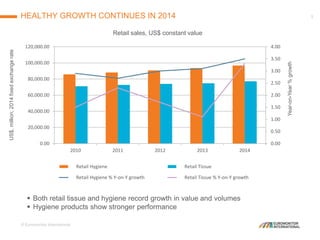

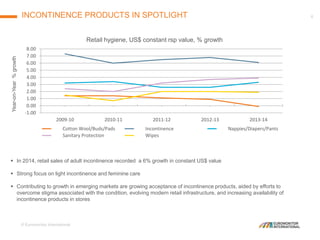

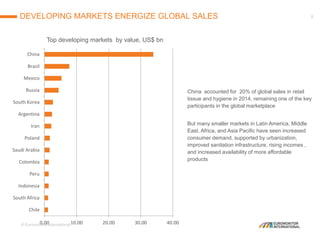

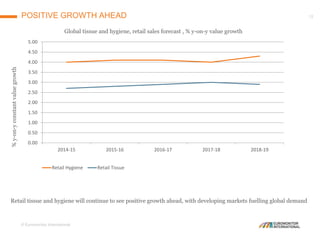

The global tissue and hygiene market reached US$174 billion in 2014, with notable growth in both retail tissue and hygiene products. Adult incontinence products specifically recorded a 6% growth due to increased acceptance and availability in emerging markets. The outlook remains positive, especially in developing regions, which are driving demand and contributing to the overall market expansion.