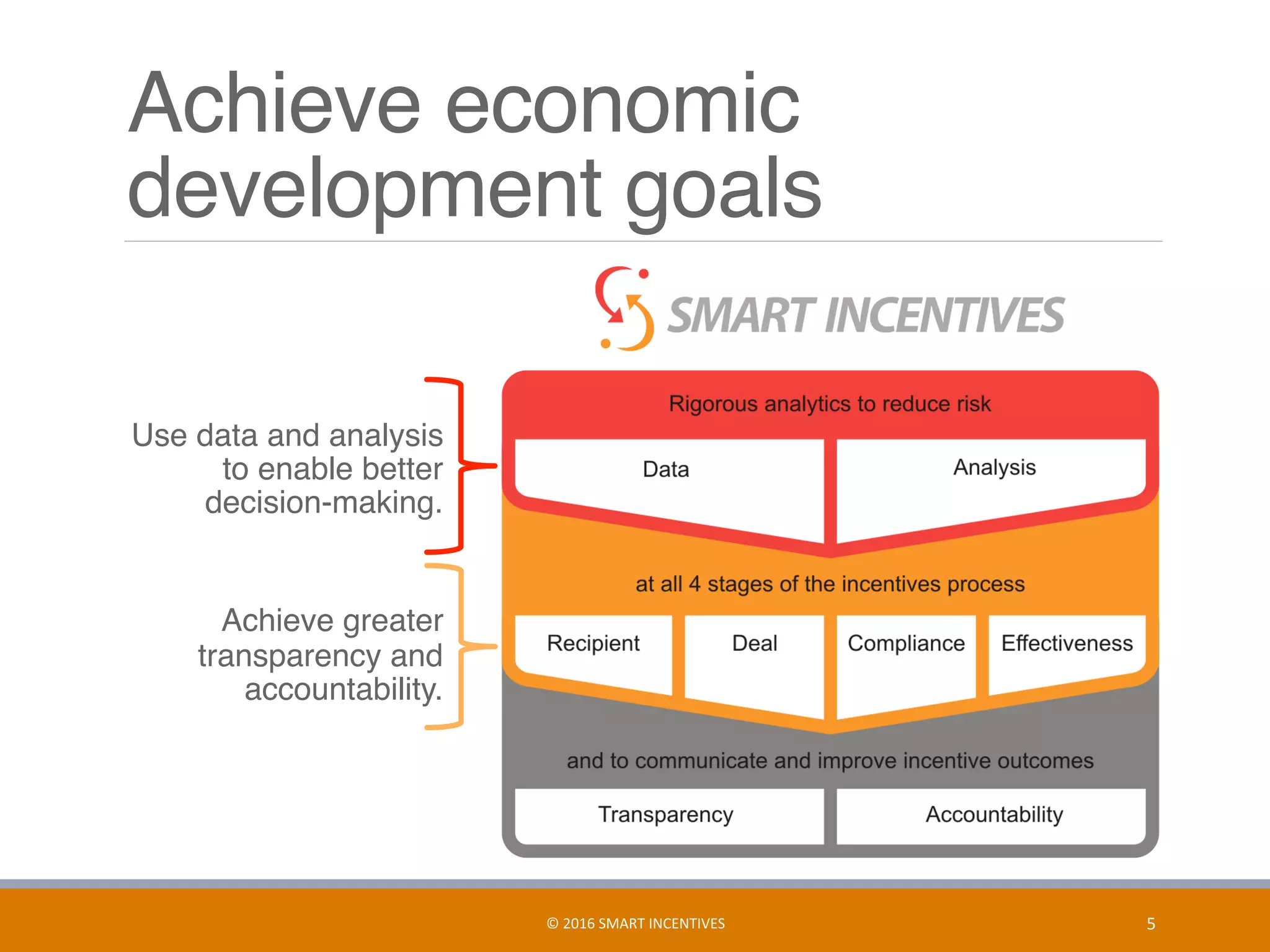

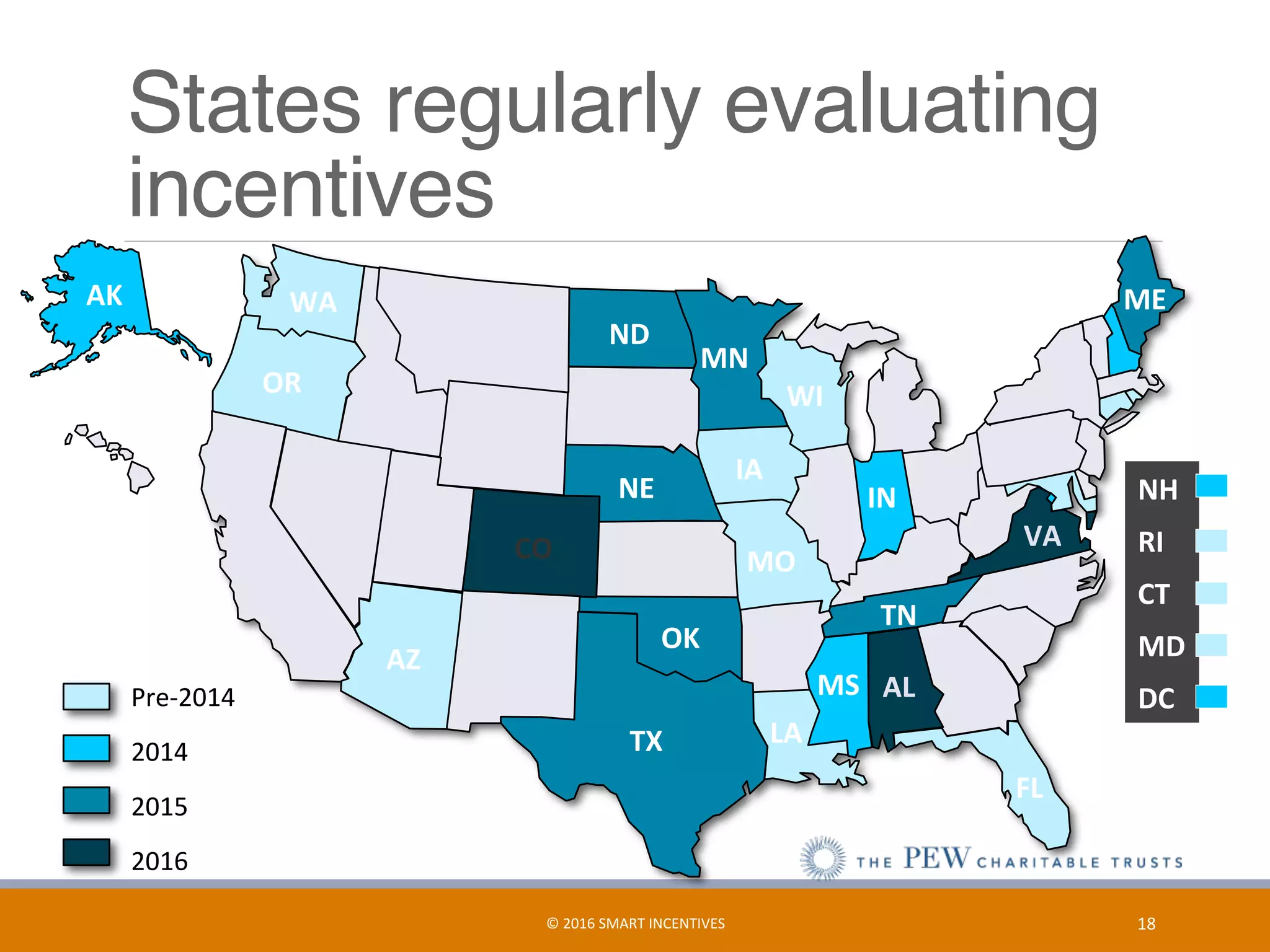

The document discusses the use of incentives in economic development to achieve community goals such as job creation and investment. It emphasizes the need for data analysis and due diligence to understand the risks and benefits of incentive programs, as well as compliance and effectiveness monitoring to ensure that these incentives deliver net benefits to the community. The author encourages better communication and transparency regarding incentive use and outcomes, advocating for continuous evaluation to improve incentive strategies.