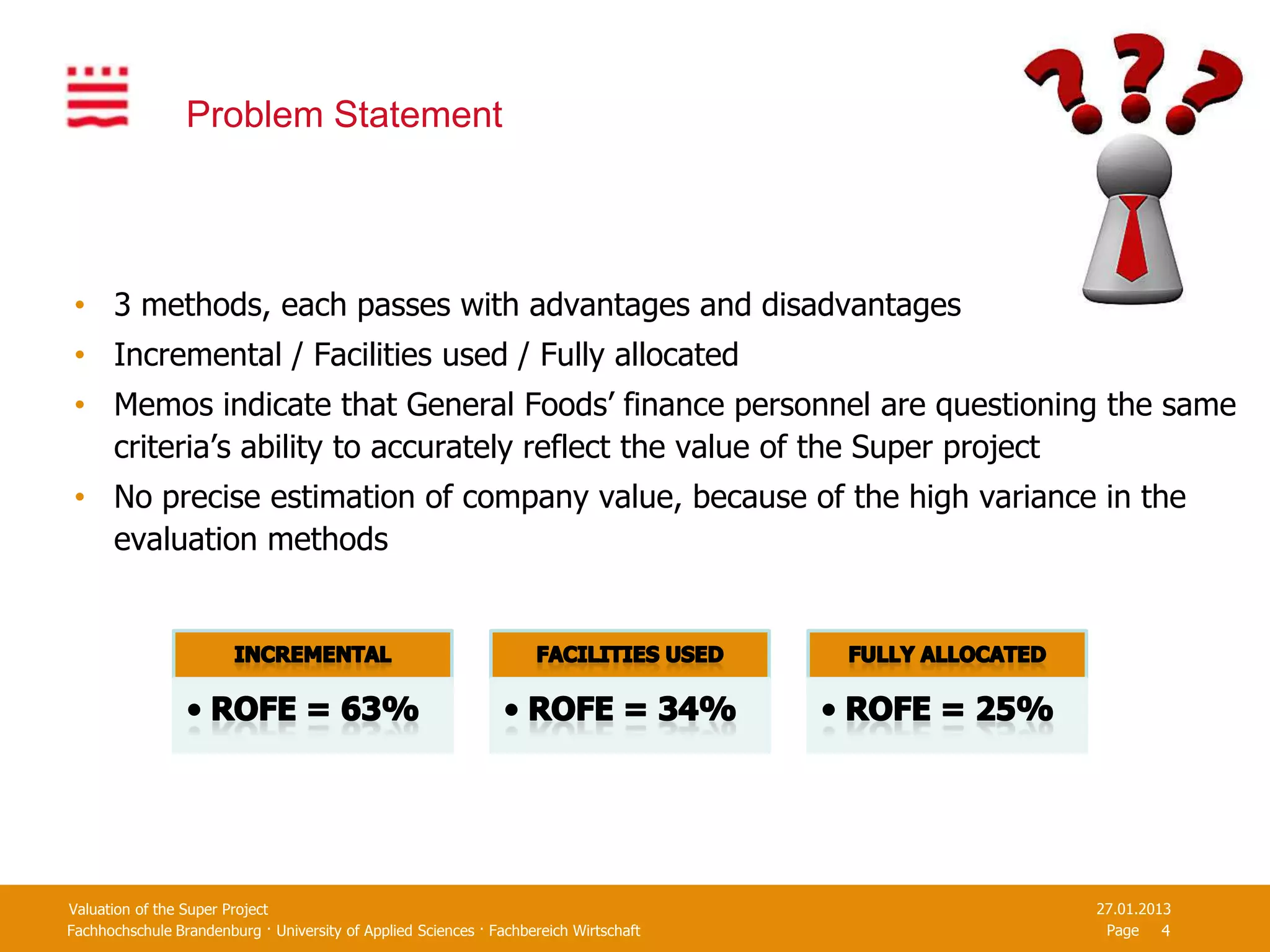

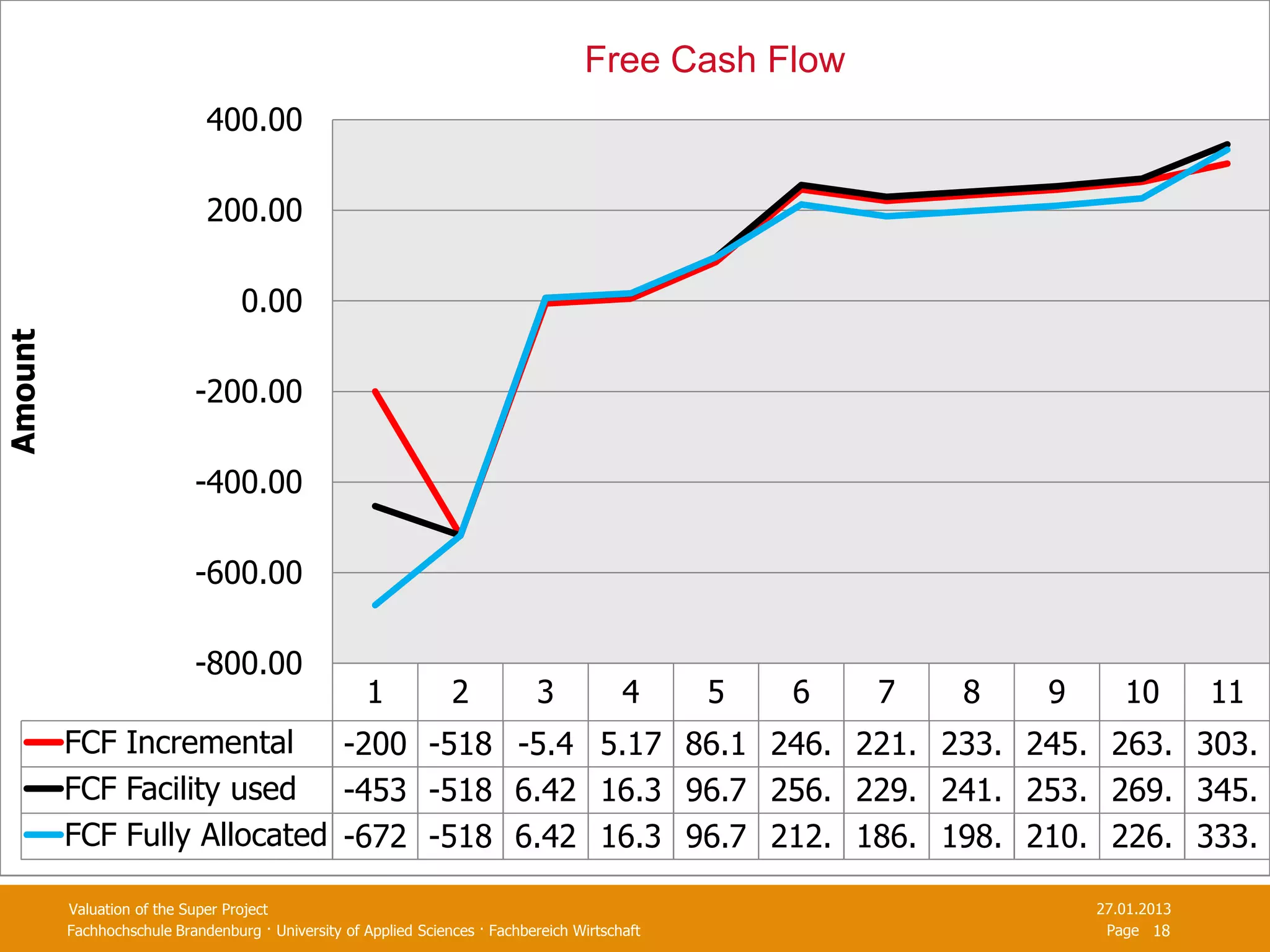

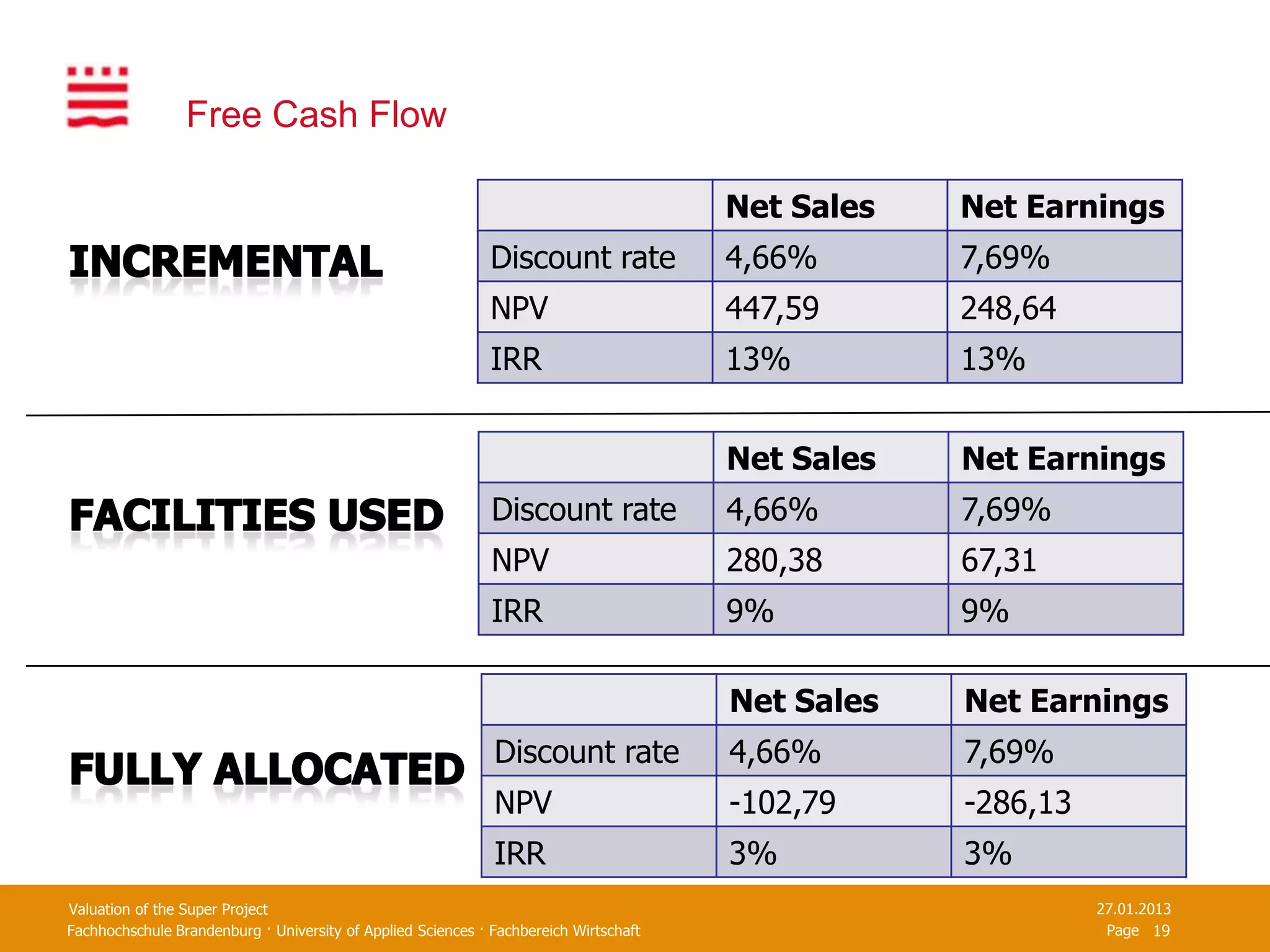

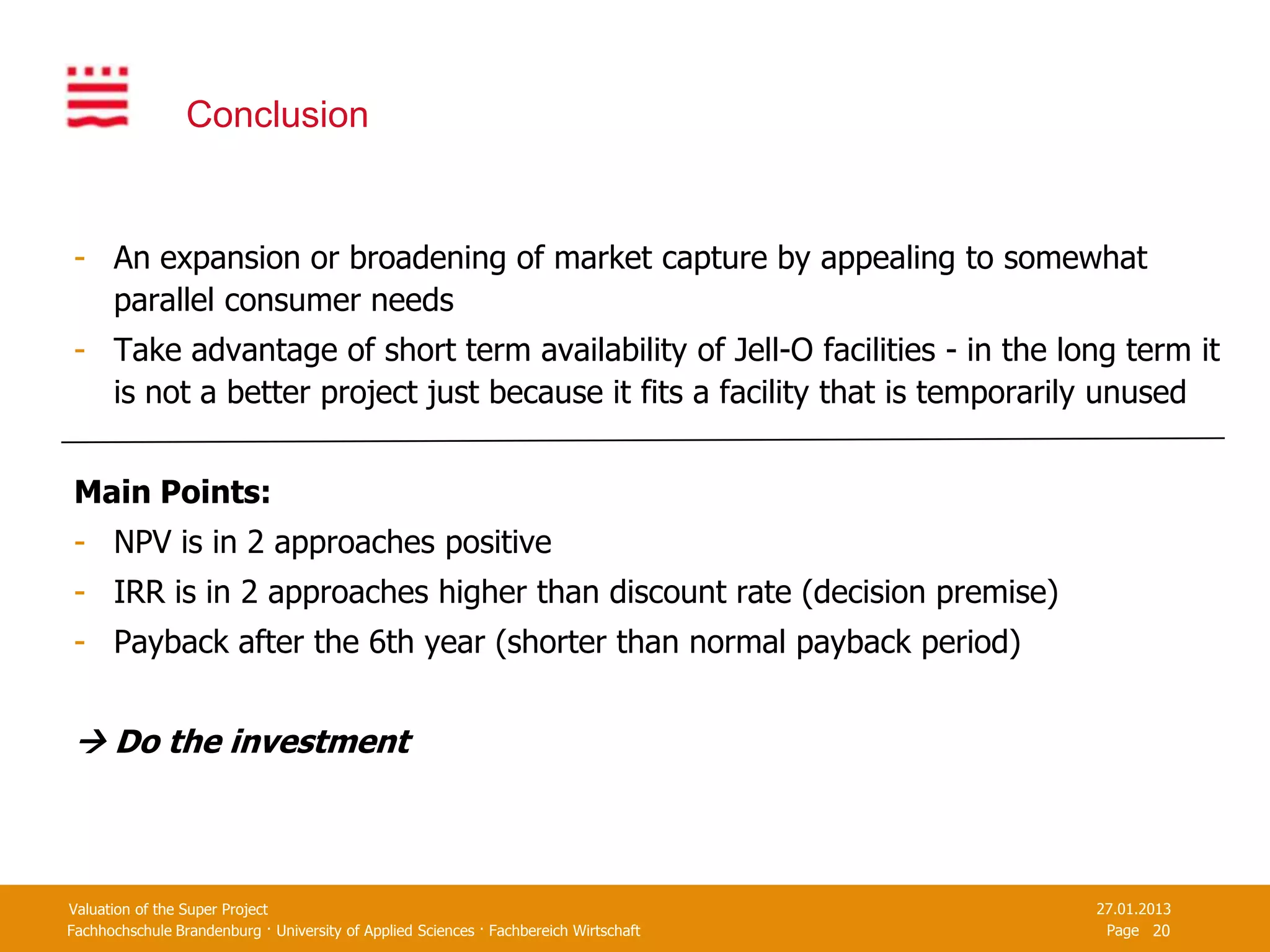

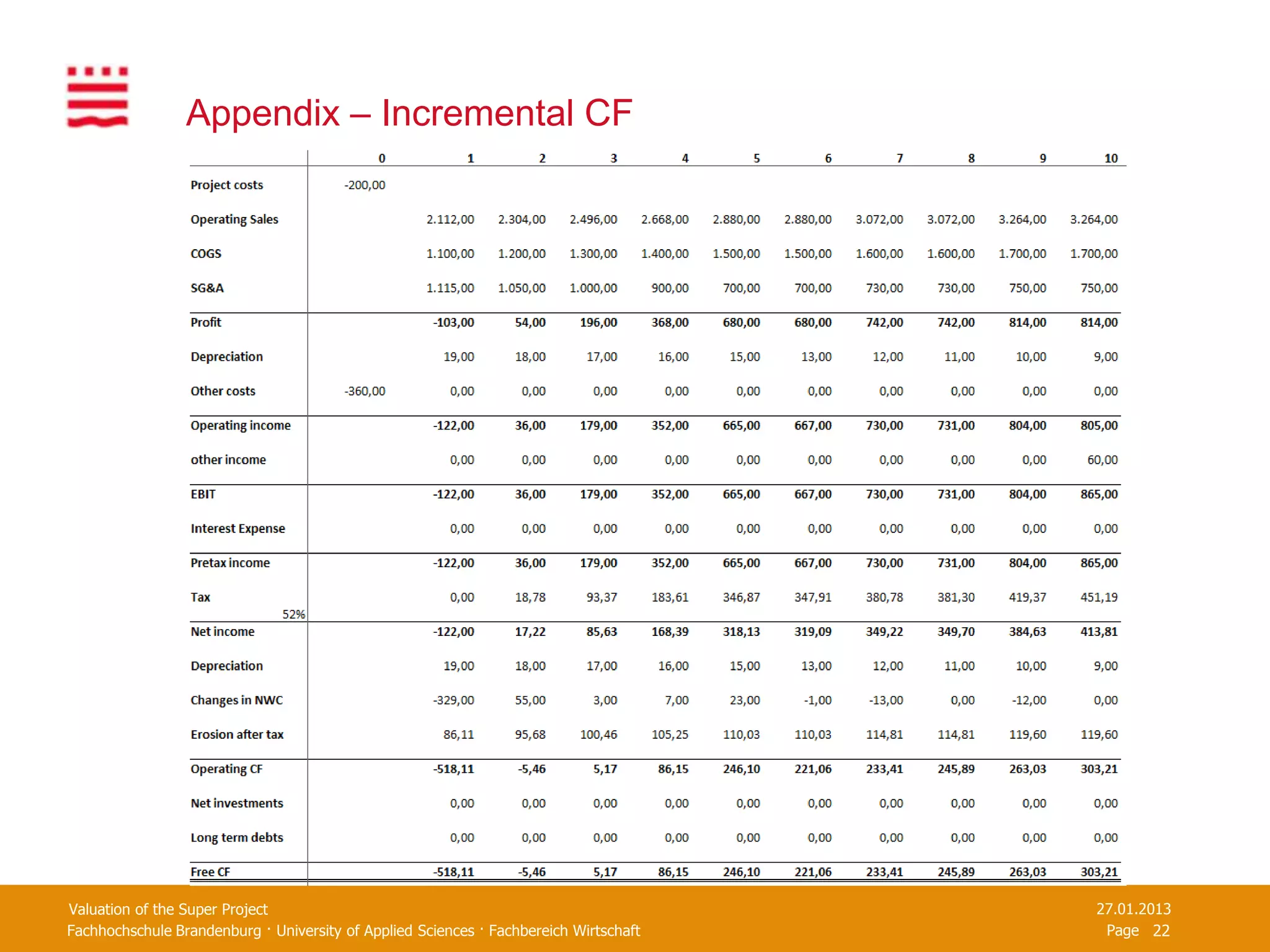

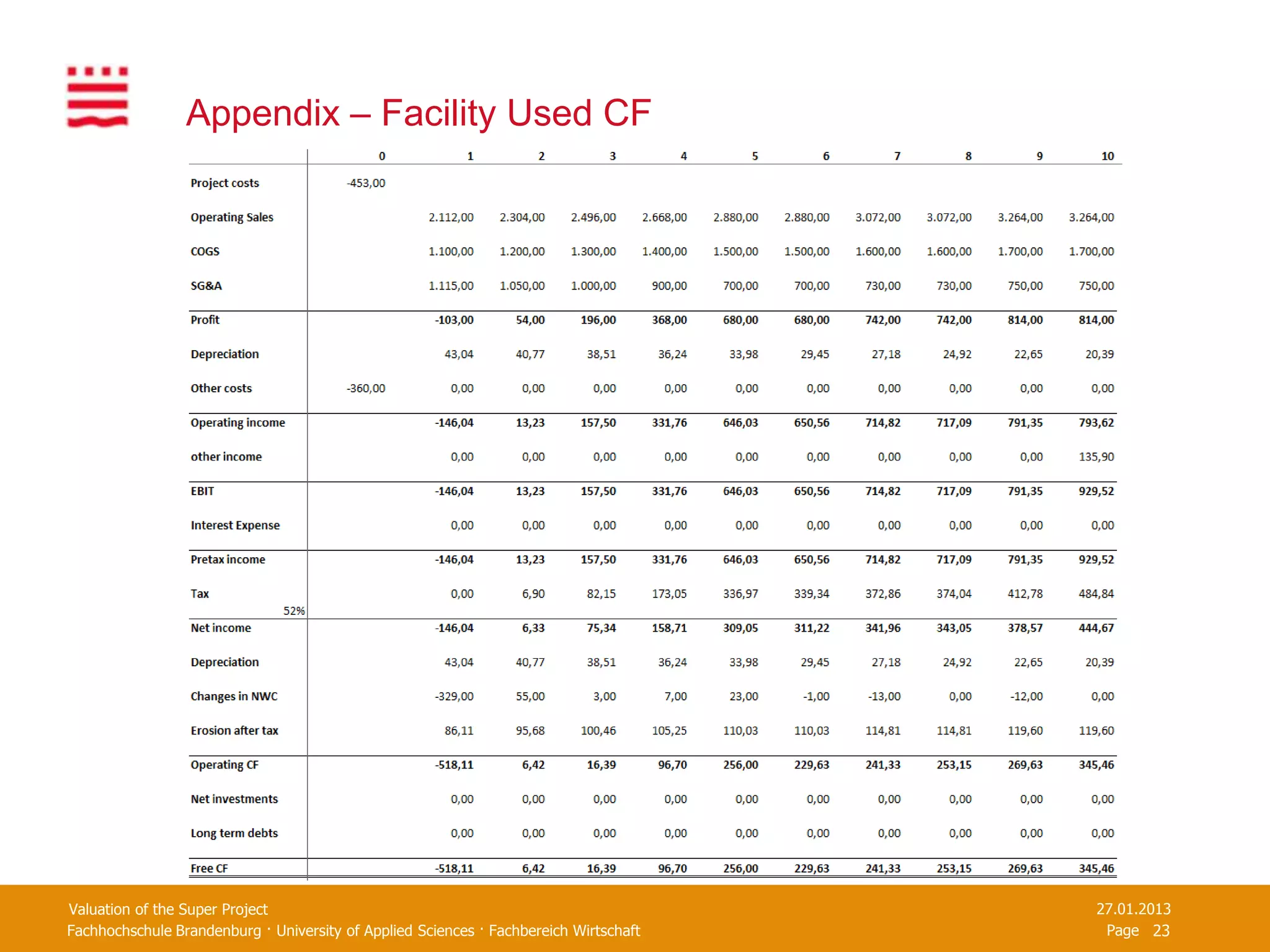

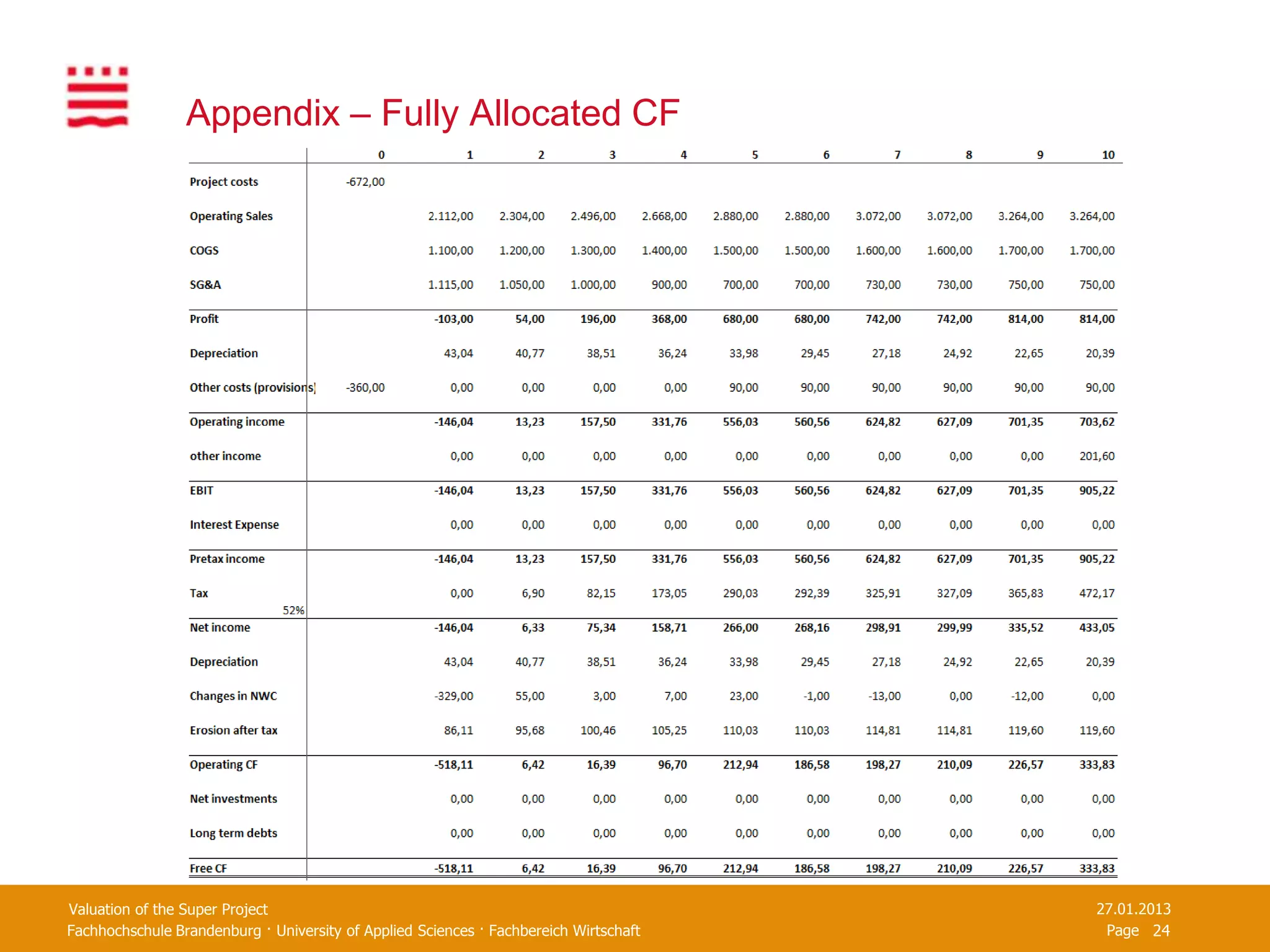

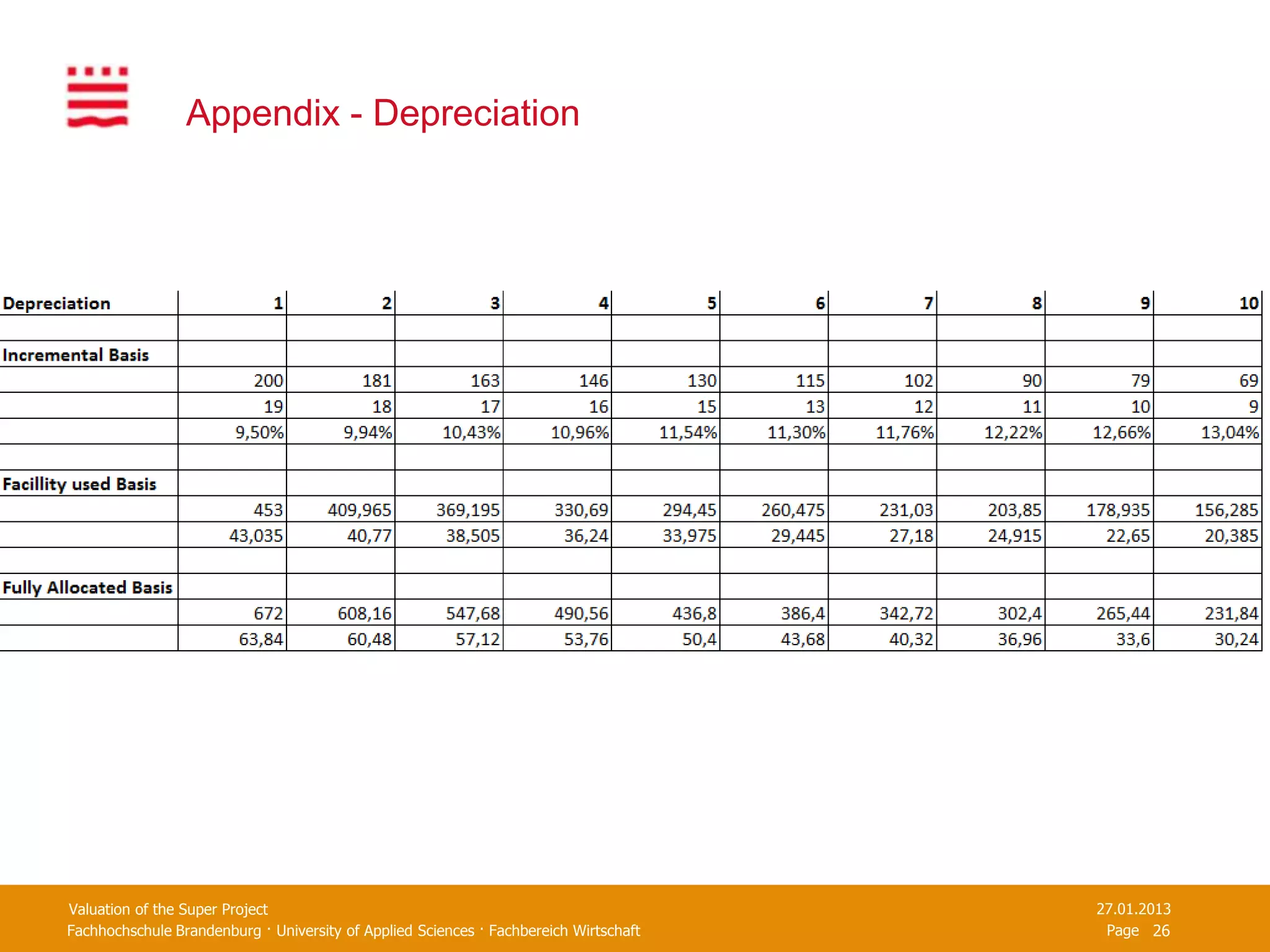

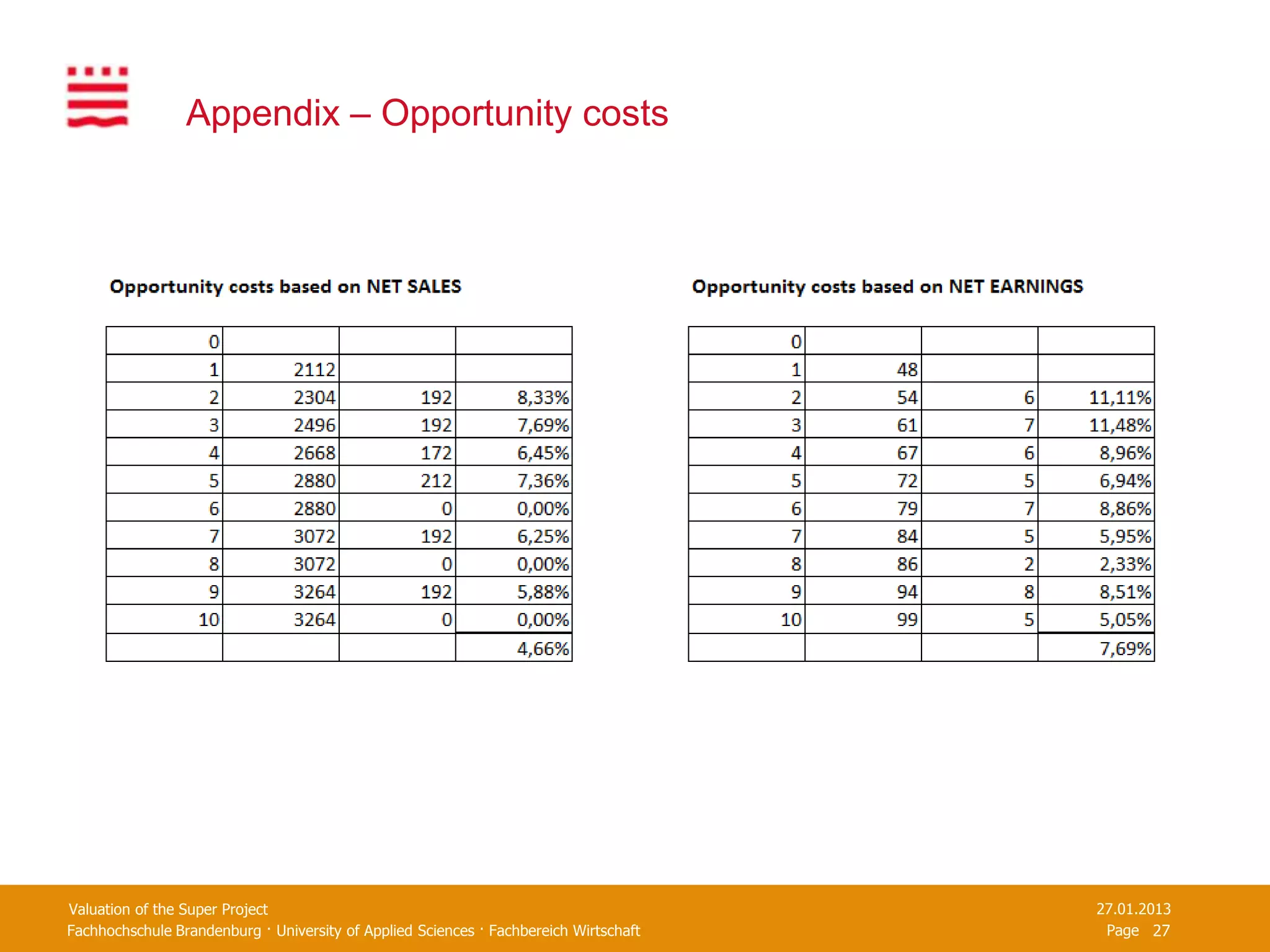

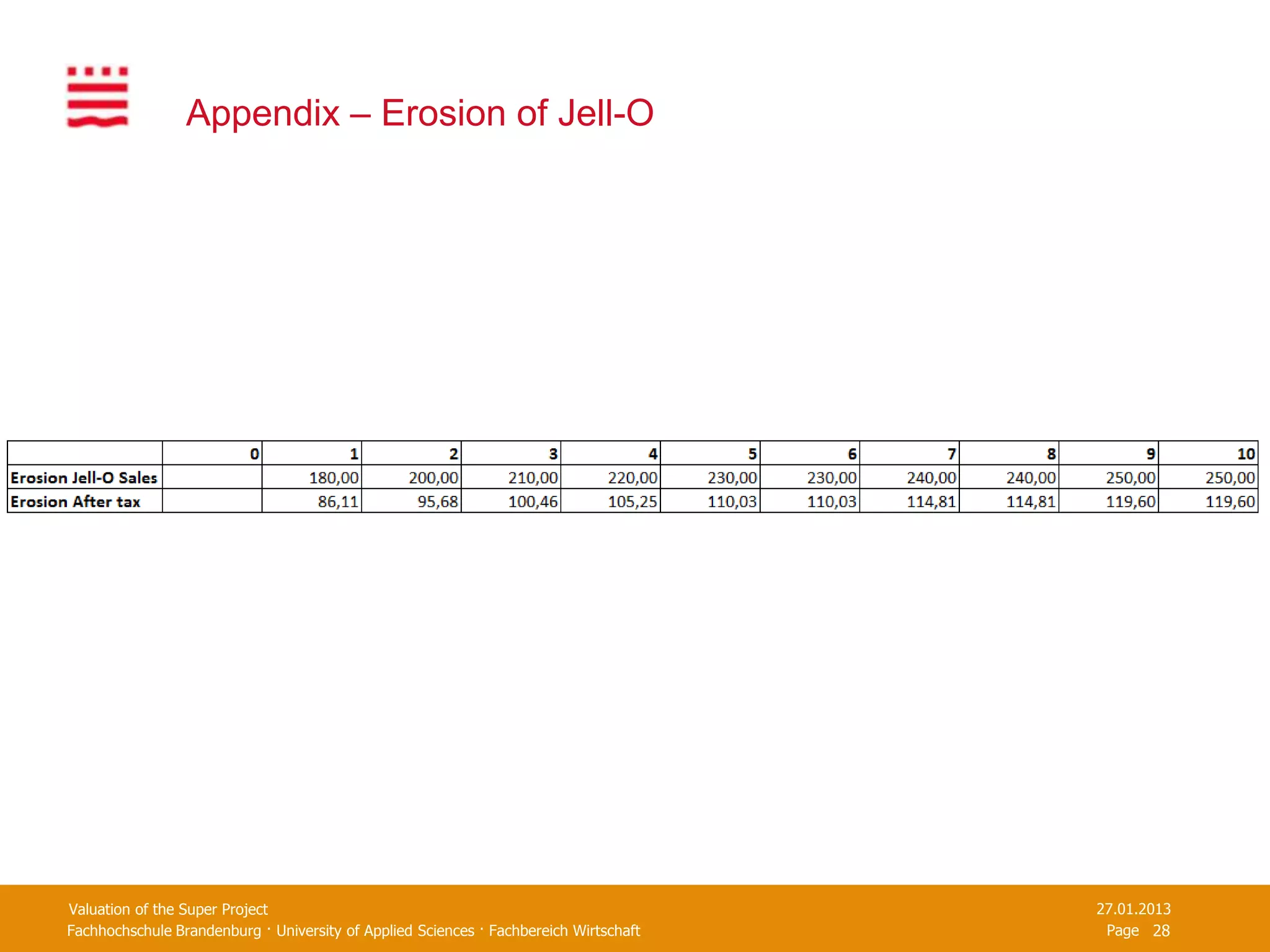

The document summarizes the valuation of the Super Project being considered by General Foods. It identifies three methods used by General Foods to evaluate projects - incremental, facilities used, and fully allocated - each with advantages and disadvantages. The document recommends evaluating the Super Project using an incremental cash flow analysis that accounts for relevant cash flows and avoids non-cash expenses. It concludes the Super Project has a positive NPV and IRR above the discount rate under two of the three methods, so the investment should be undertaken.