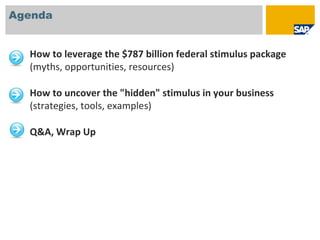

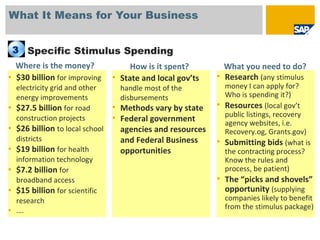

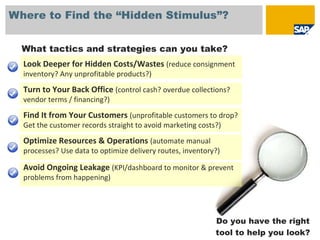

The document discusses a live panel discussion on leveraging the $787 billion federal stimulus package for businesses. It provides an agenda for the discussion, introduces the panel speakers and their backgrounds, describes the current economic situation, and discusses myths and realities about the stimulus package. It then outlines three key things the stimulus means for small and mid-sized businesses: tax incentives and provisions, SBA loan and lending changes, and specific stimulus spending. It also discusses how businesses can find "hidden stimulus" within by integrating data to better plan resources and execute processes.