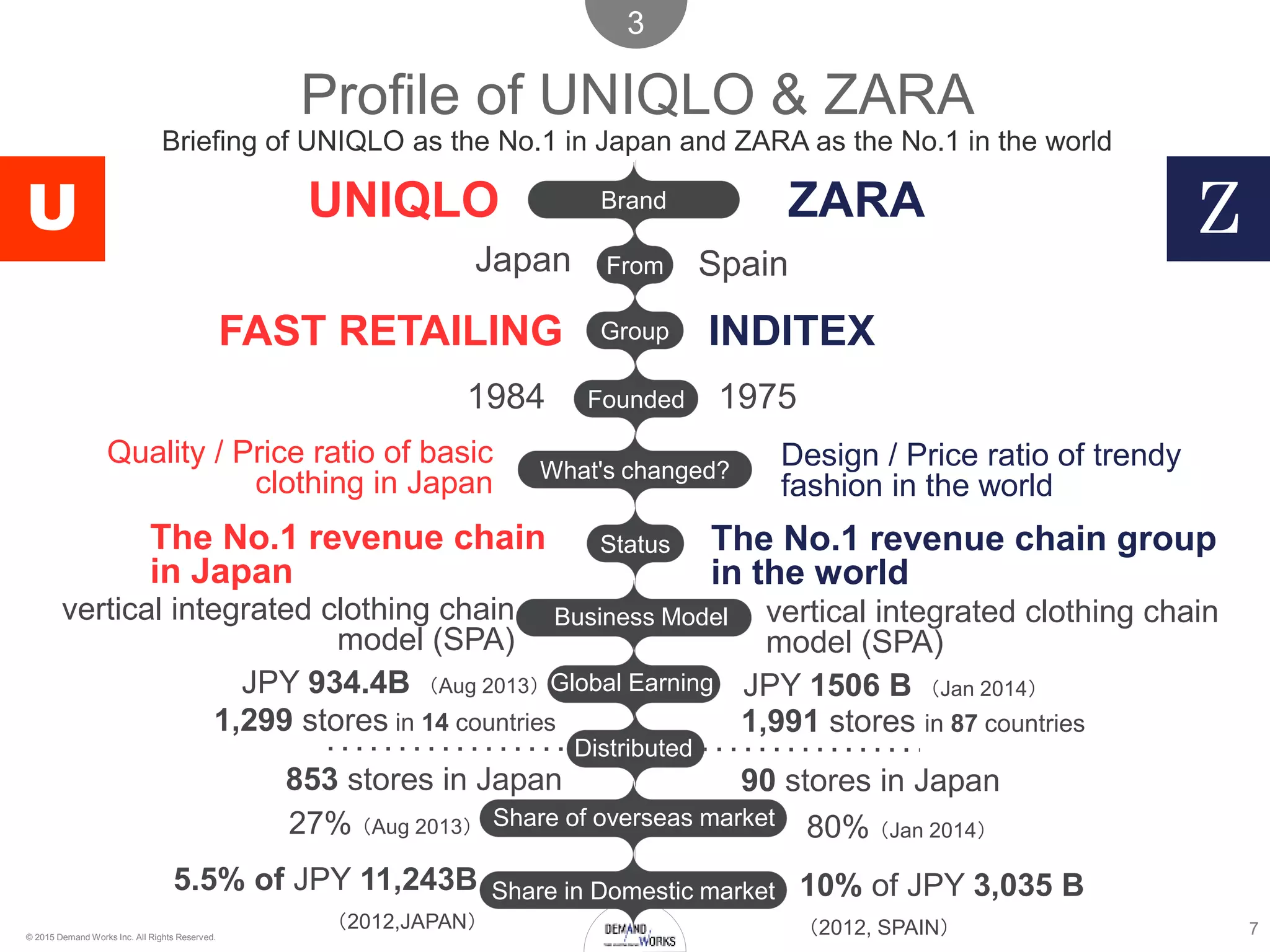

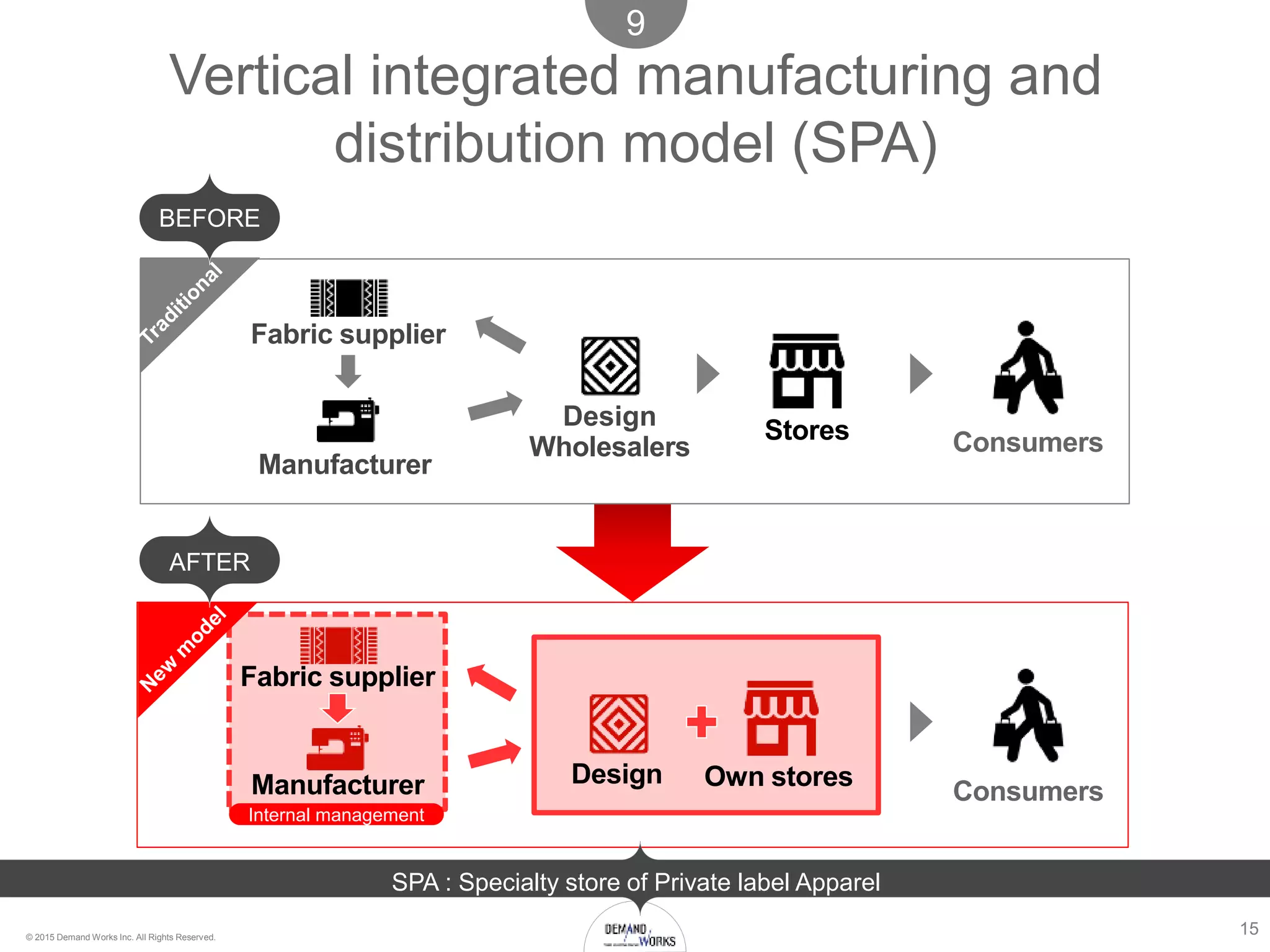

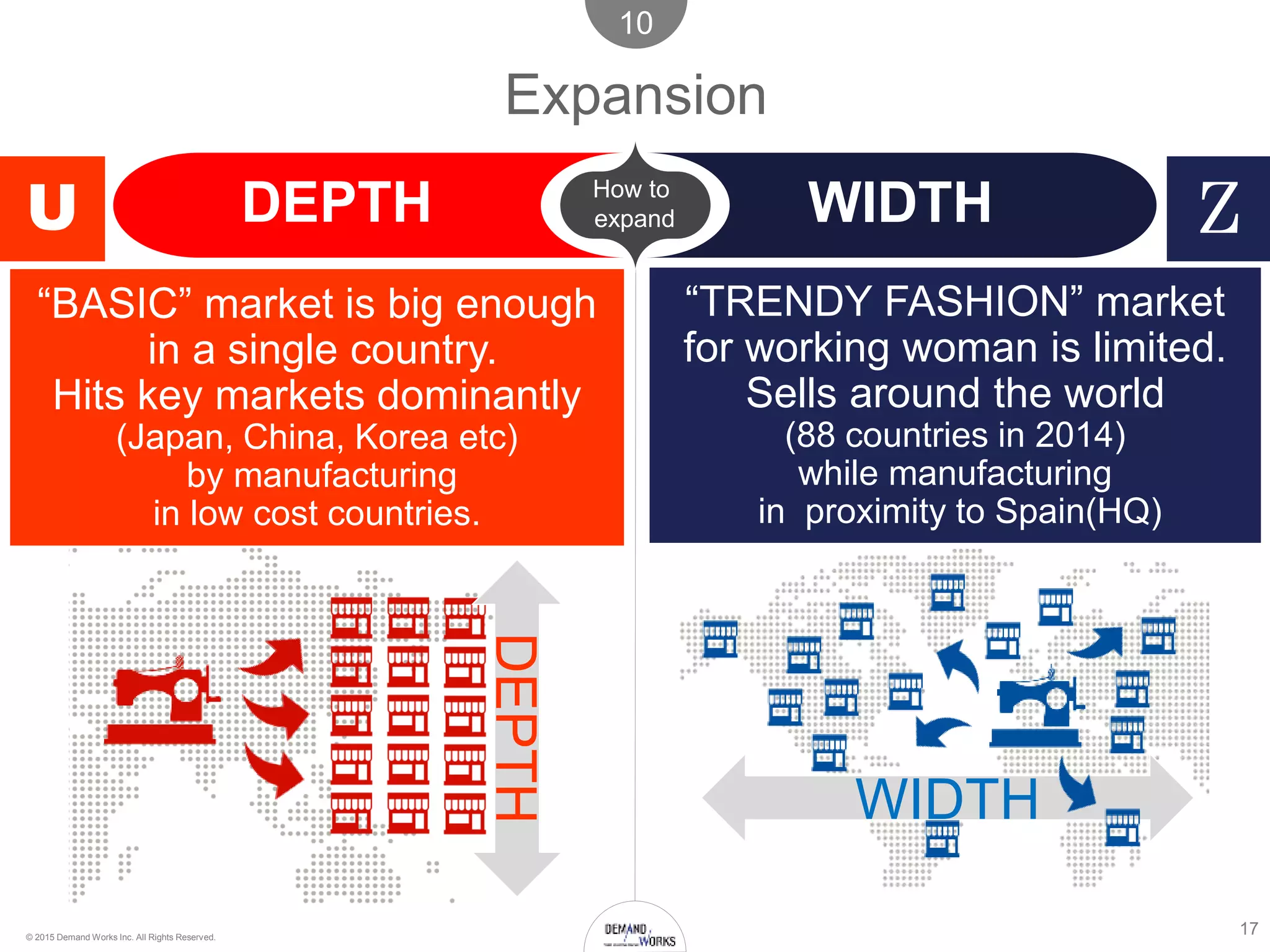

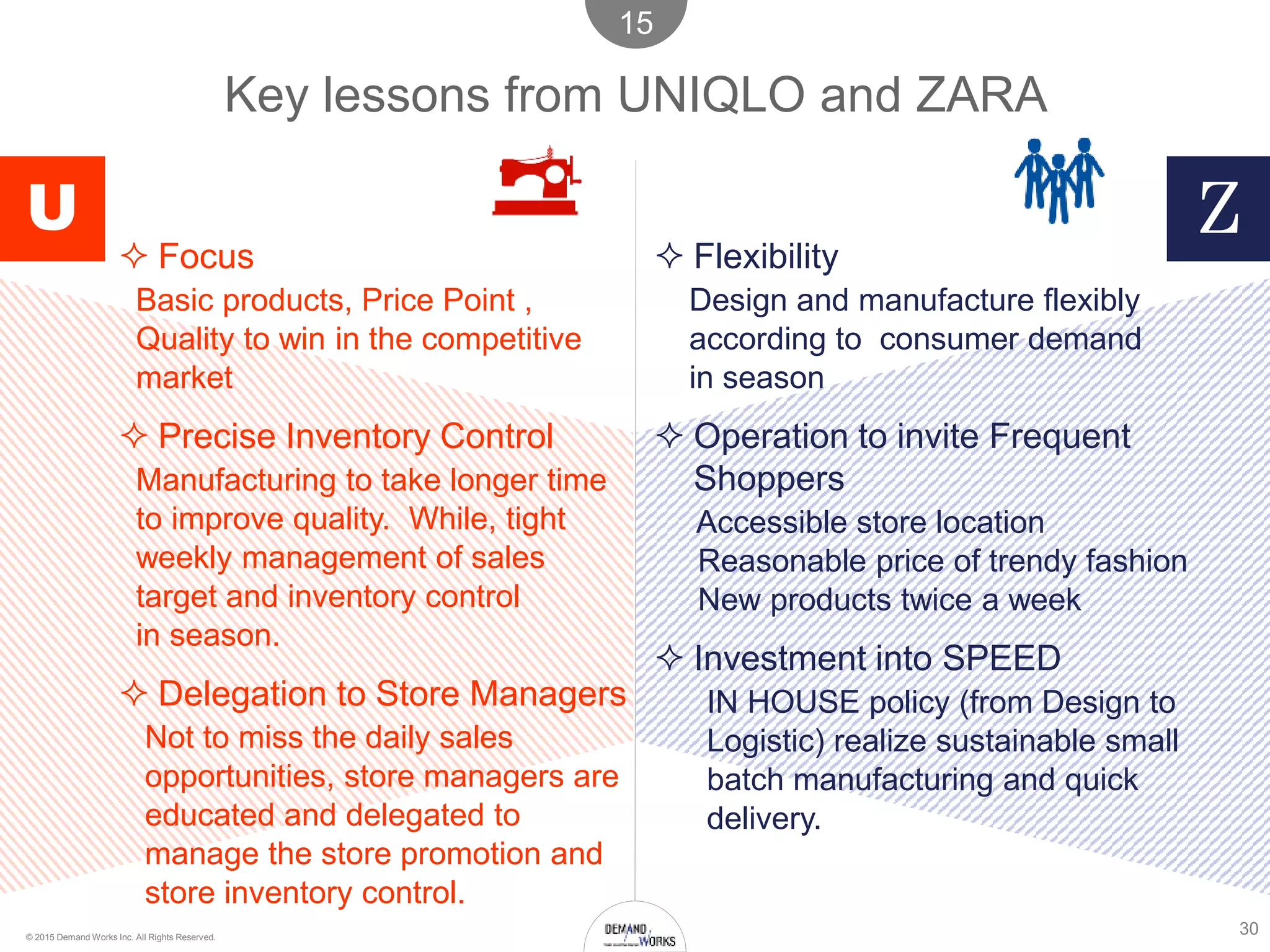

The document compares the business models of Uniqlo and Zara, highlighting their positions as leaders in the global clothing market, with Uniqlo known for its high-quality basics at low prices and Zara for its trendy fashion offerings. It provides insights into their pricing, consumer behavior, market strategies, and operational logistics, demonstrating how both brands have disrupted the traditional retail approach. Additionally, it emphasizes the importance of supply chain management and consumer responsiveness as key factors in their success.