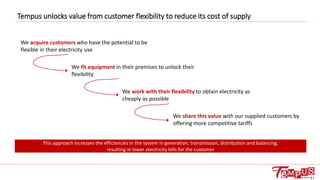

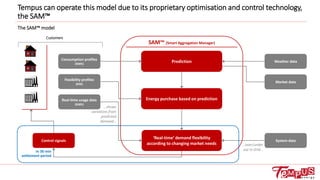

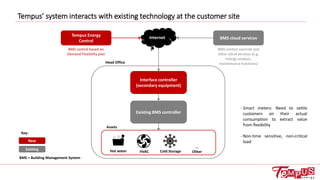

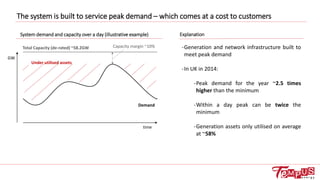

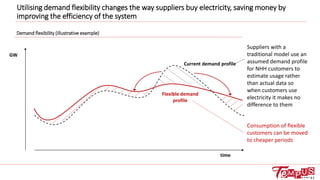

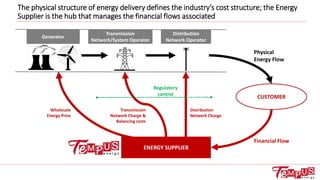

The document discusses how inefficient electricity systems and inflexible demand lead to higher electricity bills, while demand flexibility presents opportunities for reducing costs and improving system efficiency. It highlights the limitations of traditional supplier models and the potential benefits of adopting innovative approaches like those offered by Tempus, which utilizes customer flexibility to optimize energy usage and reduce costs. By integrating technology to manage real-time demand and offering competitive tariffs, companies can unlock significant savings for consumers.

![A day in the UK market - Fluctuations in electricity prices

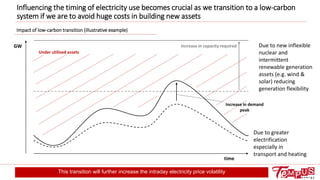

Impact of demand and generation fluctuations on price

[UK half hourly spot prices, 27th Oct 2014, £/MWh]

66

225

69

2

3

0 50 100 150 200 250

£8-20

£20-50

£50-100

£100-200

Over £200

0

10

20

30

40

50

60

70

80

90

100

time

(half hourly

periods)

£MWh

£86/MWh

£17/MWh

Number of days

Difference between max and min prices in a day

[£, number of days, 2014]](https://image.slidesharecdn.com/15-151118170623-lva1-app6892/85/Unlocking-demand-flexibility-for-lower-electricity-bills-6-320.jpg)

![Wholesale costs

Supplier operating costs

Supplier

profit

Environmental & Social

costs

VAT

Network costs

Demand flexibility can be used to optimise most elements that make up the bill

Minimised by

shifting flexible

demand to off-

peak periods

Reduced by

actively trading

and varying

demand to

match low price

periods

Household Bill Savings with demand flexibility

Balancing charges

also minimised by

managing usage in

real time

Wholesale costs, 39%

Supplier operating

costs, 13%

Supplier profit, 6%

Environmental & Social

costs, 11%

VAT, 5%

Network costs, 26%

Household Electricity Bill Breakdown (Ofgem 2015)

Government taxes,

regulations and

legislations Costs of running a supply business

[the only costs that traditional

suppliers can effectively control]

Transmission and

distribution costs

Cost of

electricity

trading

11Further opportunities can arise from raising revenue from participating in balancing services and capacity market](https://image.slidesharecdn.com/15-151118170623-lva1-app6892/85/Unlocking-demand-flexibility-for-lower-electricity-bills-11-320.jpg)