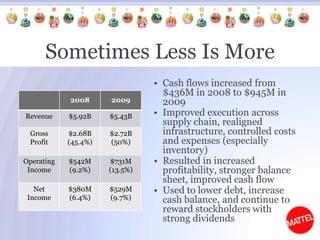

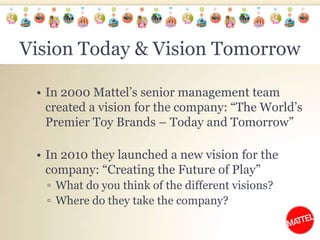

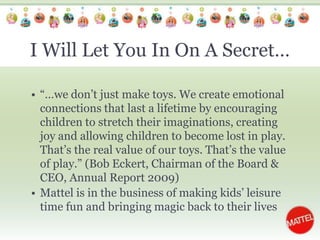

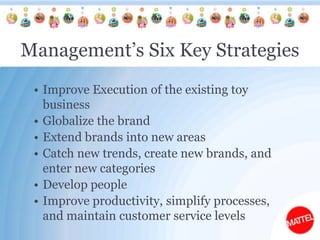

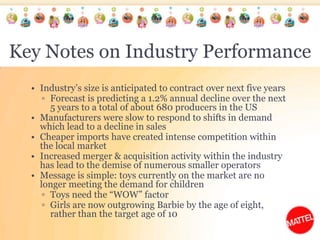

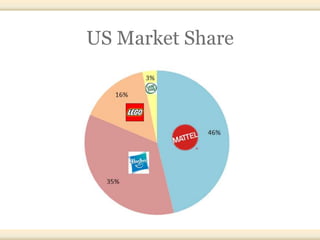

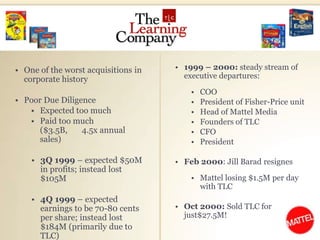

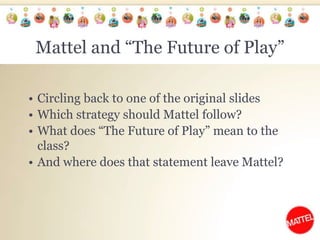

Founded in 1945, Mattel became a publicly traded company in 1960 known for iconic brands like Barbie and Hot Wheels. In the late 1990s and 2000s, Mattel struggled financially and competitively but was able to turn things around in the late 2000s by improving operations and focusing on core brands. Today, Mattel aims to create the future of play through innovation while maintaining its position as a leader in the toy industry.