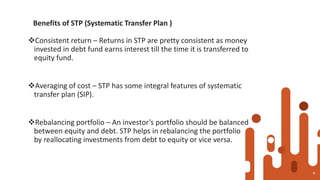

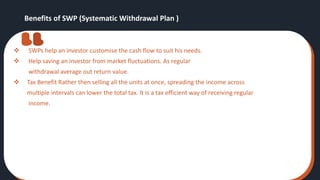

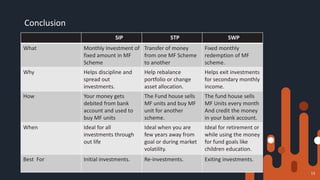

SIP, STP, and SWP are three common investment plans used in mutual funds. SIP allows investing a fixed amount regularly in a mutual fund scheme. STP transfers funds from one mutual fund scheme to another systematically. SWP allows withdrawing a fixed amount from a mutual fund scheme regularly. All three plans provide benefits like rupee cost averaging and tax efficiency. SIP is best for initial investments, STP for rebalancing portfolios, and SWP for exiting investments while receiving monthly income.