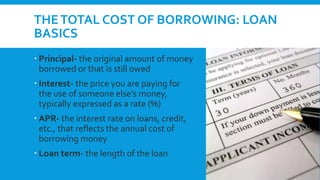

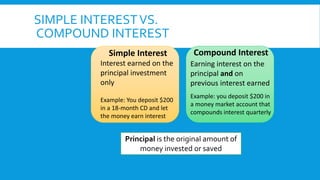

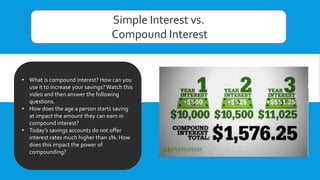

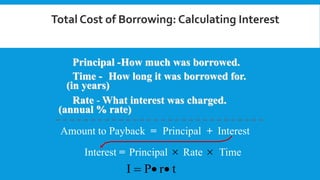

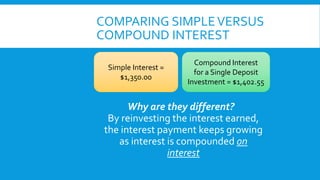

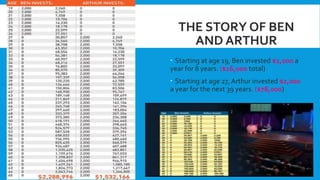

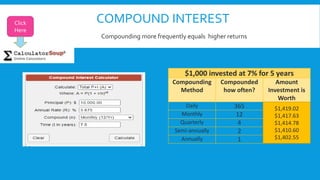

This document discusses the power of compound interest for savings and investments. It explains that compound interest is earned on both the principal amount and accumulated interest over time. This leads to much higher returns compared to simple interest, where interest is only earned on the principal. The document uses online calculators and examples to demonstrate how factors like investment amounts, interest rates, and length of time impact compound growth. It emphasizes that starting investments earlier and allowing interest to compound more frequently can significantly increase the total accumulated value of savings and retirement accounts.

![SAVING AND

INVESTING

TARGET

EXPLAIN HOW SAVINGS AND

INVESTING CONTRIBUTETO

FINANCIALWELL-BEING,

BUILDING WEALTH, AND HELPING

MEET PERSONAL FINANCIAL

GOALS

USEAN ONLINECOMPOUND INTEREST

CALCULATORTO CALCULATETHETOTAL

AMOUNTAN INDIVIDUALWOULD HAVE IN A

SAVINGSOR RETIREMENT ACCOUNT

IDENTIFYWHAT FACTORS IMPACT

COMPOUNDING AND HOW

EXPLAIN WHY COMPOUNDING CAN BE A

POWERFUL SAVINGAND INVESTING

STRATEGY

Meet short-term

goals

Keep funds secure

while growing

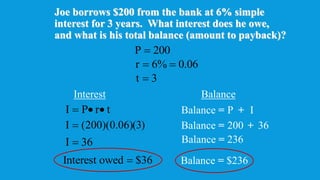

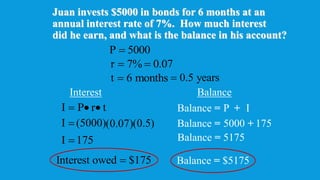

Simple interest

Plan for long-term goals

like retirement

More risk for more return

on an investment

Compound interest-

interest on initial principal

and all accumulated

interest

(I = P [(1 + i)n -1]](https://image.slidesharecdn.com/interest-211028161432/75/Interest-1-2048.jpg)