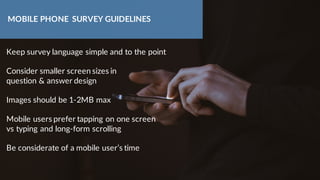

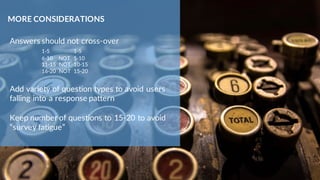

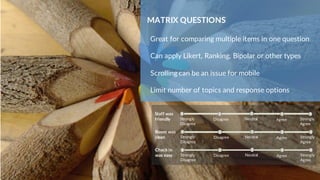

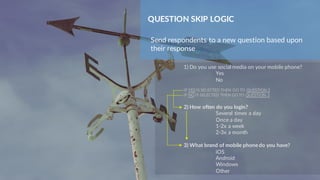

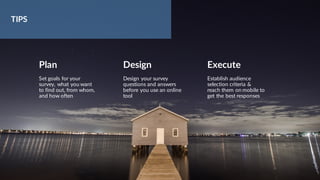

The document is a comprehensive guide on conducting mobile consumer research surveys, focusing on the importance of understanding market opportunities and reaching the right audience. It emphasizes the advantages of mobile surveys such as affordability, speed, and improved engagement compared to traditional methods. Additionally, it provides detailed tips on designing effective surveys, including question types, audience selection, and survey logic for deeper insights.