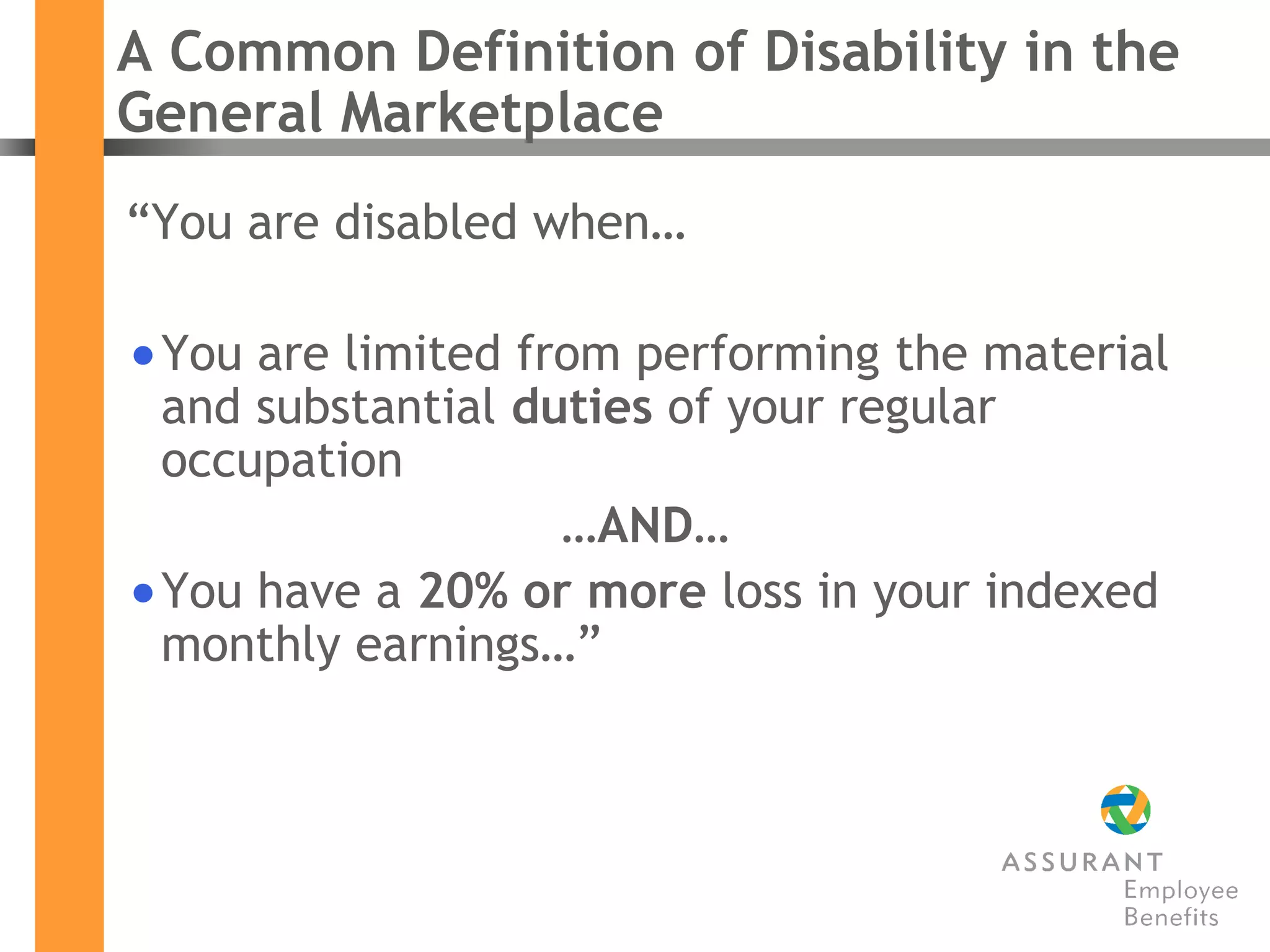

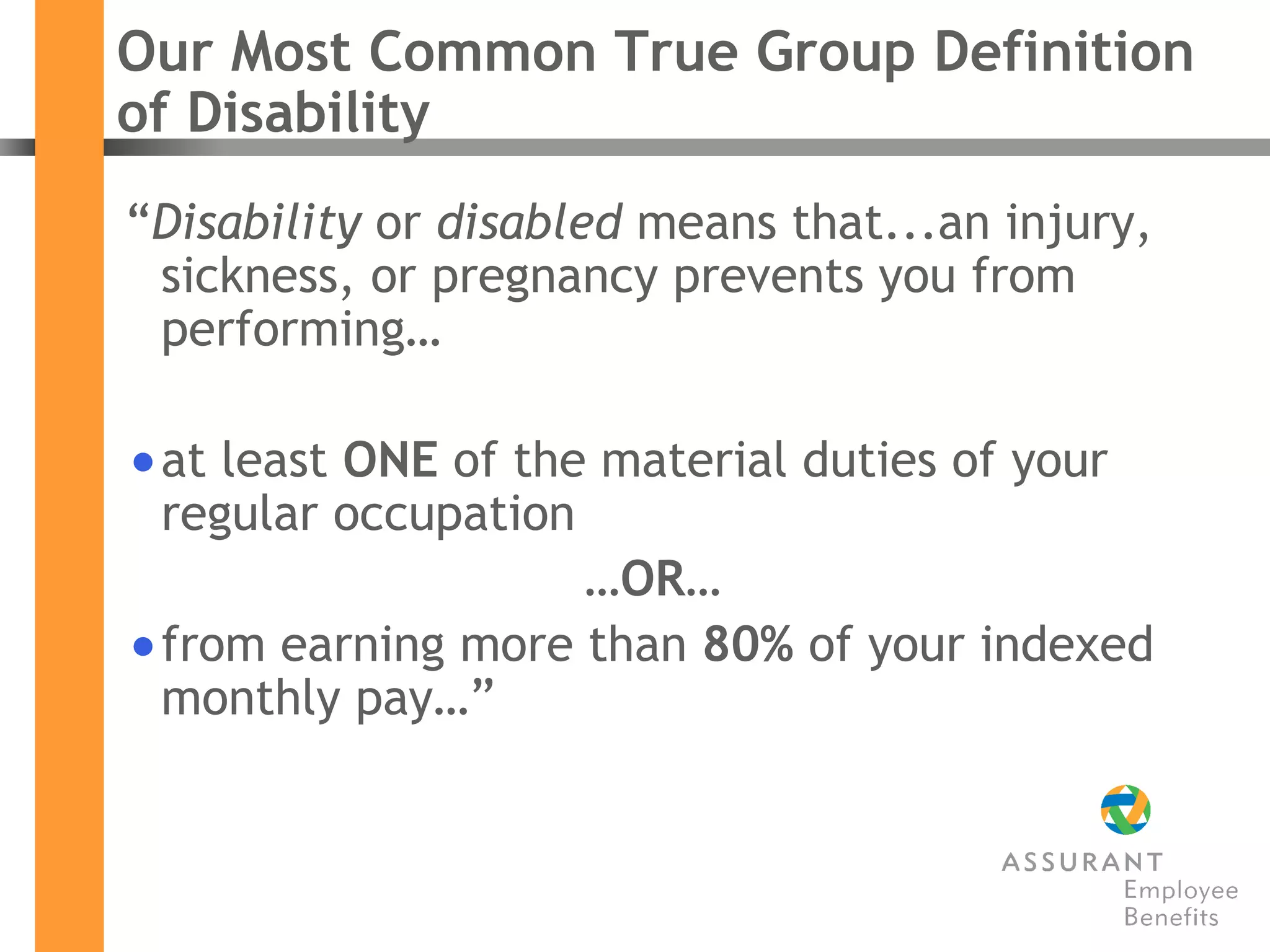

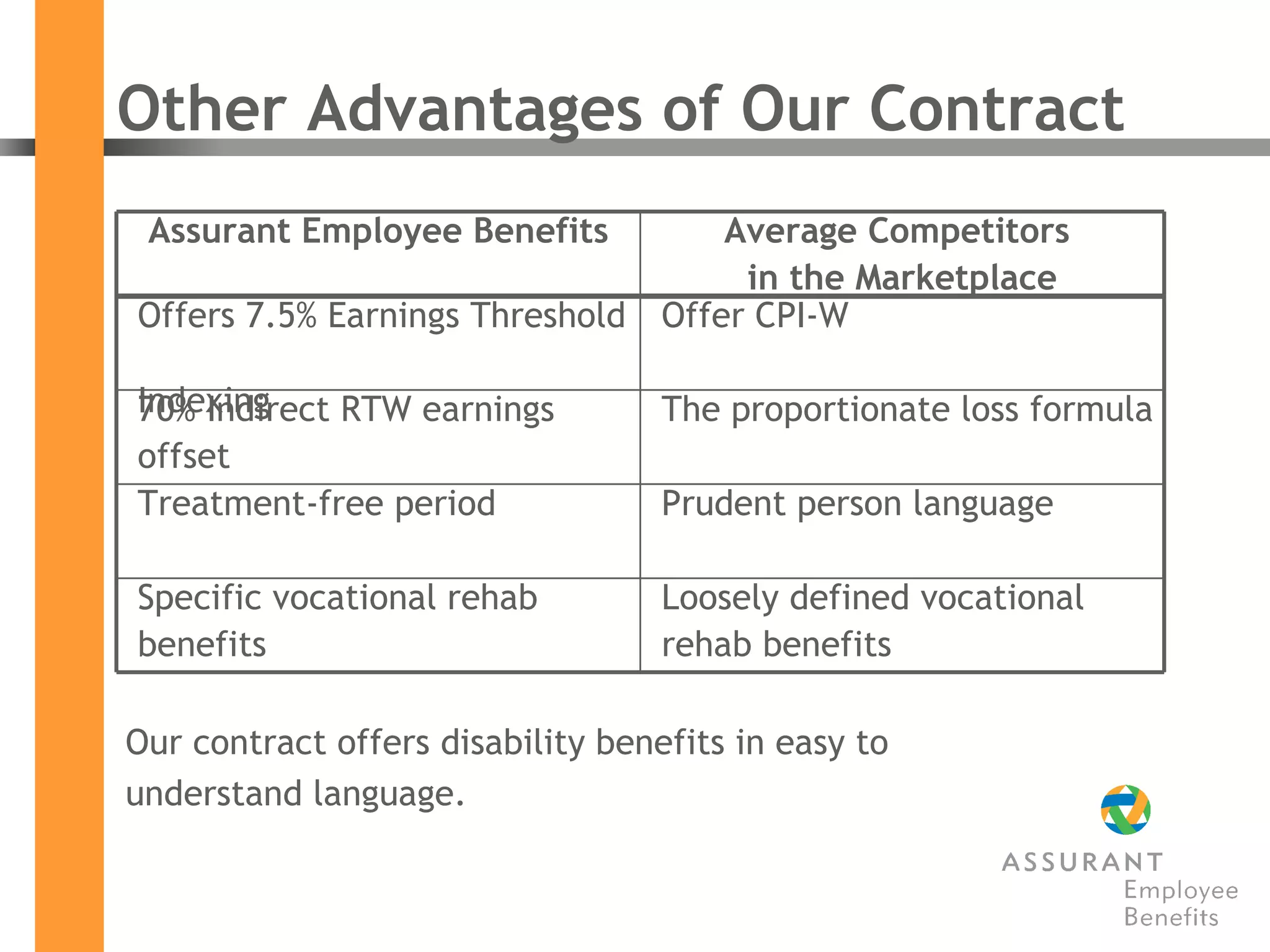

Assurant Employee Benefits offers various disability insurance plans, including their most common true group disability plan. Their definition of disability focuses on the inability to perform one material duty of your regular occupation or earn more than 80% of your monthly pay. They strive to approve legitimate claims promptly through their three disability benefit centers. Their plans also include additional benefits and options to support claimants' financial security and return to work.