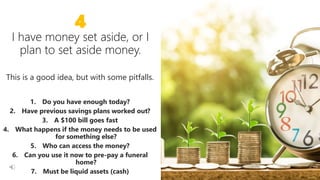

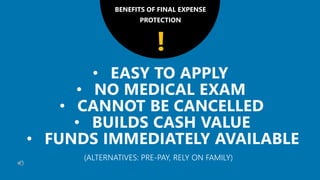

The document discusses the importance of final expense benefit insurance to cover burial, cremation, and additional end-of-life expenses, emphasizing financial planning for unforeseen events. It outlines the benefits, costs, and considerations involved, such as affordability and policy options, as well as the potential impacts on family members. Various factors, including age, health, and the urgency of acquiring coverage, are highlighted as influencing the decision-making process regarding final expenses.

![If I don’t protect the future […] then if we ever

found ourselves in the situation that I found

myself in when I was seven, it would be have

been an unmitigated disaster

—BOOMER ESIASON, former NFL

Quarterback, Forbes Magazine

2](https://image.slidesharecdn.com/finalexpenseforvideo-210804192154/85/Final-Expense-Benefit-Insurance-2-320.jpg)