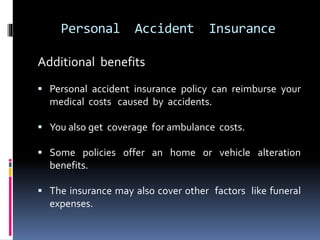

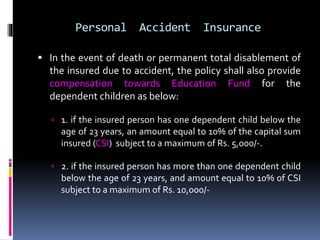

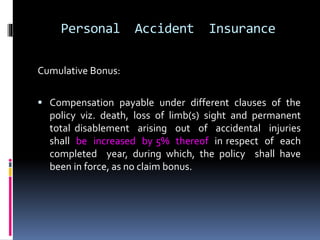

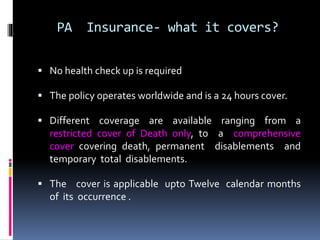

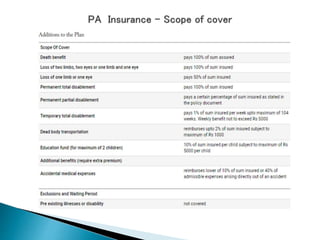

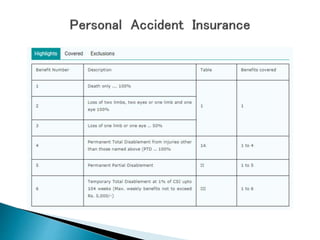

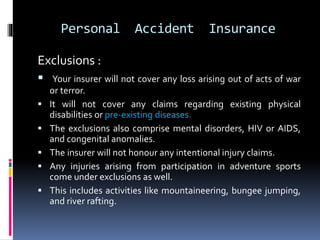

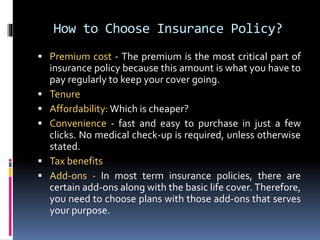

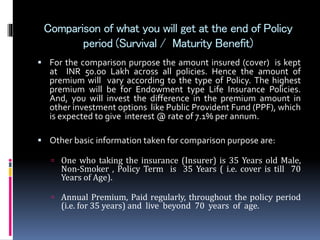

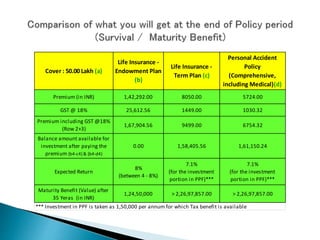

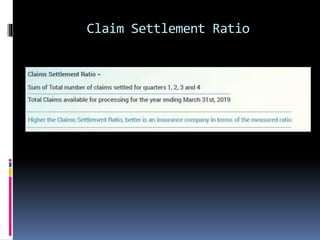

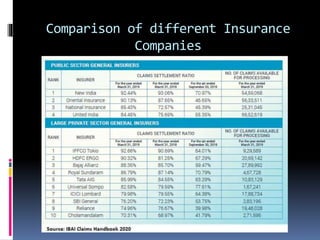

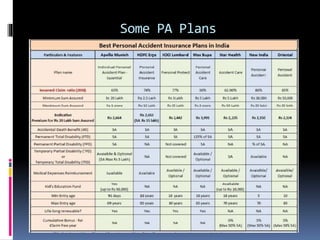

The document discusses the importance of insurance, emphasizing that it acts as a safety net for individuals and their families against life's uncertainties. It outlines different types of insurance, including life insurance, health insurance, and personal accident insurance, detailing their benefits and coverage. The document also provides insights on how to choose the right insurance policy and offers a comparison of various policies based on premium costs and expected returns.