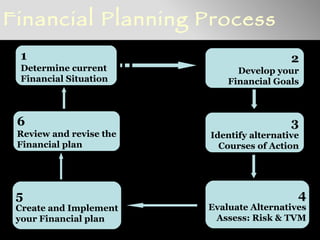

Money Plant Financial Services provides various financial planning services including insurance planning, tax planning, investment planning, retirement planning, and more. It aims to provide optimal financial solutions to individuals. The company represents clients, not any specific fund houses or insurance companies. It assists clients in developing financial goals and implementing financial plans through products like life insurance, health insurance, mutual funds, fixed deposits, bonds, and real estate investments. The document provides details on various financial products and services offered by the company.