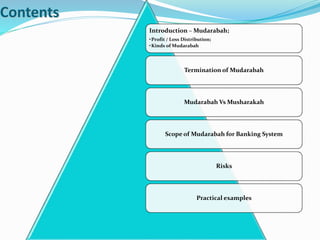

Mudarabah is an Islamic contract where one party provides capital to another party for investing in a commercial enterprise. The capital provider is called rabb-ul-mal and the manager is called mudarib. Profits are shared according to a predetermined ratio, while losses are solely borne by the capital provider except in cases of misconduct or negligence by the mudarib. There are two main types of mudarabah - restricted and unrestricted. The contract can be terminated by either party with notice. Mudarabah is used by Islamic banks to accept deposits and invest funds on behalf of depositors based on profit and loss sharing. However, there are also risks involved for the banks in applying mudarabah.

![Mudarabah – Application (Deposit [Liability] management)

A

POOL MANAGEMENT

Pools according to (1) size of deposit, (2) Tenure

CB

G IH

M ON

S UT

D FE

J LK

P RQ

V XW

Time (tenure)

S

i

z

e

o

f

D

e

p

o

s

i

t](https://image.slidesharecdn.com/presentation11-150613073001-lva1-app6892/85/Presentation1-1-15-320.jpg)