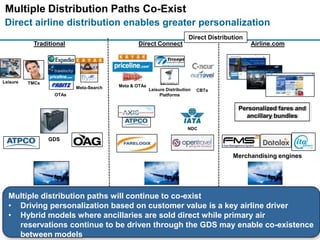

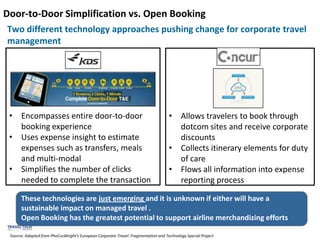

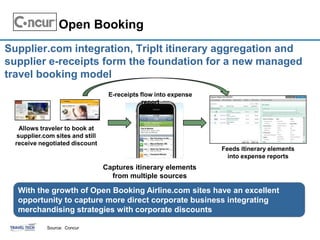

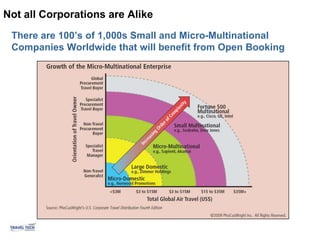

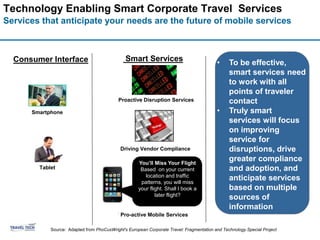

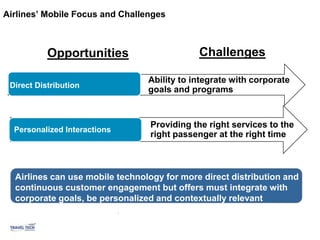

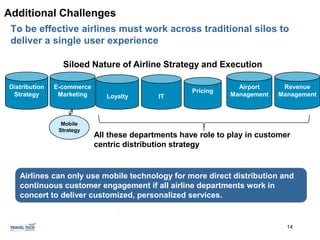

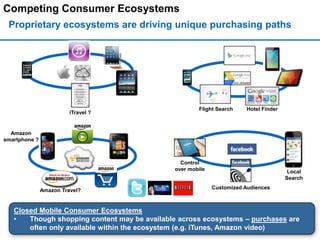

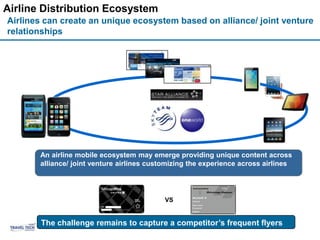

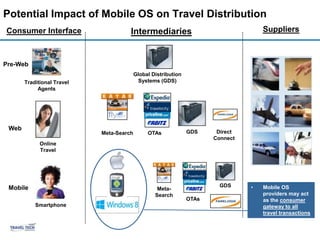

The document discusses the shifting landscape of travel distribution as multiple paths co-exist and mobile becomes the dominant platform. It highlights how corporate travel has been challenging for direct distribution but trends toward open booking will enable booking through airline websites. Airlines must provide consistent customer experiences across departments to capitalize on opportunities in direct distribution and personalized mobile services.