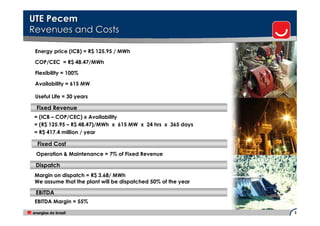

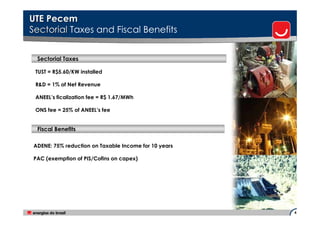

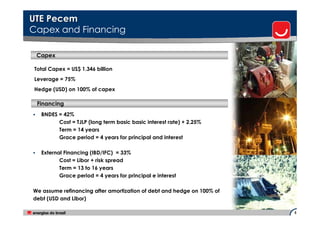

This presentation provides an overview and financial analysis of the UTE Pecém power plant project in Brazil. It outlines key assumptions used in the analysis, including an energy price of R$125.95/MWh, availability of 615MW, and a 30-year useful life. It estimates annual fixed revenue of R$417.4 million and fixed costs of 7% of revenue for operation and maintenance. It also discusses sectoral taxes, fiscal benefits, a capital expenditure of US$1.346 billion to be financed with 75% leverage, and debt terms.