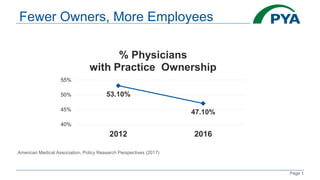

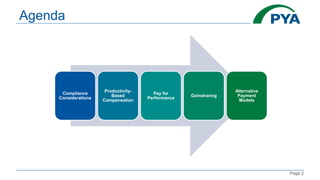

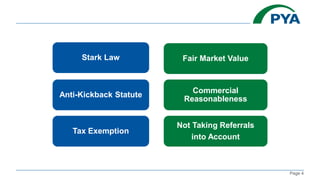

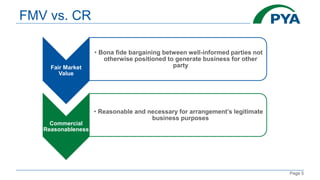

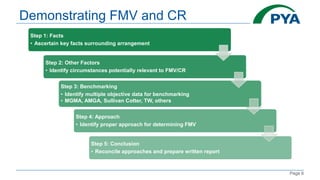

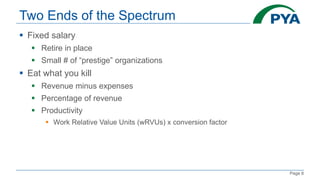

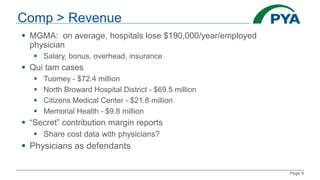

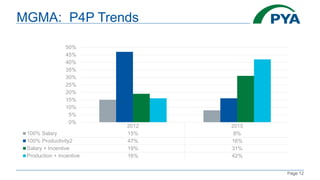

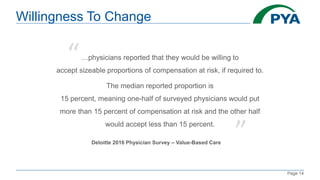

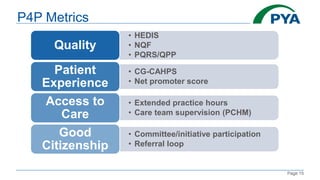

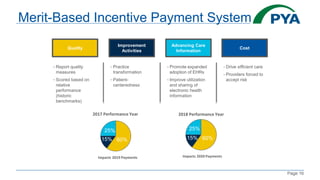

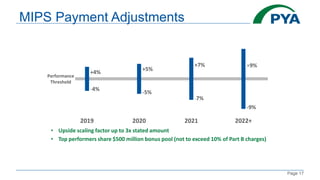

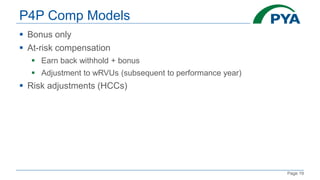

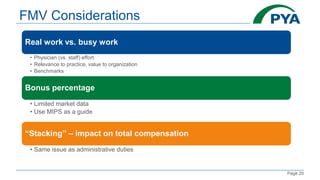

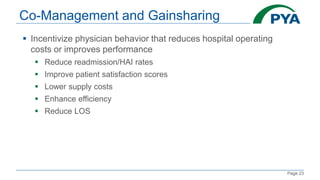

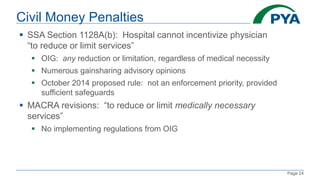

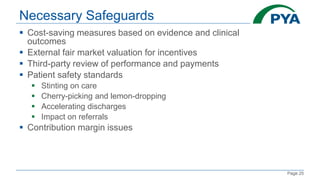

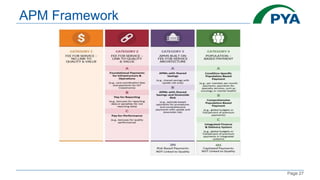

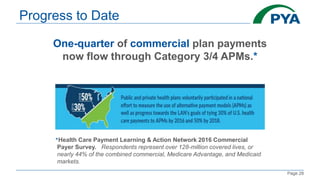

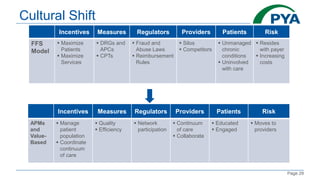

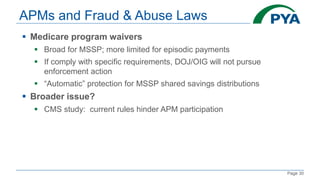

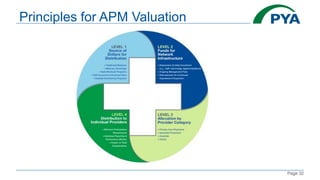

The document discusses various physician compensation models focusing on value-based care, emphasizing compliance considerations like the Stark Law and anti-kickback statutes. It reviews compensation trends, including productivity-based pay, pay-for-performance metrics, and gainsharing initiatives, alongside regulatory implications and alternative payment models. The document advocates for a shift toward more coordinated care and efficient practices within healthcare systems.