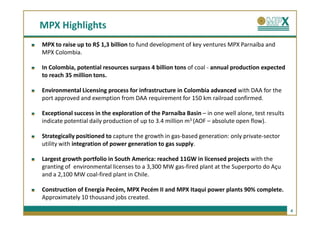

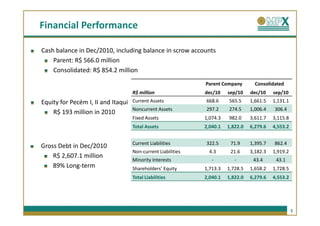

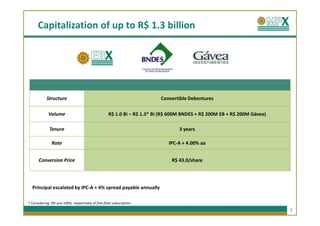

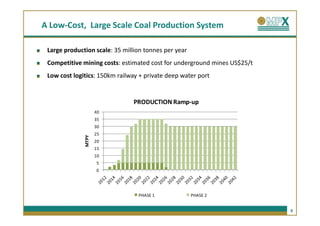

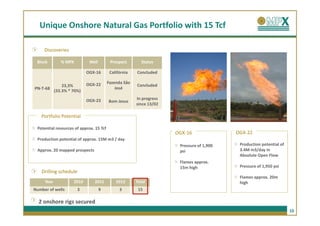

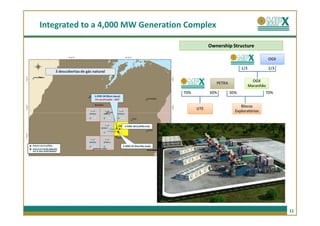

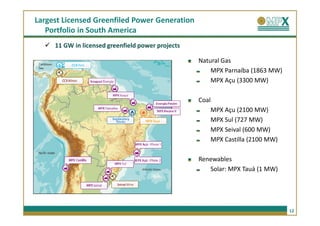

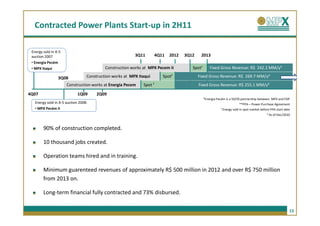

MPX reported strong 4Q10 results and outlined its growth strategy for 2011. It raised up to R$1.3 billion to fund key ventures in natural gas exploration and coal mining in Colombia. Construction of three power plants in Brazil, totaling 1,445 MW, is 90% complete with startups expected in 2H11 and 1H12. MPX has the largest licensed greenfield power portfolio in South America at 11 GW across various fuel sources and countries.