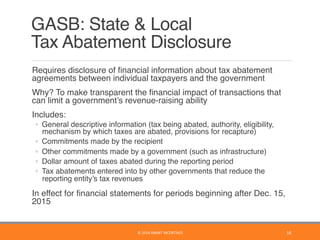

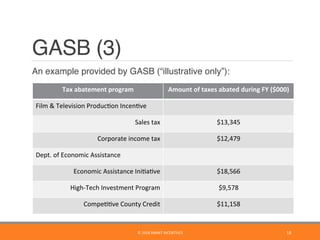

The IEDC webinar presented by Ellen Harpel outlines the importance of using incentives in economic development to achieve community goals such as job creation and business growth. It emphasizes the need for thorough analysis and transparency in assessing the return on incentives to ensure accountability and effective decision-making. The document highlights best practices for compliance monitoring, program evaluation, and communication with stakeholders to maximize the impact of incentives.