This document provides an overview of managing sell-side due diligence for mid-market private companies. It discusses:

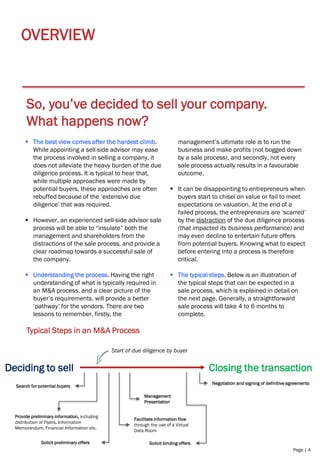

- The typical steps involved in an M&A sale process, which generally takes 4-6 months and includes preparing the company, marketing to potential buyers, conducting due diligence, negotiating offers, and closing the transaction.

- Key aspects of preparing a company for sale including ensuring paperwork is in order, cleaning up the balance sheet, improving physical appearance, developing a business plan, and preparing management.

- Common due diligence activities undertaken by buyers to evaluate whether to make an offer, how to structure the deal, and how much to pay. This includes financial, legal, technical, and