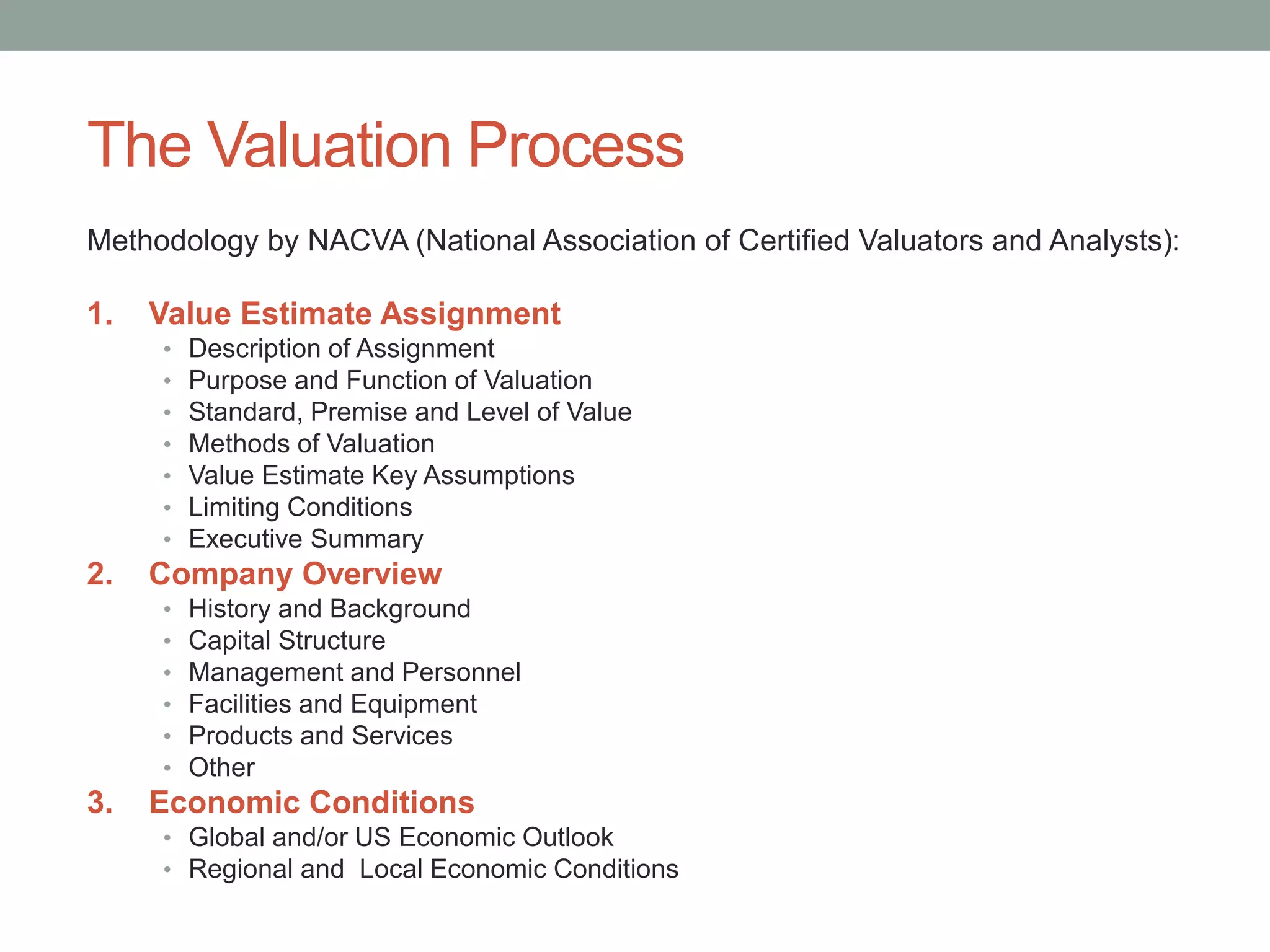

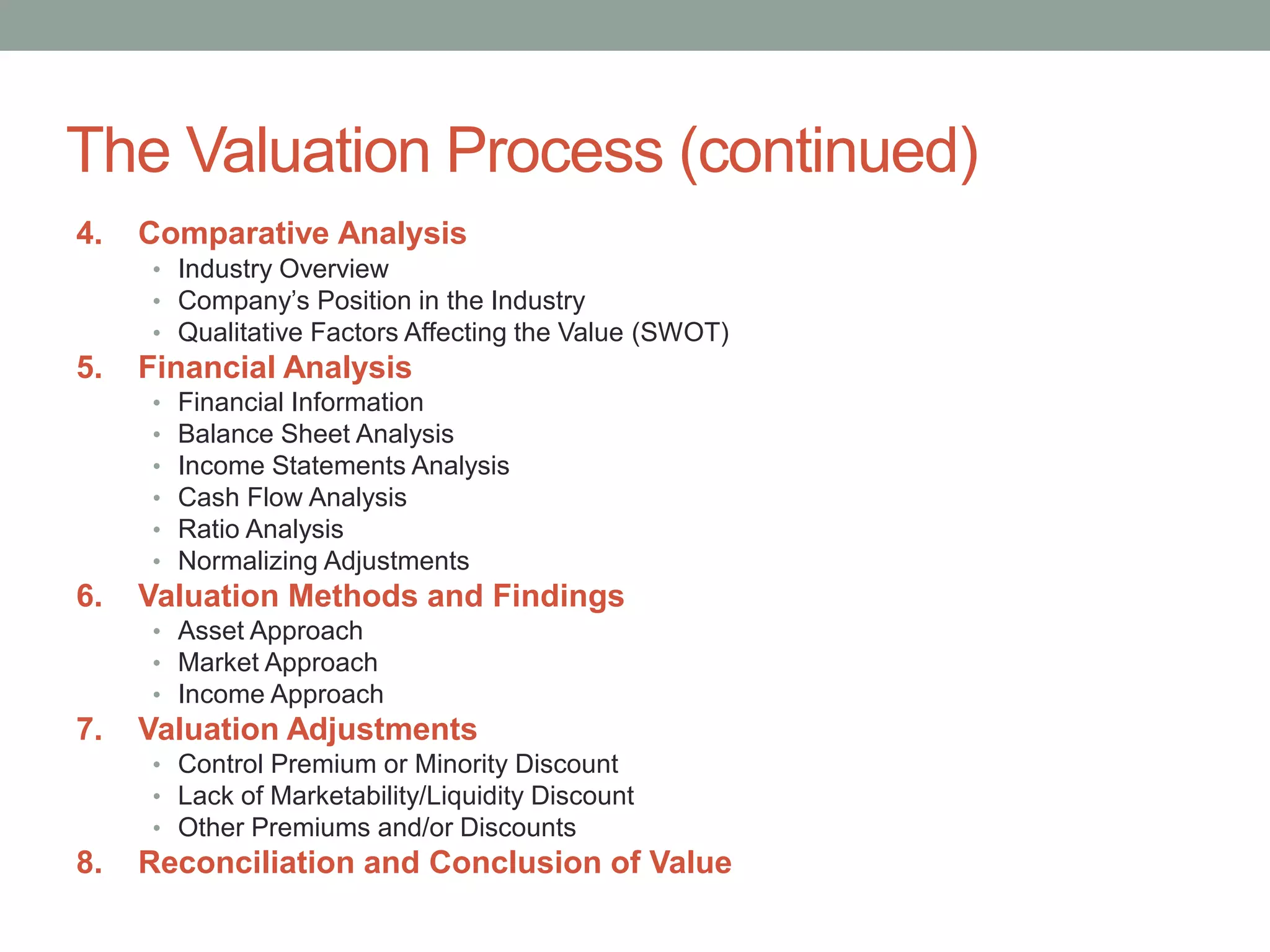

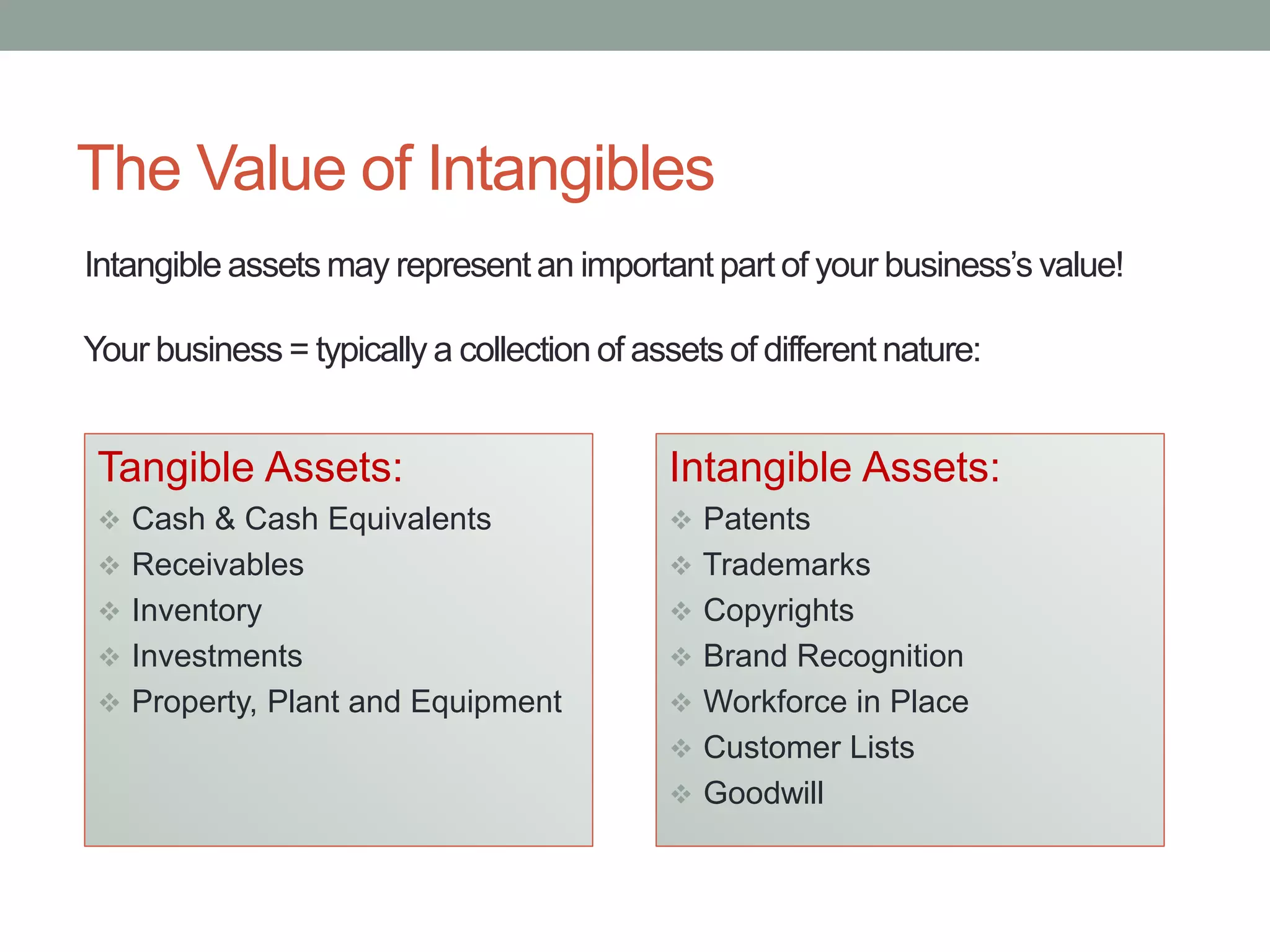

This document discusses the importance of understanding the value of a business. It notes that while business owners often only consider valuation when selling, other needs like estate planning, financing, and succession planning also require understanding value. The document outlines factors that influence business value like growth, industry, and competition. It then summarizes common valuation methods like asset, market, and income approaches. Finally, it stresses the importance of planning exit strategies in advance through techniques like buy-sell agreements, mergers/acquisitions, and tax strategies.