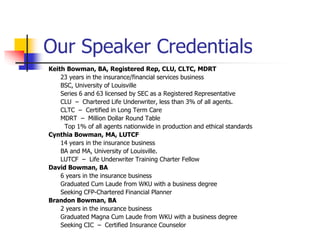

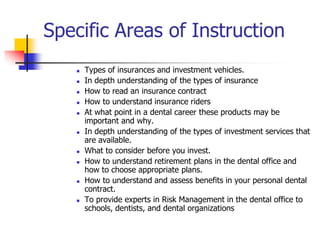

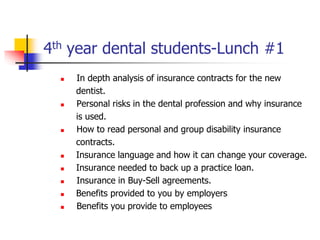

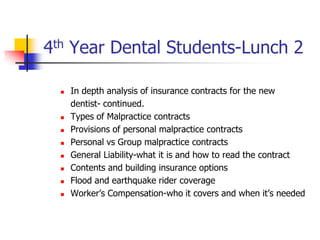

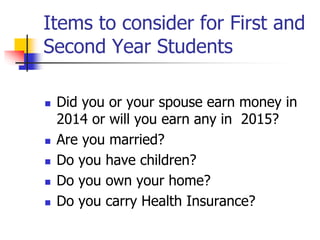

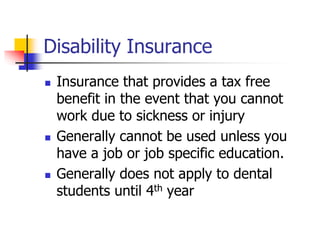

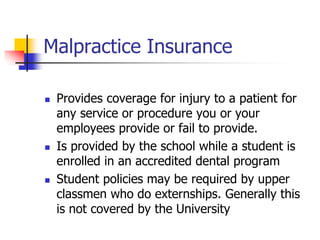

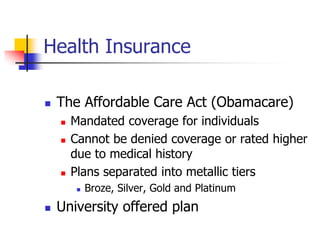

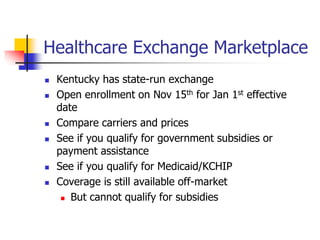

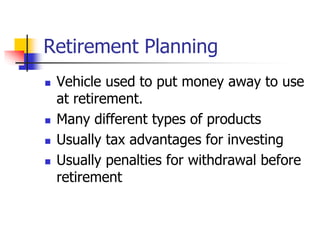

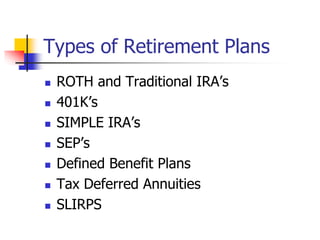

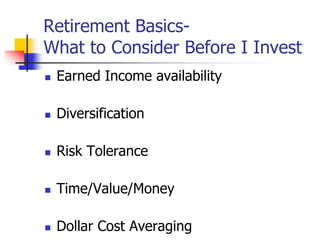

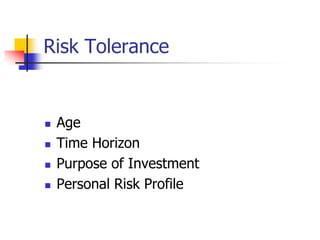

This document provides information about a presentation for 1st and 2nd year dental students on planning for the future. It introduces the four presenters, who have experience in the insurance and financial services industry. The presentation will cover common insurance and investment products students may need during their dental career, including disability, malpractice, health, life, and retirement insurance as well as investment options. It will also discuss factors for students to consider regarding current needs and how these may change over the course of their education and career.