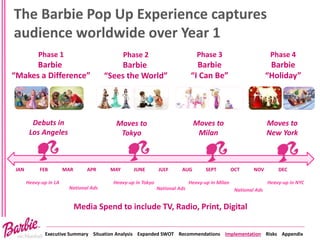

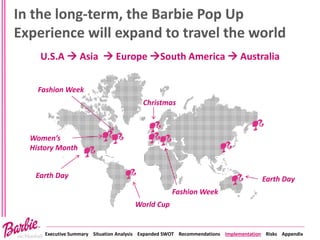

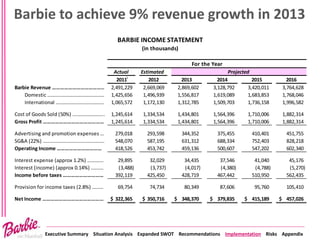

The recommendations are to launch a Barbie "Pop-Up Experience" in 4 cities starting in 2013, and expand digitally. The pop-up will have interactive simulations and limited edition dolls to generate buzz. A gaming website will develop online games featuring Barbie backstories to facilitate a seamless brand experience and engage a broader age range. The goals are 9% total growth by 2013, with international growth outpacing domestic to have international revenues exceed domestic by 2015.