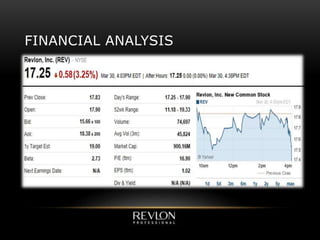

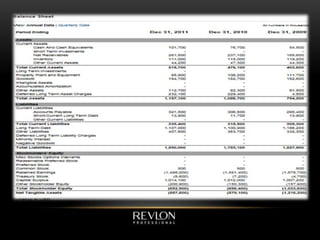

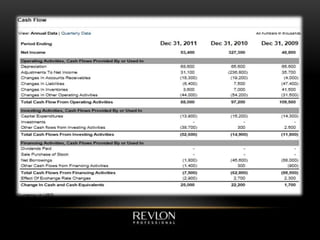

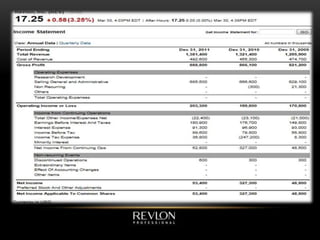

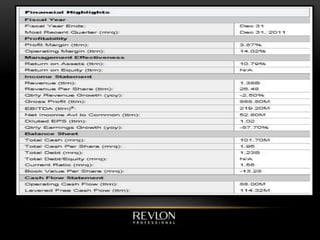

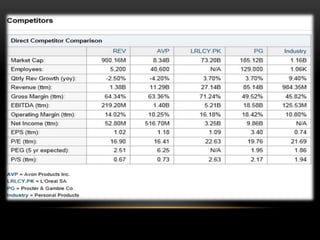

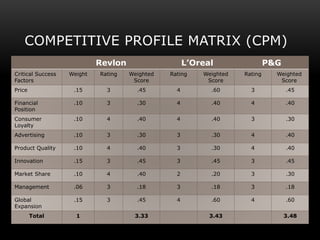

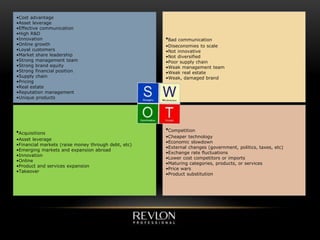

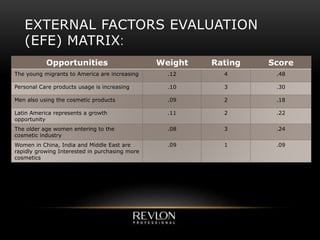

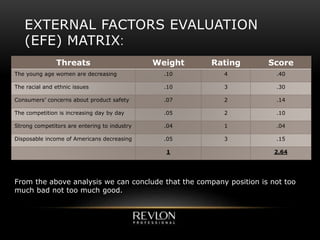

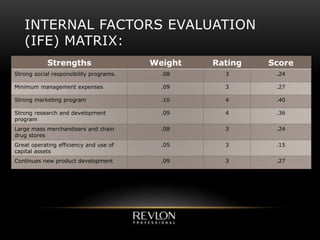

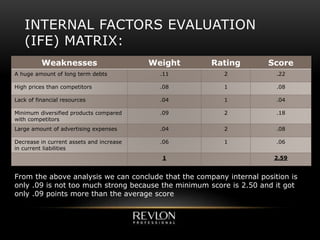

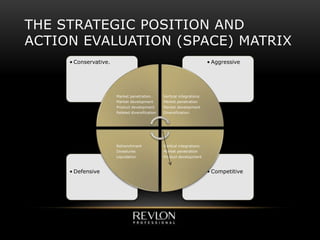

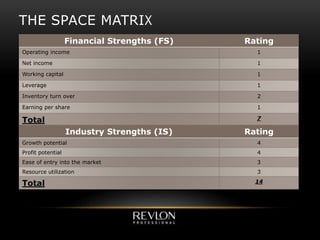

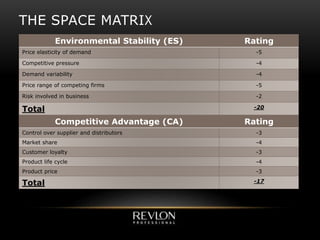

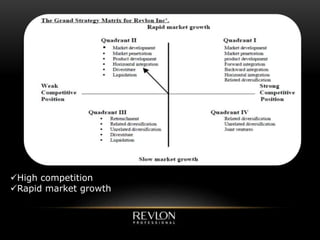

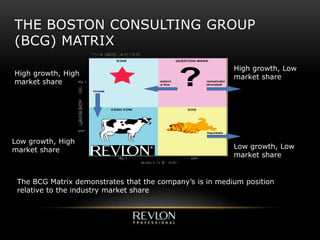

The document analyzed Revlon, a cosmetics company founded in 1932. It discussed Revlon's history, products, mission, vision, objectives. It then performed external and internal analysis using tools like SWOT, EFE, IFE, CPM, SPACE and BCG matrices. The analyses found Revlon in a weak competitive position against strong rivals. It recommended strategies like market development, penetration, product development, integration and divestiture to improve Revlon's financial position and competitiveness. Failing that, liquidation was the last option.