This document discusses lessons learned from transit-oriented development (TOD) projects. Key points include:

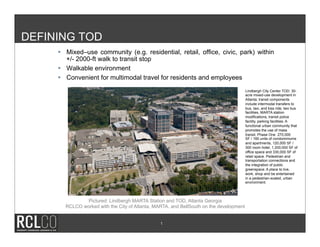

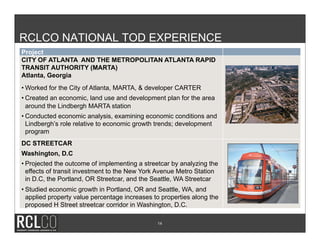

1) TOD projects mix residential, retail, office, and civic uses within a half-mile of transit to promote walkability and transit usage. The Lindbergh City Center project in Atlanta is provided as an example.

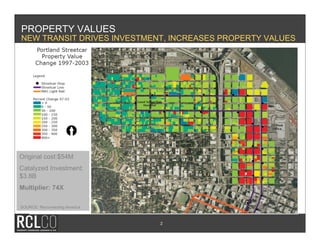

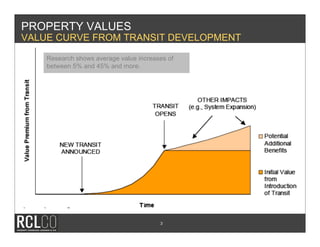

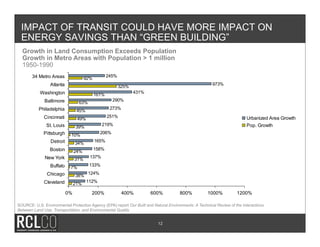

2) New transit investments can significantly increase surrounding property values, with research showing average increases of 5-45%.

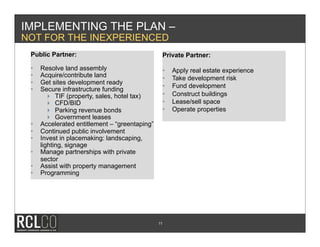

3) TOD projects face challenges including assembling land from multiple owners, high development costs, and community opposition to density. Long-term collaboration between public and private partners is important for success.

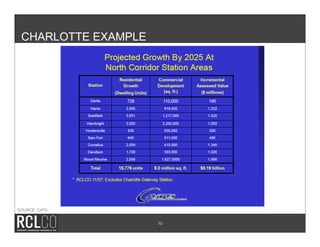

4) Case studies from Charlotte provide lessons on defining market opportunities